Galaxy Surfactants Ltd was Incorporated in 1986. The company is India’s Largest Manufacturer of Oleo chemical-based Surfactants and Specialty Care Products for Home Care and Personal Care Industries.

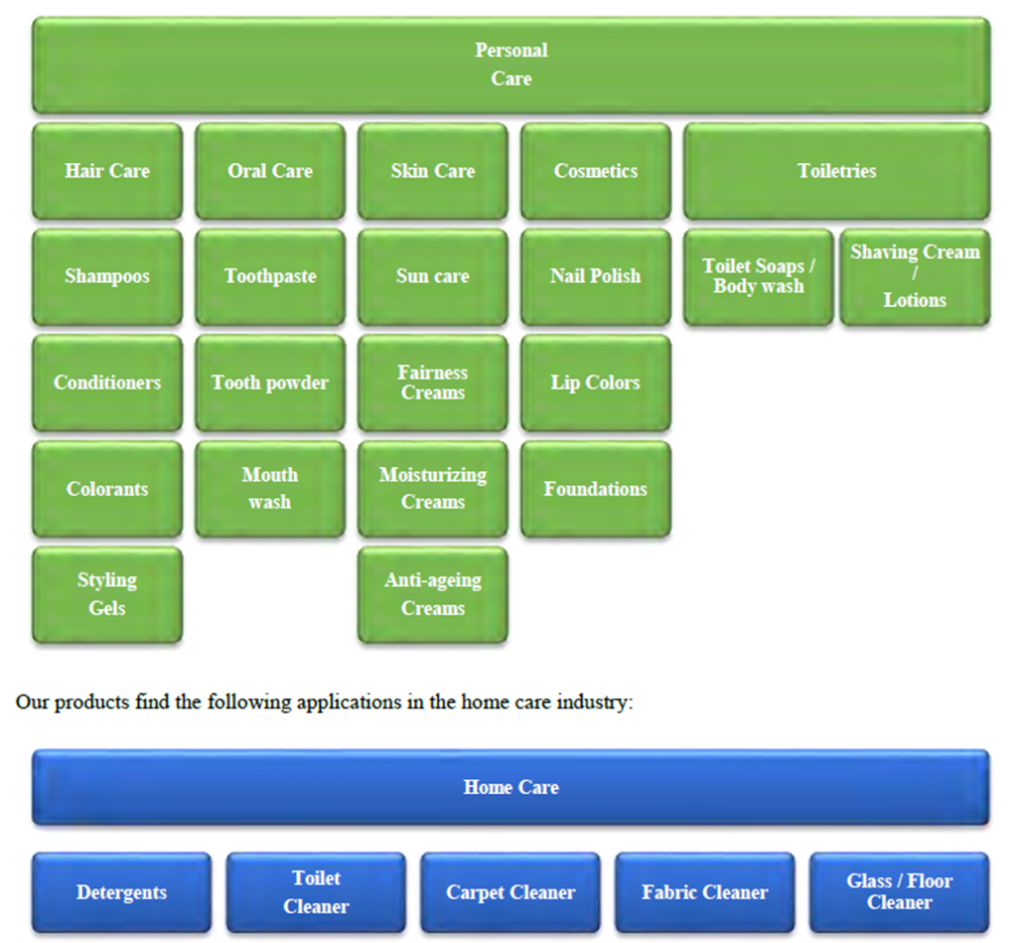

These products are used in consumer-centric Home and Personal care products like hair care, oral care, skin care, cosmetics, soap, shampoo, lotion, detergent, cleaning products, etc. The company is a preferred supplier to leading MNC’s, Regional and Local FMCG brands.

The co. offers 210+ Products under its Performance Surfactants and Speciality Care Products which includes varieties of products under hair care, oral care, home care, skin care, cosmetics and toiletries.

The co. launched 2 new products in FY23 driven by sustainable trends:

Galseer Tresscon – It is designed for the preparation of Shampoo Bars ensuring the formulation is sustainable, safe, green, and environmentally friendly

GalMOL CCT – It is used in beauty and personal care products for moisturization properties.

As of FY23, Company derives 65% of its revenue from Performance Surfactants, while 35% is derived from Specialty Care Products. Company earns 39% of its revenue from India while 61% is earned from rest of the world which includes US, Europe & AMET.

The Company has 7 Strategically Located Facilities with In-house Project Execution Capabilities, 5 in India with an installed capacity of 3,24,238 MTPA, 1 in Egypt with 117,500 MTPA, and 1 in the US with 600 MTPA, having average capacity utilization is about 65%.

The Company has 1,380+ Clients across 80+ Countries. The co.’s major clients are Unilever, Reckitt Benckiser, P&G, L’OREAL, Himalaya, Colgate Palmolive, Emami and a few more. It has maintained long-term relationships with all of the top 10 customers.

Revenue Contribution by MNC Customers stands at 58%, Regional Players at 12%, and Local & Niche Players at 30%.

Since 2000, a total of 90 patents have been granted to Galaxy with 16 under the application in FY23.

Understanding Oleochemicals & Performance Surfactants

Oleochemicals are a group of chemicals derived from natural oils and fats, predominantly sourced from plants such as soybeans, palm, sunflower, and animal fats. These oils and fats undergo chemical processes, akin to refining or cooking, to create versatile chemicals. They find applications across various industries, including cosmetics, cleaning products, and food.

What are Performance Surfactants?

Surfactant is a surface-active substance or agent. The word “surfactant” is a shortened form of “surface-active agent”. Surfactants can be broadly defined as compounds which concentrate at surfaces (interfaces) such as water, air or water-oil when dissolved in water. Imagine you’re washing dishes, and you notice that water alone doesn’t do a great job of removing grease and food particles from the plates. So, you add a dishwashing liquid. This liquid contains something called surfactants. These are like tiny helpers that make the water molecules and the grease on the plates get along better. They surround the grease, breaking it into smaller pieces, which makes it easier for water to wash it away. Now, think about this on a larger scale – not just for dishes, but for many industrial processes and products. Performance surfactants are special types of these helper molecules that are designed to work really well in specific situations, like making shampoo lather better, cleaning fabrics more effectively, or even helping paints spread smoothly.Galaxy Surfactants make surfactants that help shampoo make more bubbles and clean ytheirhair better, or they might create surfactants that give skin creams a nice texture and feel. They work with companies that make everyday things like soaps, shampoos, detergents, and even cosmetics. Galaxy Surfactants basically provides these companies with the secret ingredients (surfactants) to make their products work better and feel nicer when we use them. The major application fields of surfactants are classified as under Household Cleaning, Industrial Cleaning, Personal Care Products, etc.

What are Specialty Care Products?

Specialty Care Products are products which perform a special function in any Home or Personal Care product. Unlike performance surfactants, these cater primarily to the masstige and prestige categories. Galaxy manufactures various types of specialty products – Mild Surfactants, Preservatives, Non-Toxic Preservative Blends, Surfactant Blends, Proteins, Syndet and Transparent Bathing Bars, Amine Oxides, Conditioning Agents, Betaines and Quats. As these products cater to the masstige and prestige segments. Affordability and consciousness play a key role in ensuring sustainable growth for this segment. Given the nature, developed markets are majorly responsible for driving growth.

Product Portfolio

Company’s products are organized into the following two product groups

- Performance Surfactants

Their portfolio of Performance Surfactants includes two categories of surfactants. These products stabilize a mixture of oil and water by reducing the surface tension at the interface between oil and water, and are utilized to remove dirt from, inter alia, skin, hair and textiles. Based on the head charge in the individual unit, they can be classified as follows: - Anionic Surfactants: In this sub-category of Performance Surfactants, the head charge is negative. This class of surfactants has high foam and very good dirt removal properties. These surfactants have applications in shampoos, toothpastes, body wash formulations as well as laundry detergents and dishwashing products. Typical surfactants manufactured by us in this sub-category include sodium lauryl sulphate, sodium lauryl ether sulphate, ammonium lauryl sulphate, ammonium lauryl ether sulphate and linear alkyl benzene sulfonic acid; and

- Non-ionic surfactants: This Performance Surfactants in this sub-category have no head charge. We manufacture a wide range of ethoxylated non-ionics with varying degrees of ethoxylation. These surfactants are most commonly used in cosmetics and personal care products like shampoos, bath and shower products. These are also used as emulsifiers and solubilisers in cosmetic applications. Their sub-category of non-ionic surfactants includes lauryl alcohol ethoxylates.

- Specialty Care Products Group

Their range of Specialty Care Products includes amphoteric surfactants, cationic surfactants, UV filters/sunscreens, preservatives and blends, speciality ingredients, fatty alkanolamides and fatty acid esters, and other products. Details of each of the aforesaid sub-categories are as follows:

- Amphoteric Surfactants: Amphoteric surfactants find application in personal care products as well as home care products. Depending on the pH (the acidity or basicity of the solution), they can be negatively or positively charged or there can be no head charge at all. These surfactants are mainly used in personal care and home care products. These are frequently used in shampoos, skin cleansers and other cosmetic products because of their excellent dermatological properties. Use of these surfactants in detergents reduces skin irritation. We manufacture Cocoamidopropyl Betaine (“CAPB”) which is used in shampoos, shower products, liquid soaps. We have also developed a patented purified version of CAPB which is used in toothpastes;

- Cationic surfactants: In cationic surfactants, the head charge is positive. These surfactants serve as effective conditioning aids because of their substantivity to hair and antimicrobial properties. Thus, they are mainly used in hair conditioners and fabric softeners. We manufacture benzalkonium chloride which can be used as a germicide, disinfectant in applications such as floor cleaners and sanitizers;

- UV Filters/Sunscreens: A sunscreen is a lotion, spray or cream that protects the skin from UV radiation. It contains materials that absorb or block the harmful radiation. We manufacture sunscreens such as Octyl Methoxycinnamate, Octocrylene and trade in various other sunscreens such as GalSORB UV Avobenzone and Benzophenone-4. Apart from these, theirpatented molecules GalHueShield HCS and Galaxy SunBeat are innovative molecules that offer unique advantages due to their specific structural features, which make them mild for the skin, moisturizing or substantive, conditioning or even-water-soluble. These molecules exhibit excellent and unique properties which overcome a number of formulation issues;

- Preservatives, Preservative Blends and Surfactant Blends: A preservative is a natural or synthetic chemical that is added to food or personal care/cosmetic formulations to prevent spoilage, whether from microbial growth or undesirable chemical changes. Preservatives are designed to help protect consumers from food poisoning and extend shelf-life of products. They can be broadly divided into anti-microbial preservatives, which function by inhibiting the growth of bacteria and fungi, and antioxidants, which inhibit the oxidation of foods and prevent rancidity. We manufacture phenoxyethanol, which due to its reduced toxicity as compared to parabens and formaldehyde, finds application in many personal care products. Further, we utilize phenoxyethanol and surfactants (lower fatty chain derivatives of amino acid) to manufacture a range of blends. These blends can be divided into the following:

- Preservative Blends: These are special customised formulations of preservatives. Preservation of home and personal care products is a challenging area since the current antimicrobials are being phased out due to serious toxicity issues to humans and as well as to the environment. In view of this, the global personal care industry has committed itself to change the ways of preservation. Their preservation strategy is built around combining phenoxyethanol and other non-toxic antimicrobials where we believe that we have a manufacturing edge. Galgaurd Trident and Galguard NT are cold-processable innovative compositions that employ multi-pronged combinatory approach to address preservation problems of a number of home and personal care products; and

- Surfactant Blends: Surface active preparations include effective blend of surfactants which are pre-formulated and can be used for shampoo, body wash, syndet and transparent soap bars. In order to reduce manufacturing complexity and production time cycle, we have developed blends which are a mixture of various surfactants that form the base of shampoos, liquid soaps and shower gel formulations. Additionally, we have developed their expertise in the technology of cold pearl formulations for pearlescence in shampoo formulations.

- Speciality Ingredients:

- Mild Surfactants: Mild surfactants are emerging against the backdrop of significant advancements in the understanding of science of personal cleansing in the last decade. Traditional surfactants and soaps have an effect of compromising the skin’s basic biological functions as they have a tendency of interacting unfavourably with top layer of skin while cleansing. The mild surfactants, particularly are of two classes:

(i) acyl amino acid surfactants and (ii) acyl isethionates. These surfactants have been shown to cleanse adequately without compromising basic function of skin. Technologies are being developed to use these two families of surfactants synergistically. One of their key innovations was the development of a patented commercial manufacturing process for mild surfactants, being acyl-amino acid-based surfactants that include acyl glycinates, sarcosinates, taurates and glutamates. This process satisfies all twelve principles of ‘green chemistry’. It utilizes a ‘green catalyst’ and is in the nature ‘closed loop’ chemistry, where by-products of one process are used to manufacture another class of surfactants. As a result of the foregoing, we are able to achieve 100% ‘atom economy’, which translates into energy-efficiency and the elimination of effluents and waste. As a result of the aforesaid process, we believe that we are uniquely positioned to address the growing need for mild surfactants in a sustainable manner.

Another one of their key innovations pertains to their development of a patented process that exploits the synergies between two classes of surfactants, namely acyl amino acid surfactants and acyl isethionates. This process enabled us to achieve multiple goals, including mild cleansing, customized skin-pH formulations, transparent/clear formulations, and consumer desired attributes of foam and lather, which were unachievable hitherto by then available technologies. The uniqueness of this patented process is that it can create synergistic, cold processable and sustainable combinations of both families of mild surfactants. We have launched one such synergistic combination of glutamate and isethionate GLI 21 and a few more are in the pipeline to meet customers’ demands for a variety of formulations. We believe that this patented process give us a significant edge over their competition.

The mild surfactants from their portfolio are suitable for liquid cleansers as well solid bathing bars, thus enabling us to participate in all forms of mild cleansing systems in different forms of liquids, bars or powders. We have recently developed a patented new oil-soluble surfactant, Galsoft TiLS, for shower oils. Shower oils are one of the ways of mild cleansing, particularly suitable for sensitive, dry and compromised skin. Current shower oil manufactures use MIPA laureth sulphate with alkanol amide, which have been reported to have skin irritating properties and possible formation of carcinogenic nitrosoamines. Galsoft TiLS overcomes the problems associated with current technologies, and opens up a new avenues for oil-based cleansers. This line of products opens a new avenue for ‘sulphate-free’ oil-soluble surfactants;- Syndet and Transparent Bathing bar flakes: Syndet noodles and transparent bathing bar flakes have good global potential since we believe that consumer preferences are moving from conventional soaps to variety of mild, neutral pH syndet based bathing bars. These products form the base for the final syndet and transparent bathing bars. Syndet noodles are in the form of ivory white coloured noodles, almost colourless bar having a mild and skin friendly base. It can be processed into bars in a conventional soap line with minor changes in equipment and process; and

- Proteins: Proteins extracted from vegetable sources like rice, wheat, barley, oats, soya, quinoa, milk and silk form their protein ingredients. Their offerings covers a wide range of products for various applications in the cosmetic industry, including conditioning of hair and skin, hair protection and strengthening, anti-irritancy, moisturization, film formers on skin, and skin healing and protection Proteins for cosmetics that we manufacture are:

- Protein Hydrolyzates: Most proteins are poorly soluble in water and therefore cannot be used in cosmetic formulations. Hydrolyzation converts the proteins into their soluble form by breaking down the proteins into smaller pieces, typically a mix of their amino acids. This hydrolyzation results in a water soluble cosmetic grade product which finds application in hair care and skin care formulations;

- Quaternized Proteins: These are protein derivatives which are made cationic so that they are substantive to hair and skin. These quaternized proteins reduce static electricity and bind well to the damaged hair. These products improve the body and manageability of hair;

- Protein Condensates: Protein condensates add various fatty acids to the protein to confer additional emulsifying and cleansing properties. These condensates are similar to surfactants and are mild, have high tolerance to skin and eye, and reduce the irritability of harsh surfactants. This expanding portfolio of specialty chemicals demonstrates the strength of their R&D capabilities in high quality personal care ingredients; and

- Specialty Actives: Vegetable derived protein derivatives (hydrolysate, condensates and quaternaries) for personal care applications have been their forte. This sustainable approach of deriving actives from nature has been further extended to innovate the specialty actives from the protein fractions of seeds of Baobab, Barley and Sacha Inchi. The isolated oligo-peptides have been shown to possess topical activity of being anti-inflammatory or anti-senescence. We believe that this new science of plant derived protein-actives would take us into the realm of cosmeceuticals and help us in fulfilling the unmet needs of beauty care.

- Syndet and Transparent Bathing bar flakes: Syndet noodles and transparent bathing bar flakes have good global potential since we believe that consumer preferences are moving from conventional soaps to variety of mild, neutral pH syndet based bathing bars. These products form the base for the final syndet and transparent bathing bars. Syndet noodles are in the form of ivory white coloured noodles, almost colourless bar having a mild and skin friendly base. It can be processed into bars in a conventional soap line with minor changes in equipment and process; and

- Fatty Alkanolamides and Fatty Acid Esters: Fatty Alkanolamides and Fatty Acid Esters are mainly used as foam, viscosity boosters and pearlizer in a formulation. We manufacture products like Cocomonoethanolamide, Cocodiethanolamide and Lauric Monoethanolamide which are used in shampoos, soaps, shaving creams, liquid detergents, shower gels and bubble baths. Fatty acid esters are used in formulations as pearlizer.

- Other Products:

- Conditioning Agents: A conditioner is a substance or process that improves the quality of another material. Conditioning agents are also called moisturizers in some cases and usually are composed of various oils and lubricants. One method of their use is coating of the substrate to alter their feel and appearance;

- Polyquats: These are polymers frequently used in hair-care products to provide conditioning benefits to the hair. The trait they all share is that they are very large molecules with periodic positive charges located at different sites along the molecule. There are many different types of these cationic polymers, with widely varying molecular structures and charge densities (amount of positive charge/molecule). Each specific type of polyquaternium molecule is assigned a numeric designation, such as polyquaternium-4 or polyquaternium-11;

- Amine Oxides: Amine oxides are surfactants that have no head charge. They are most commonly used in the home care and personal care products, and find application in toilet and other multi-functional cleaners. Theiramine oxide products include foam stabilizers such as lauryl myristyl amine oxide and lauryl myristyl amidopropyl amine oxide.

Product Applications

Surfactants generally finds application in almost every chemical industry. The major applications of surfactants are classified as:

- Household cleaning: Detergents and soaps are majorly used for cleaning purpose because pure water cannot remove oily and organic soiling. Further, surfactants are used in detergent additives, laundry detergents, dishwashing products, and other household cleaners including all-purpose detergents, abrasive cleansers, specialty cleaners, glass and multi-surface cleaners, tub, tile and sink cleaners, metal cleaners and oven cleaners.

- Industrial and Institutional Cleaning (I&I Cleaning): Generally, bigger institutions like commercial and industrial sector, public sector and government are classified as the end users of I&I cleaning.

- Personal care products: The use of surfactants in this segment falls into three major categories: hair care (cleansing and conditioning), skin care (cleansing and conditioning) and cosmetics.

- Industrial applications: The main industries wherein surfactants are largely used are textile & leather industry, oil industry, gasoline & fuel additives, agrochemicals, food processing, polymers, paints and coatings, inks, pharmaceuticals and water and waste treatment.

Industry

Global surfactants industry

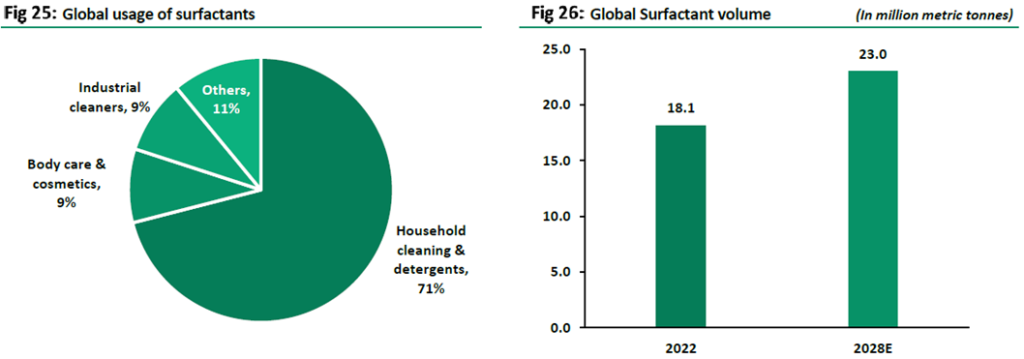

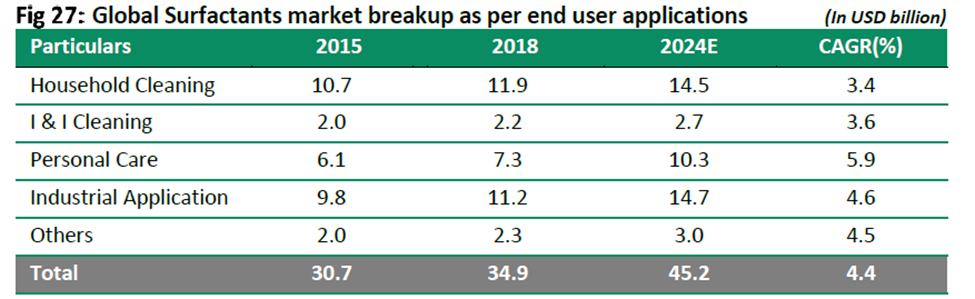

As per S&P global insights, the global consumption of surfactants in 2021 was ~17.6 million metric tons with an estimated market value of $40.8 billion. Surfactants are used in many applications for home and personal care use with properties like softening, emulsification & detergency. The most important application of surfactants is in the formulation of household detergents and they are also used in hand and automatic dishwashing detergents, cleaning applications, hair conditioners, cosmetic & personal care products, institutional cleaning and industrial processes. The growth is largely dependent on the home and personal care segment growth in developing and mature markets. New formulations continue to develop and innovate in emerging markets and across the world which will drive the growth going ahead. Household cleaning & detergents is one of the most important application sectors for surfactants, accounting for approx. 71% of global consumption in the major consuming regions.

The global surfactants market is projected to register a CAGR of over 5% during 2022-28.

The market was adversely impacted by COVID-19 in 2020 and the first half of 2021. Several countries were forced to go into lockdown, which forced people to minimize the use of personal vehicles, creating a decline in the demand for lubricant and fuel, thus decreasing the demand for fuel additives and surfactants. However, the consciousness regarding personal hygiene and clean surroundings increased during the pandemic, and it remains a major priority despite its retraction. This has stimulated the demand for personal and household cleaning products, thus enhancing the market growth of surfactants.

- Over the short term, the growing personal care industry and the growing demand for biosurfactants to serve the growing oleochemical market are driving the growth of the surfactants market.

- Increasing environmental awareness against the use of surfactants is expected to hinder the growth of the market.

- New inventions in the field of surfactants and the introduction of bio-based surfactants will act as a market opportunity.

- The Asia-Pacific region is expected to dominate the market, and it is likely to witness the highest CAGR during the forecast period.

In terms of volumes, the surfactant market was 16.35 million tonnes market in 2015 which is expected to grow at a CAGR of 3.9% till 2024 to touch 22.97 million tonnes.

Domestic surfactants industry

The Indian surfactants market was a ~$1.4 bn market in 2015 which is expected to grow at a CAGR of 6% to touch USD ~2.3 Billion by 2024E. In terms of volumes, it is a 778 KT market growing at a CAGR of 5.8% and the same is expected to touch 1221 KT by 2024E. In terms of application, household cleaning and personal care together made up for 49% of the total surfactants market. Also in line with the application market, personal care surfactants market is expected to be the fastest growing market growing at a CAGR of 7.6% till 2024.

India’s surfactants market is growing enormously due to increasing demand from various end-use industries such as home care, personal care, and industrial cleaning. The growing population and disposable income of individuals are also driving the market. However, the strict government regulations for the use of surfactants in certain applications and the availability of cheaper alternatives from other countries are some of the challenges faced by the market. Additionally, the market is also affected by fluctuating raw material prices and competition from domestic and international players. The surfactants market in India is also growing due to increasing demand for surfactants as well as the growth of various end-use industries such as textiles, agriculture, and construction. Additionally, the increasing use of bio-based surfactants and rising environmental concerns are also fuelling the market.

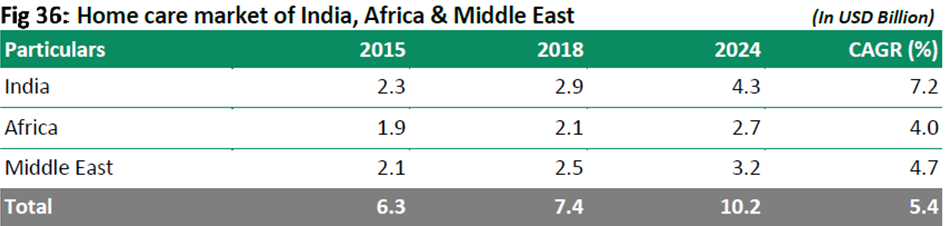

The home care market of India is expected to clock higher growth rate as compared with Africa & Middle East. Dishwashing detergents is the largest segment in home care followed by laundry detergents, which include laundry power and laundry liquid. Dishwashing detergents make up around 32% of the total household cleaning agents market.

Speciality Ingredients offers unique opportunity to grow

Within speciality, personal care ingredients has the largest growth potential. The speciality ingredients market is USD 15-18 billion market in 2023 comprising of 25% commodities, 35% by fine chemicals and remaining 40% by differentiated specialties. The personal care ingredients market covers more than 130 ingredients within the eight main groups of which are surfactants, conditional polymers, emollients, rheology control agents, emulsifiers, antimicrobials, UV absorbers and hair fixative polymers. Hair care and skin care are the two largest applications and, as a result, ingredients used in them have a larger share in the market.

UV Absorbers: Sunscreen: A Sunscreen can be defined as a lotion, spray or cream that protects the skin from UV Radiations. It contains materials that absorb or block harmful radiations. Sunscreen comprise of inter alia, benzophenones, salicylates, homosalates, octocrylene, ethylhexyl methoxycinnamate and titanium di-oxide.

Preservatives: A preservative is a natural or synthetic chemical that is added to food or personal care formulation to prevent spoilage, whether from microbial growth or undesirable chemical changes. Not only do they help protect consumers from food poisoning but they also extend shelf-life. They can be broadly divided into anti-microbial preservatives, which function by inhibiting the growth of bacteria and fungi, and antioxidants, which inhibit the oxidation of foods and prevent rancidity. Preservatives enhance the shelf life of the products and rising demand for premium personal care products will act as a key trigger for preservatives demand. Rising awareness about health and hygiene products is also likely to fuel the market for preservatives across the globe.

Preservative Blends: The Preservative Blends market was a USD 133.5 million market in 2015 which reached approx. USD 185.7 million in 2021 growing at 6% per annum. The same is expected to become a USD 0.21 Billion market by 2024E. Beauty and Personal Care as an application makes up for majority consumption of preservative blends globally. Almost 32.9% of the total preservative blends consumption was by the beauty and personal care category. In terms of volumes, Asia Pacific made up for 40 percent share in 2016. The demand for preservative blends is expected to rise rapidly in the regions of Africa and Middle East.

Mild Surfactants: Surfactants milder than the traditional surfactants are mild surfactants. Mild Surfactants can be categorised into Sarcosinates, Alkyl Isethionates, glycinates, glutamates, taurates.

An Introduction to Personal Care Ingredients Market

Personal care products cover a diverse array of products we use in our daily life, including skin care, hair care, cosmetics and oral hygiene products. It represents a large market, dominated by MNCs with some of the most recognizable brands globally. While brands are known to all, there is less awareness of the chemistry behind these products or the ingredients constituting them.

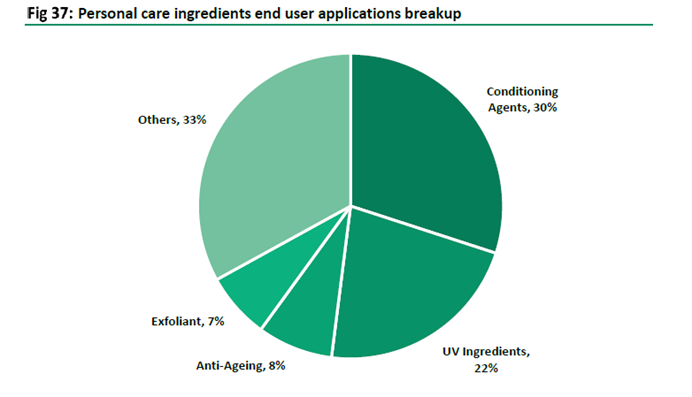

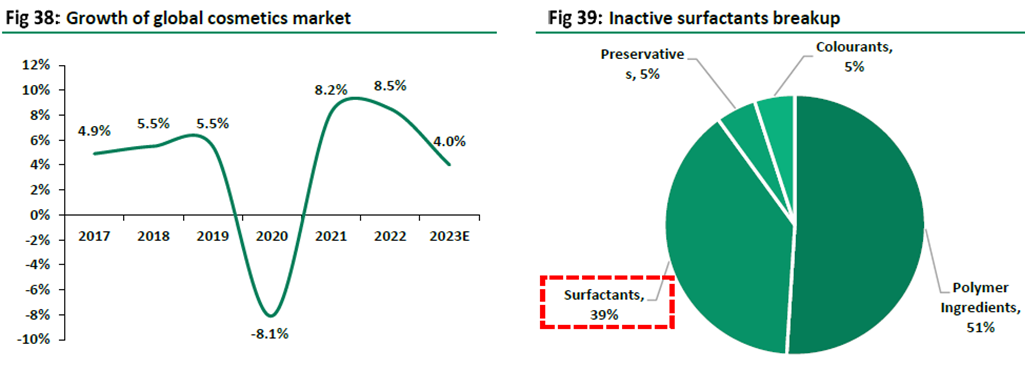

Ingredients used for personal care products can either be undifferentiated bulk chemicals (waxes, solvents, etc) or specialty chemicals. Specialty personal care ingredients constitute ~ 30% of the overall personal care ingredients market and are further sub-divided into active or inactive ingredients. Inactive ingredients alter physical properties of personal care formulations. These include surfactants, preservatives, colorants and polymer ingredients. Active ingredients add functionality to products, offering specific benefits to the end-user. Active ingredients include anti-ageing agents, exfoliants, conditioning agents and UV protecting agents. In India active ingredients account for 40% of the market by value, while the balance 60% is inactive ingredients.

India’s personal care ingredients market is projected to grow at a CAGR of 9.3% by the end of 2026, owing to growing demand for these ingredients in various personal care products, such as toiletries, fragrances, skin care, hair care, oral care, makeup items and so on. Also, growing urbanisation and increasing consumer spending on beauty products across Tier I and Tier II cities i.e. in metro cities along with the towns and small cities in India is anticipated to boost demand for personal care ingredients in the country. Moreover, rising awareness among people towards hygiene, sanitation and personal care is expected to be another major factor propelling demand for personal care ingredients in India. The Indian personal care products sector presents strong potential growth opportunities for the global as well as domestic companies owing to the presence of a large base of the potential customer population. Apart from this, the personal care and cosmetics sector in India has shown considerable and continued growth, with increasing shelf space in retail stores and boutiques in India, stocking cosmetics from all across the globe.

Key Players

Furthermore, some of the key players in the market include BASF, Clariant, Evonik , Solvay, Galaxy Surfactants, Kumar Organics, Croda, Godrej, VVF, Seppic, Sensient, Schulke, Dow, DSM, Innolex, Innospec, Lonza, Lubrizol and Ashland. These companies are using several strategies to expand market share and gain a competitive advantage over their competitors. The strategies include new product launches, mergers and acquisitions, partnerships, and collaborations.

Key Risks

Company does not enter into long-term supply contracts with any of their raw material suppliers and typically source raw materials from third-party suppliers or the open market. The absence of long-term contracts at fixed prices exposes us to volatility in the prices of raw materials that we require and we may be unable to pass these costs onto their customers, which may reduce their profit margins.

Company currently does not have long-term contractual arrangements with most of their significant customers, and conduct business with them on the basis of purchase orders that are placed from time to time.

Co’s operations are subject to extensive government regulation and are required to obtain and maintain a number of statutory and regulatory permits and approvals under central, state and local government rules in the geographies in which they operate, generally for carrying out their business and for each of their manufacturing facilities in India, Egypt and USA.

Raw Material

The principal raw materials Company uses to manufacture their products include fatty alcohols, fatty acids, ethylene oxide, Sulphur, caustic soda, LAB, phenol, DMAPA and PAA. Company is dependent on a single supplier for ethylene oxide, which is one of their key raw materials. Raw materials are imported mainly from South East Asia, Germany, USA and Japan. Company’s major feedstock Fatty Alcohol constitutes 50-55% of their raw material purchases. Fatty Alcohol and Fatty Acids accounted for nearly 2/3rds of the raw material purchases. Crude-based Derivatives accounted for nearly 1/5th of the raw material purchases. Company also consumes certain crude petroleum derivatives. The major ones are Ethylene Oxide, Phenol, and Linear Alkyl Benzene. These make up 22-25% of the total company’s feedstock purchases.

ROCE Calculations

The company has a gross fixed asset turnover of around 2.67x, so for every 100rs of capex, its able to generate approx. 267rs of revenue. With EBIT Margin at around 11% & working capital deployed at around 19% of sales, it is able to generate a ROCE of around 25%.

| Capex | 100 |

| Asset Turnover | 3 |

| Incremental Revenue | 267 |

| EBIT Margin | 11% |

| EBIT | 29 |

| Working capital deployed | 19 |

| Total Capital employed | 119 |

| ROCE | 25% |

Benchmarking

Croda International is a company based in England, which is into personal care additives, pharma and crop additives. They generate an EBITDA margin of 20%-23%.

| Particulars | FY16 | FY17 | FY18 | FY19 | FY20 | FY21 | FY22 | CAGR |

| Croda Revenue Growth | 15% | 10% | 1% | -1% | 1% | 36% | 11% | 10% |

| Croda EBITDA margin | 23% | 24% | 24% | 23% | 21% | 23% | 21% | 8% |

| Croda PAT margin | 16% | 17% | 17% | 16% | 15% | 17% | 18% | 11% |

Fine Organics is an Indian company which makes oleochemical based food additives, polymer additives & not present in surfactants, hence its margin profile is different from Galaxy Surfactants.

| Particulars | FY15 | FY16 | FY17 | FY18 | FY19 | FY20 | FY21 | FY22 | FY23 | CAGR |

| Fine Organics Revenue Growth | 12% | 8% | 19% | 6% | 23% | -2% | 9% | 66% | 61% | 22% |

| Fine Organics EBITDA margins | 17% | 21% | 18% | 18% | 22% | 23% | 18% | 19% | 27% | 39% |

| Fine Organics PAT margins | 8% | 11% | 10% | 11% | 13% | 16% | 11% | 14% | 20% | 45% |

Financials Snapshot

| PARTICULARS | FY18 | FY19 | FY20 | FY21 | FY22 | FY23 |

| Total Income | 2444 | 2774 | 2604 | 2796 | 3699 | 4456 |

| Total Expenditure | 2146 | 2416 | 2229 | 2337 | 3286 | 3878 |

| Gross Profit | 748 | 876 | 938 | 1073 | 1174 | 1432 |

| PBIDT | 298 | 358 | 375 | 460 | 413 | 578 |

| PAT | 158 | 191 | 230 | 302 | 263 | 381 |

| Sources of Funds | ||||||

| Net Worth | 719 | 877 | 1068 | 1301 | 1574 | 1883 |

| Total Debt | 348 | 298 | 372 | 268 | 366 | 272 |

| Capital Employed | 1067 | 1175 | 1440 | 1569 | 1940 | 2154 |

| Cash Flow | ||||||

| Cash Flow from Operations | 145 | 283 | 316 | 365 | 5 | 573 |

| Cash Flow from Investing activities | -55 | -167 | -151 | -165 | -84 | -149 |

| Cash Flow from Finance activities | -90 | -119 | -144 | -165 | 59 | -264 |

| Free Cash flow | 61 | 74 | 162 | 250 | -166 | 409 |

| Debt to Equity(x) | 0.5 | 0.3 | 0.3 | 0.2 | 0.2 | 0.1 |

| Current Ratio(x) | 1 | 2 | 2 | 2 | 2 | 2 |

| ROCE(%) | 25 | 27 | 24 | 26 | 19 | 24 |

| PBIDTM(%) | 12 | 13 | 14 | 17 | 11 | 13 |

| PATM(%) | 6 | 7 | 9 | 11 | 7 | 9 |

Management team

Mr. Unnathan Shekhar, Mr. Gopalkrishnan Ramakrishnan, Mr. Shashikant Shanbhag and Mr. Sudhir Dattaram Patil, have been associated with the Company since its incorporation in 1986, and have played a significant role in the development of the business. Promoters have an average experience of over 35 years, out of which an average of over 30 years have been with the co.

Board Of Directors

Mr. Unnathan Shekhar is the Managing Director of our Company. He has been associated with the Company since May 20, 1986. He holds a Bachelors Degree in Chemical Engineering from the University Department of Chemical Technology, Mumbai and a Post Graduate Diploma in Management from Indian Institute of Management, Calcutta. He has over 30 years of experience in the chemical manufacturing industry. He is a recipient of the “Distinguished Alumnus Award for 1998” conferred by the University Department of Chemical Technology Alumni Association.

Mr. Shekhar Ravindranath Warriar is the Chairman and a Non-Executive Independent Director of the Company. He has been associated with our Company from June 29, 2007 till his retirement in April’22. He was a fellow member of The Institute of Cost Accountants of India. He has been associated with Hindustan Unilever Limited for more than 30 years in various capacities. He was the former Managing Director – Foods Division, Executive Director (Beverages) and Divisional Vice President Commercial for Detergents at Hindustan Unilever Limited.

Mr. Melarkode Ganesan Parameswaran is the Chairman* (*w.e.f. April 20,2022) and Non-Executive & Independent Director of the Company. He has been associated with the Company since September 24, 2005. He holds a Bachelors Degree in Chemical Engineering from the Indian Institute of Technology, Madras and a Post Graduate Diploma in Management from Indian Institute of Management, Calcutta. He is also a PhD from Mumbai University and has completed the Advanced Management Program from Harvard Business School. He recently completed his term as Advisor to FCB Ulka Advertising, where he had a career spanning 25 years. He joined Ulka Advertising in 1989 as Vice President, South and later became Executive Director and CEO of FCB Ulka Advertising – part of FCB Worldwide and the Interpublic Group, USA during which time he set up various divisions such as Digital, Direct and Healthcare practices and Cogito Consulting. He was earlier associated with The Boots Company (India) Limited as a Marketing Planning Manager and United Database (India) Private Limited as General Manager (Sales). He serves as an adjunct professor at S.P. Jain Institute of Management and Research. He is an independent director at Qube Cinema Technologies Private Limited. He has a brand advisory website titled www.brandbuilding.com and serves as a coach and mentor for brand building. He was a member in the Board of Governors of Indian Institute of Management, Calcutta (2007-2017) and a recipient of “Distinguished Alumni Award” from Indian Institute of Technology, Madras in 2009. He has over 30 years of experience in marketing and advertising industry. He is also a member of Advisory Committee for SEBI Investor Protection and Education Fund.

Mr. Natarajan K. Krishnan is an Executive Director and the Chief Operating Officer of the Company. He has been associated with the Company since April 21, 1993. He holds a Bachelor’s Degree in Commerce from University of Mumbai and is a Cost Accountant from the Institute of Cost and Works Accountants of India. He completed the Advanced Management Programme from the Harvard Business School in May 2016. Since joining Galaxy in April 1993, he has headed diverse functions including Finance, IT, Business Creation, Business Commercial, Global Sourcing and Supply Chain and was designated as Chief of Operations in December 2009. Prior to joining the Company, he worked with Indian Organic Chemicals Limited as Deputy Manager (Finance).

Mr. Kasargod Ganesh Kamath was the Executive Director (Finance) of the Company (till October 6, 2022). He has been associated with the Company since September 10, 2004. He is a qualified Company Secretary from The Institute of Company Secretaries of India and a Cost Accountant from the Institute of Cost and Work Accountants of India. He was also an associate of The Institute of Bankers, London and The Indian Institute of Bankers. He also holds a Bachelor of Laws (LL.B.) degree from the Mangalore University. He joined our Company in 2004 as General Manager – Finance and Company Secretary. In the year 2014 he was given the responsibilities of Special Projects and was designated as Vice President – Special Projects. He joined the Board with effect from April 1, 2017. He has more than 20 years of experience in the banking and financial sector.

Mr. Vaijanath Kulkarni is a Whole-Time Director of the Company. He has been associated with the Company since June 17, 1995. He holds a Bachelors Degree in Chemical Engineering from Shivaji University, Kolhapur. He has also attended the Global Advance Management Programme for Global Leadership – 2009 from the Indian School of Business, India and the Kellogg School of Management, USA. He started his career with Galaxy as a Chemical Process Engineer and has been associated with the Company for the past 20 years. He was the managing director of Galaxy Chemicals (Egypt) S.A.E prior to his appointment on October 16, 2022 as Whole-Time Director of the company.

| Name | Reported Designation | Annual Remuneration (in crores) |

| U. Shekhar | Managing Director | 2.0 |

| K. Natarajan | Executive Director & Chief Operating Officer | 2.0 |

| K. Ganesh Kamath * | Chief Financial Officer (till 6th Oct 2022) | 1.2 |

| Vaijanath Kulkarni | Whole Time Director | 2.0 |

| Abhijit Damle | Chief Financial Officer (w.e.f. 1st july 2022) | 0.6 |

| Total | 7.8 |

*Mr. K. Ganesh Kamath was director of the Company till October 6, 2022, salary paid to Mr. Kamath excludes retirement benefits paid to him.

Related party transactions

As per our analysis of RPT, nothing unusual has come to our notice.

| Related Party Transaction (in Rs crs) | FY19 | FY20 | FY21 | FY22 | FY23 |

| U. Shekhar | |||||

| Short-term employee benefits | 2.3 | 1.9 | 0.0 | 1.8 | 2.0 |

| Other Long-term employee benefits | 0.0 | 0.0 | 0.4 | 0.0 | 0.0 |

| K. Natarajan | |||||

| Short-term employee benefits | 2.3 | 1.9 | 1.8 | 1.8 | 2.0 |

| Other Long-term employee benefits | 0.0 | 0.0 | 0.5 | 0.0 | 0.0 |

| K. Ganesh Kamath | |||||

| Short-term employee benefits | 2.4 | 1.9 | 2.9 | 2.9 | 1.2 |

| Other Long-term employee benefits | 0.0 | 0.0 | 0.6 | 0.0 | 0.2 |

| Post employment benefit | 0.0 | 0.0 | 0.0 | 0.0 | 0.9 |

| R. Venkateswar | |||||

| Short-term employee benefits | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Other long-term benefit | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| V. Kulkarni (w.e.f. 16th October 2021) | |||||

| Short-term employee benefits | 0.0 | 0.0 | 0.0 | 0.8 | 2.0 |

| Abhijit Damle (w.e.f. 1st July, 2022) | |||||

| Short-term employee benefits | 0.0 | 0.0 | 0.0 | 0.0 | 0.6 |

| Dividend Distributed | |||||

| Galaxy Chemicals | 5.4 | 13.2 | 10.9 | 3.1 | 27.9 |

| Galaxy Emulsifiers Pvt. Ltd. | 0.4 | 0.9 | 0.8 | 0.2 | 2.0 |

| Galaxy Surfactants Limited – Employees Welfare Trust | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| U. Shekhar | 3.0 | 7.2 | 5.9 | 1.7 | 15.2 |

| K. Natarajan | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| K. Ganesh Kamath | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| V. Kulkarni | 0.0 | 0.0 | 0.0 | 0.0 | 0.1 |

| Lakshmi Shekhar | 0.1 | 0.2 | 0.2 | 0.1 | 0.5 |

| Karthik Shekhar | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Shridhar Unnathan | 0.0 | 0.1 | 0.1 | 0.0 | 0.2 |

| Total | 15.9 | 27.2 | 24.0 | 12.3 | 54.7 |

Contingent Liabilities

| Particulars | FY19 | FY20 | FY21 | FY22 | FY23 |

| Excise duty & Service tax | 4 | 3 | 6 | 7 | 7 |

| Income tax | 1 | 1 | 1 | 1 | 1 |

| Sales tax | 5 | 7 | 6 | 5 | 4 |

| Custom duty | 8 | 8 | 8 | 42 | 42 |

| Customer claim | 0 | 0 | 0 | 0 | 0 |

| Total | 18 | 19 | 21 | 55 | 54 |

| As a % of Net Worth | 2.1% | 1.8% | 1.6% | 3.5% | 2.9% |

The company’s contingent liability as a % of net worth is 2.9% in FY23 and it has increased from 2.1% in FY19. A major portion of contingent liabilities is safe items which we have taken into consideration in calculating total liability.

Other income

The company earned around 10crs in FY23 as other income. other income majorly includes interest income, Forex Gains, Insurance claims received & Interest subvention income. Other income as a % of PBT is 3% on average which is not material.

| DESCRIPTION | FY15 | FY16 | FY17 | FY18 | FY19 | FY20 | FY21 | FY22 | FY23 |

| Other Income | 4 | 6 | 10 | 10 | 5 | 6 | 11 | 13 | 10 |

| PBT | 113 | 161 | 207 | 219 | 277 | 289 | 372 | 329 | 473 |

| Other Income as a % of PBT | 3% | 4% | 5% | 5% | 2% | 2% | 3% | 4% | 2% |

Share holding

70.9% of the company is held by promoter group. Mr Unnathan Shekhar, Mrs Sandhya Sudhir Patil and Mr Shashikant Rayappa Shanbhag together holds the highest equity capital (~35.1%) in the company. FIIs hold 2.99% and DIIs own 12.64% stake. Public investors hold 13.43%.