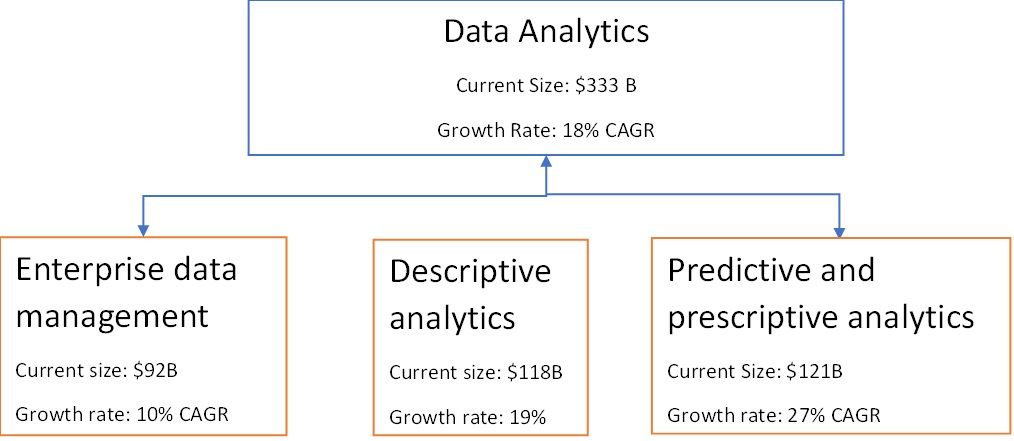

The data analytics industry is amongst the fastest growing industry in the IT services industry. The market size for data and analytics is around $333 Billion in 2024 which is slated to grow at 18% CAGR.

The primary drivers for increased data and analytics adoption are as follows:

Manage the Data Explosion, Provide Differentiated User Experience, Optimize Business Decision-making and Reduce Risks

Analytics is further classified between Data engineering, Descriptive analytics, Predictive and Prescriptive analytics.

Data engineering

This consists of 5 elements – Data integration, Data engineering, Data management, Data security and Data governance. Data engineering is slated to grow at 10% CAGR and is currently valued at $92B.

Descriptive analytics

Descriptive & Diagnostic Analytics provide insights on past business events using historical data and statistical tools. It leverages BI and visual analytics to identify potential causes behind past business events. Modelling and basic regression techniques are applied to establish the relationship between past business events and extract insights for ad-hoc reporting. Self-service visualization with in-built data exploration tools is used by stakeholders to isolate confounding information for root cause analysis.

Descriptive analytics is currently valued at $118B and is slated to grow at 19% CAGR. The primary growth driver industries for this industry are Technology, CPG and retail, BFSI. All of these are slated to grow at 19%-20% CAGR.

Descriptive & Diagnostic Analytics provide insights on past business events using historical data and leverage visual tools to present findings with additional data exploration capabilities.

Predictive and prescriptive analytics

Predictive Analytics leverages data mining and advanced statistical models to derive insights from historical and transactional data to identify patterns and predict future trends. Data Mining refers to the extraction of patterns, including anomalies, within large data sets using ML algorithms. Predictive Modelling refers to a combination of different statistical modelling techniques to draw up predictions about future trends.

Prescriptive Analytics uses several complex techniques to recommend the best course of action for employees and agents of a business. Core techniques used in Prescriptive Analytics include: (i) Optimization, the process of finding an optimal solution to a business problem by leveraging advanced mathematical models. Real-life business events, are used as inputs to the model to find the best course of action; and (ii) Simulation, building a digital replica of the mathematical model constructed above to examine the corresponding changes to any alteration in the model configuration parameters. Unlike the optimization model which is used to find recommendations, the simulation model allows analysts to identify the impact of unknown variables and explore alternatives.

Predictive analytics is currently valued at $121B and is slated to grow at 27% CAGR. The increasing demand for forecasting and planning multiple business scenarios is expected to drive the spend on Predictive Analytics.

Applications for analytics

Overall key applications for data analytics include the following in customer analytics/ marketing analytics/ supply chain analytics/ finance and risk analytics/ HR analytics/ Geospatial analytics in demand forecasting, segmentation analysis, predictive pricing, fraud analytics, warranty analytics, customer behaviour analytics, product assortment and decision making and other predictive modelling techniques.

Outsourced analytics functions:

An increasing demand for Advanced Analytics functions and lack of in-house talent are driving the demand for outsourced Analytics services. The Analytics services market is addressed broadly by two types of players: (i) multi service providers who offer analytics offerings at scale along with their System Integration (SI) and other IT offerings. & (ii) pure play analytics players who solely provide niche analytics offerings.

As per Analytics India magazine report:

Indian analytics industry is currently around $45.4 Bn. This signifies a growth of 26.5% in the market size y-o-y. Analytics will contribute 41% of IT/ ITES market for India by 2026. Analytics industry can grow at CAGR of 22% in India for the next 5 years. At this rate, analytics will grow to $120 B in India by 2030.

Of the total market size; the analytics outsourced market size is around $100 Billion, of which 80% is managed by large IT companies and 20% is managed by pure play analytics players.

The growth rate for pure play analytics companies is slated to be higher at 25% vs analytic arms of large IT players is expected to grow at 18%-20% due to the following reasons:

India is the top outsourcing destination for analytics, and Indian companies including Multi Service Providers and Pure Play Analytics firms have a share of approximately 40% of the addressed market.

The Indian delivery market is estimated to grow at approximately 20% CAGR (2020-2024). Western Europe and USA have a larger concentration of Pure Play Analytics players, who create differentiation through their expertise in niche solutions and products. USA delivery market is expected to grow at approximately 24% CAGR (2020-2024).

So overall addressable market for pure play data analytics companies is currently around $45 Billion if we consider Indian analytics revenues ($100 Billion if we look at total global outsourced analytics market size) which is slated to grow between 20%-25% CAGR over the next decade.

This is the fastest growing industry within the IT services space. Also, pure play analytics companies are expected to grow at a much faster pace compared to diversified IT players due to slower growth rates of the other service lines.