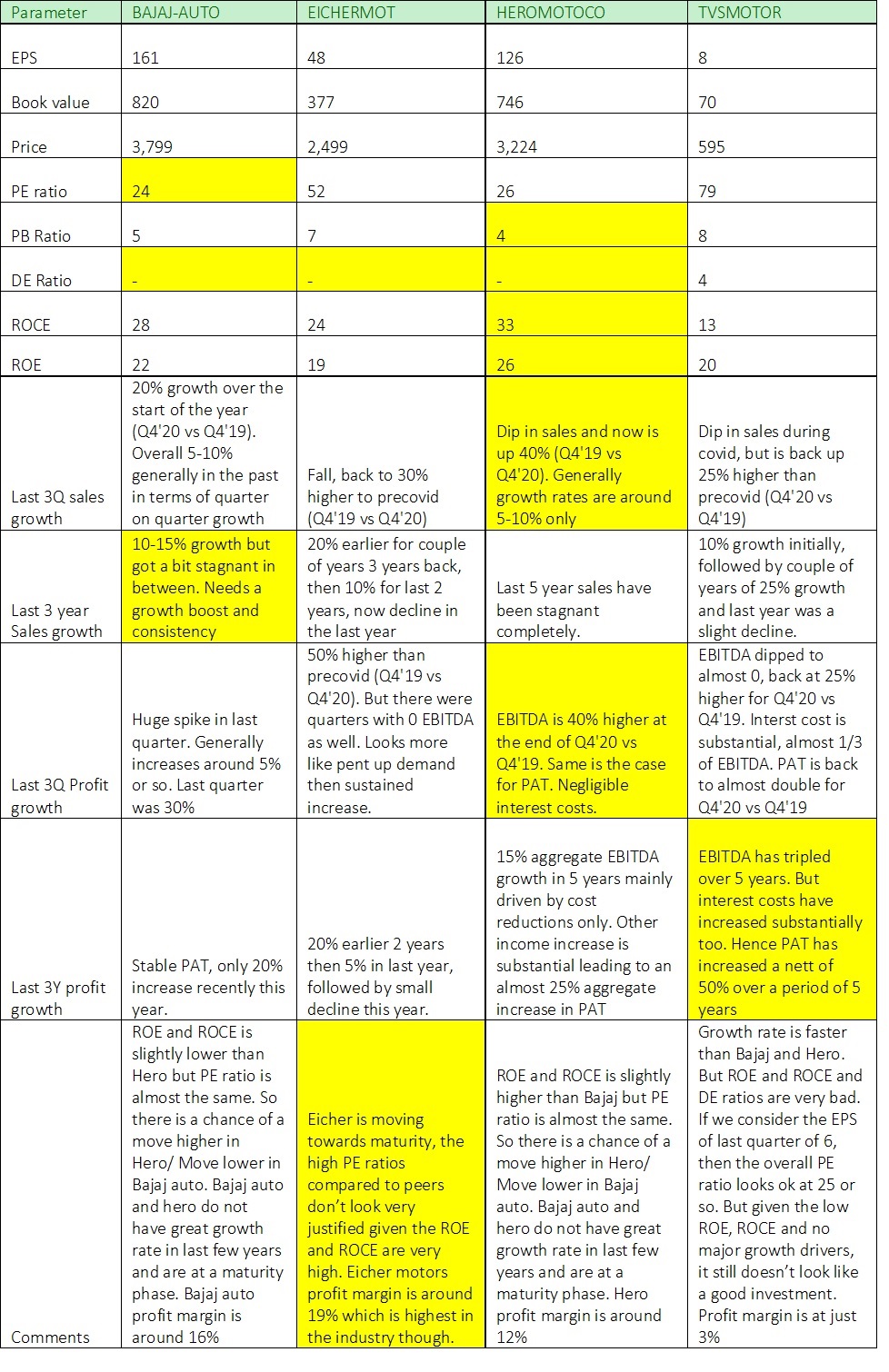

I have done the comparison of 2 wheeler companies in this blog. The Indian 2 wheeler industry is dominated by 4 players.

Hero motors have higher ranking in most of the parameters, followed by Bajaj. It is also evident that the PE ratio for Hero motors is lowest in the industry. The only parameter where Hero motors ranks lower is the profit margin which is 12% vs 19% for Eicher.

Also, there is little downside risk in investing in Hero and Bajaj as the PE ratios are much lower as well as their high score in return ratios as well as recent growth post covid. Also, Eicher has a very high PE ratio and recent results do not encourage, as a result there is a substantial chance of a correction in the stock price compared to the industry leaders. TVS motors has very high PE ratios and very small margin with not very encouraging return ratios. The only thing going is the high growth in profits over the last few years.

The columns highlighted in yellow indicate the best performer in the industry for that parameter.

Also view my analysis on the FMCG players if you like my comparison of 2 wheeler companies.