Motherson Sumi – Samvardhana Motherson

Business Model

Motherson Sumi Systems Limited was incorporated in 1986 and listed in 1993, is listed at the Bombay Stock Exchange and National Stock Exchange of India, in India. The company’s business in India consists of designing, manufacturing and supplying wiring harness systems to domestic customers in India across segments viz. passenger cars, commercial vehicles, motorcycles/two-wheeler segments etc.

The Company also exports harnesses to OEMs in Japan, Europe as well as Tier 1 OEM Suppliers (including Company’s subsidiaries for mirrors business).

Also, included in the portfolio is designing, development, manufacturing and supplying of interior and exterior modules as well as plastic components to OEMs in India. Rubber and metal parts are also manufactured and supplied to customers in India and exported to Europe.

Business area of the company

Motherson Sumi Systems, including its subsidiaries and JVs is one of the leading manufacturers of automotive wiring harnesses, mirrors for passenger cars and a leading supplier of plastic components and modules to the automotive industry.

Products and services offered by the company

Wiring Harness- The wiring harness division of Motherson is a full-service system supplier with complete in-house design, development and manufacturing capability. It is one of the most vertically integrated business divisions with a product range that promotes technological advancement across both the automotive and non-automotive sectors that it supplies to.

Vision Systems- Motherson is one of the leading global suppliers of vision systems to the automotive industry and the product range includes interior mirrors, exterior mirrors and camera-based detection which it supplies to almost all major OEMs. Vision Systems is aided by strong vertical integration and provides full-service solutions to its customers.

Modules and Polymer Products- The division encompasses the largest business line in Motherson. It develops and produces a highly diversified product range from simple plastic parts to highly integrated systems and modules, supplying to OEMs globally. The group also exhibits capabilities in mould design, tooling and elastomer processing.

Metal Products- The division offers an array of products like cutting and gear cutting tools, cabins for off-highway vehicles, HVAC systems, shock absorbers, metal components and assemblies with varied technologies, sheet metal parts, clutches for car AC compressors as well as coating services to a wide spectrum of industries.

Technology & Software- The division focuses on technology and innovations and sustains the digital foundation of the group’s global operations. It also caters to external clients from different industries globally. This division thinks beyond the current capabilities and has a futuristic approach in understanding industry trends and providing solutions.

Retail and services- The division consists of a wide spectrum of businesses that do business through direct channels like B2B supply, utilising distributor networks and engaging in direct sales and services to the end customers. Most products and services of this division directly support the manufacturing operations of customers.

Aerospace- Motherson offers global solutions to the aerospace industry segment, by providing integrated solutions. This division is an initiative of the group to establish its presence in sectors beyond automotive.

Logistics- The Logistics division of Motherson aims to bring in efficiency, technology and specialisation in the automotive supply chain. It deals with the logistics of finished vehicles in both the groups’ internal supply chain as well as for external customers.

Health and medical- The division is driven by its purpose of positively impacting lives globally by helping people become healthy, and stay healthy. The division works towards realising this by providing products, solutions and services that help people manage and improve their health, and enable people to access affordable care of the highest quality.

Vision 2025:

USD 36 Billion of sales by 2025 from the current USD of 10Billion. Possibility of 3x revenue growth in next 2 years.

3CX10 No country, customer or component should contribute more than 10% to our revenues.

75% of revenue from automotive industry, 25% from new divisions.

Up to 40% of consolidated profit as dividend.

Structure:

Samvardhana Motherson is 50.4% owned by Sehgal family and 17.7% owned by Sumitomo wiring systems. Sumitomo wiring systems is slowly exiting their stake as they want to focus on Motherson wiring systems (MSWIL) business alone. So there will be slight overhang of their selling on the stock which will allow us to accumulate the stock at appropriate price.

Samvardhana motherson owns 33.4% of MSWIL. The current valuation of MSWIL is 25k crore, at 33%, Samvardhana owns nearly 8k crores of MSWIL.

Management Team

The company is founded by Vivek Chaand Sehgal. He is currently the chairman on the board.

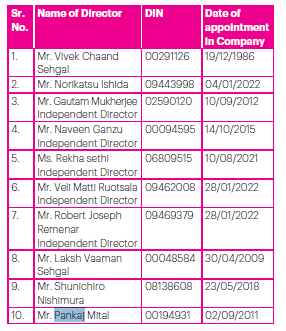

Board of directors:

| Name | Designation | Annual Remuneration |

| Vivek Chaand Sehgal | Chairman | |

| Alok Goel | Company Secretary | |

| Gautam Mukherjee | Non Executive Independent Director | 0.54 |

| Naveen Ganzu | Non Executive Independent Director | 0.53 |

| Rekha Sethi | Non Executive Independent Director | 0.39 |

| Robert Joseph Remenar | Non Executive Independent Director | 0.12 |

| Veli Matti Ruotsala | Non Executive Independent Director | 0.13 |

| Laksh Vaaman Sehgal | Non Independent & Non Executive Director | |

| Norikatsu Ishida | Non Independent & Non Executive Director | |

| Shunichiro Nishimura | Non Independent & Non Executive Director | |

| Pankaj Mital | Whole Time Director | 3.30 |

As can be seen from the above 2 tables, most of the board is with the company for more than 10 years. The chairman, Vivek Chaand Sehgal and his son Laksh Vaaman Sehgal do not draw salaries.

Shareholding:

Samvardhana Motherson is 50.4% owned by Sehgal family and 17.7% owned by Sumitomo wiring systems. Sumitomo wiring systems is slowly exiting their stake as they want to focus on Motherson wiring systems (MSWIL) business alone. So, there will be slight overhang of their selling on the stock which will allow us to accumulate the stock at appropriate price.

FIIs hold 10.87%; DIIs hold 14.74% and Public hold 9.55% stake.

Business Break-up

| Division | Revenue – Q4FY23 | EBITDA | % of Revenue |

| Wiring Harness | 7472 | 715 | 33% |

| Polymer | 12114 | 871 | 54% |

| Vision Systems | 4595 | 606 | 20% |

| Others | 1824 | 235 | 8% |

| Total | 22477 | 2031 |

The primary businesses are Wiring harness; Polymer products which include bumpers door panels, Instrument panels and vision systems which include mirrors.

Break-up by products:

| Wiring Harness | 29% |

| Vision Systems | 19% |

| Bumpers | 14% |

| Door Panels | 11% |

| Instrument Panel | 6% |

| Engineering | 3% |

| Other Polymer products | 12% |

| Non Auto | 2% |

| Others | 3% |

Revenue by customer:

| Revenue by customer | |

| Mercedes Benz | 9.50% |

| Audi | 8.90% |

| Volkswagen | 7.40% |

| Suzuki/ Maruti | 6.10% |

| BMW | 4.90% |

| Porsche | 4.50% |

| Daimler Group | 3.60% |

| Hyundai | 3.50% |

| Renault | 2.80% |

| PSA Group | 2.70% |

| Paccar | 2.50% |

| Ford | 2.40% |

| GM | 1.90% |

| Scania | 1.70% |

| John Deere | 1.60% |

Revenue by country:

| Country wise | |

| India | 22% |

| USA | 18% |

| Germany | 16% |

| China | 9% |

| Hungary | 6% |

| Spain | 5% |

| France | 4% |

| Mexico | 4% |

| Brazil | 3% |

| South Korea | 3% |

| Poland | 3% |

| Others | 8% |

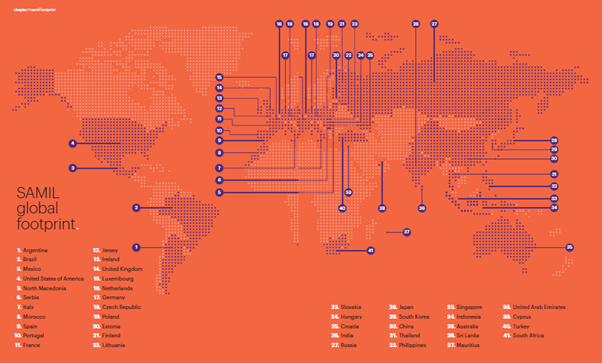

The company is diversified globally with major revenues coming from India and USA.

Presence

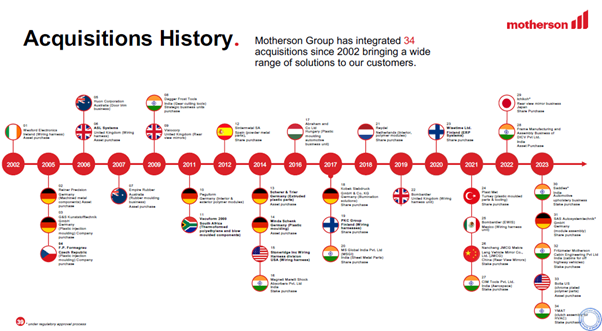

Acquisition History

The company has grown historically through acquisitions. The philosophy is to acquire companies that have strong client base with their existing clients but are in financial trouble. The company started with Indian wiring harness joint venture with Sumitomo wiring systems and over a period have diversified into global wiring harness business, Mirrors and polymer products, bumpers. The company now has businesses across various geographies in a huge number of auto ancillary products.

New business forays:

The company has entered new businesses and is planning to grow that business to ensure they contribute 25% of their revenues that is 25000 crores by 2025.

Capex and business growth prospects:

The company has continuously expanded through acquisitions. The company is planning to increase their business into newer areas like Aerospace, health and medical as well as logistics. The company has lined up a capex plan of 3000 crores in FY24.

Key triggers:

Revenue growth from revival as shown in the financials section.

Improvement in margins due to higher utilization and turn around of recently acquired businesses as shown in the financials section.

Growth in new business forays

EV agnostic portfolio and Increased requirements of sophistication of products for EV will aid Motherson Sumi as it has been in the forefront of latest technology developments through its acquisitions.

Financials:

| DESCRIPTION | Mar-17 | Mar-18 | Mar-19 | Mar-20 | Mar-21 | Mar-22 |

| Gross Sales | 43,157 | 56,521 | 63,523 | 60,729 | 57,370 | 63,536 |

| Sales Growth | 31% | 12% | -4% | -6% | 11% | |

| Total Expenditure | 38,209 | 51,171 | 58,175 | 56,075 | 53,011 | 59,075 |

| Operating Profit (Excl OI) | 4,167 | 5,123 | 5,348 | 4,654 | 4,359 | 4,461 |

| Profit Margin | 10% | 9% | 8% | 8% | 8% | 7% |

| Other Income | 264 | 170 | 220 | 225 | 229 | 496 |

| Operating Profit | 4,431 | 5,293 | 5,569 | 4,879 | 4,588 | 4,957 |

| Interest | 375 | 411 | 423 | 593 | 512 | 543 |

| PBDT | 4,056 | 4,882 | 5,145 | 4,286 | 4,077 | 4,415 |

| Depreciation | 1,059 | 1,575 | 2,058 | 2,721 | 2,926 | 2,958 |

| Profit Before Tax | 3,083 | 3,267 | 3,200 | 1,622 | 1,173 | 1,424 |

| Profit After Tax | 2,172 | 2,260 | 2,098 | 934 | 1,243 | 817 |

| EPS – Basic (Reported) | 7.6 | 5.1 | 5.1 | 3.7 | 3.3 | 2.5 |

| PAT Margin | 5% | 4% | 3% | 2% | 2% | 1% |

Quarterly Results:

| DESCRIPTION | Mar-22 | Jun-22 | Sep-22 | Dec-22 | Mar-23 |

| Total Revenue from Operations | 17241 | 17615 | 18261 | 20226 | 22477 |

| Revenue Growth QoQ | 0 | 0 | 0 | 0 | |

| Other Income | 85 | 98 | 94 | 122 | 75 |

| Total Income | 17326 | 17713 | 18355 | 20348 | 22552 |

| Total Expenditure | 16871 | 17440 | 17790 | 19615 | 21575 |

| Profit before Share of Associates and tax | 407 | 273 | 466 | 732 | 977 |

| Share of (loss)/profit in Associates and Joint Ventures | 11 | -1 | 7 | 14 | 24 |

| Profit before tax | 396 | 274 | 460 | 718 | 953 |

| Tax | 266 | 93 | 171 | 217 | 254 |

| Profit after tax | 130 | 182 | 288 | 501 | 699 |

| PAT Margin | 1% | 1% | 2% | 2% | 3% |

| Basic EPS | 0.18 | 0.31 | 0.36 | 0.67 | 0.97 |

| Diluted EPS | 0.18 | 0.31 | 0.36 | 0.67 | 0.97 |

PAT margin has started recovering as per latest quarterly results. Also there has been lot of debt reduction. Both of these should aid generating higher cash flows going forward.

The company has started moving into phase of higher growth and profitability.

Latest conference call key points

Q4FY23:

Yearly gross revenues of INR89,000 crores. SAMIL Automotive business order book is nearly USD 70 billion or INR5.7 lakh crores. This is a reflection of our customer support and trust. Approximately 20% of this would be coming from the EV side. 7 strategic acquisitions in the past 14 months, potentially adding 40 facilities, 8,000 employees and approximately USD 4.9 billion on gross and USD 1.1 billion net basis to the top line of the company post closure.

We’ve also created a strong platform for future growth with a well-diversified product portfolio, customers and our countries. The company has reported yet another stellar performance with the highest ever consolidated revenue of over INR78,700 crores. This is a 23% year-on-year growth. And correspondingly, the absolute EBITDA is also the highest at INR6,400 crores. Please note that the PAT has grown 3x against last year. For Q4, we have achieved another highest ever quarterly revenue of approximately INR 22,500 crores, representing an 11% quarter-on-quarter increase and a 30% growth on a year-on-year basis.

As a brief walk through, this stops up the SMRP BV Booked Business of about USD39.5 billion, with other automotive business divisions such as Wiring Harness division, Lighting & Electronics, Elastomers etc. Out of the USD70 billion booked business, 20% is geared towards pure EV platforms.

Total India business including subsidiary is over INR15,000 crores in FY ’22 and has grown at over 25% for the year. With this growth capex and purchase of related land and buildings, the capex for the next year is likely to increase to about INR3,000 crores plus/minus 10% as compared to INR2,200 crores this year.

During the year, we completed seven acquisitions that will add to combined gross revenue of approximately USD 4.9 billion on gross basis and about USD 1.1 billion on a net basis.

In fact, on an aggregate level for the year, we still expect that the industry is likely to grow. Now the growth pace is obviously going to get calibrated depending upon how the environment plays out. But overall, the downside risks of this are much less than the potential upside is the way we see it. On the energy price, while we have seen a sizable decline happen in this quarter and ongoing as well, we anticipate at least up till now that things are looking pretty static to where it was in the end of the previous quarter. It, however, remains at least 3, 3.5x higher than pre- COVID level. So, we are not out of the woods. And obviously, much of the geopolitical aspects will get played into it.

On the duration of the order book side, the average duration is anywhere between 5 to 6 years. So that’s the time span over which we expect this INR5.7 lakh crores order book to get delivered.

This quarter, there has been forex losses also that is embedded in the interest cost. Some of the corresponding gains have come on the top line side. So that’s how it’s been reported. From the perspective of debt, we do expect the deleveraging to continue on the organic side of the business. The working capital improvements are not out of the way completely.

So, whatever was there for last year is already there and has been already reflecting in the numbers, and the discussion continues for how these pan out for the rest of this year. And these will be discussed at the end of the year.

Then there is a whole host of M&As that we have anyway announced for which the payouts will happen in the ensuing year, and there is a large pipeline of M&As as well. So, with what we have announced so far, I think we should still be within the 2x net debt-to-EBITDA levels. That’s the way at least we see with the announced transactions.

Back of the envelope calculation, we were to do your 70 billion over 5 to 6 years would anyway imply slightly more than 12-odd billion of revenues.

As you mentioned, this capex is going to go towards both, automotive and nonautomotive business. We’re also expanding the facilities. We talked about 7 of them, 6 of them will be in India. And 3 of those will be in the automotive and 3 in nonautomotive side as we go towards our 2025 target and the diversification.

These are the capex that are related to orders that we have won, that we had to execute for the customers’ new launches and the new programs that we are getting. As you can tell from the past calls, we’ve also talked about our expansion of doing acquisitions in Aerospace, how the order book has doubled over there. We are building new facilities in that as well.

The only additional piece, unlike maybe some of our peers said, we do own our land and building. So, our capex numbers include the investments we’ll be doing on land and building side as well.

Check out more ideas here.

Comment