The Global luggage industry is a key component of the wider global travel industry.

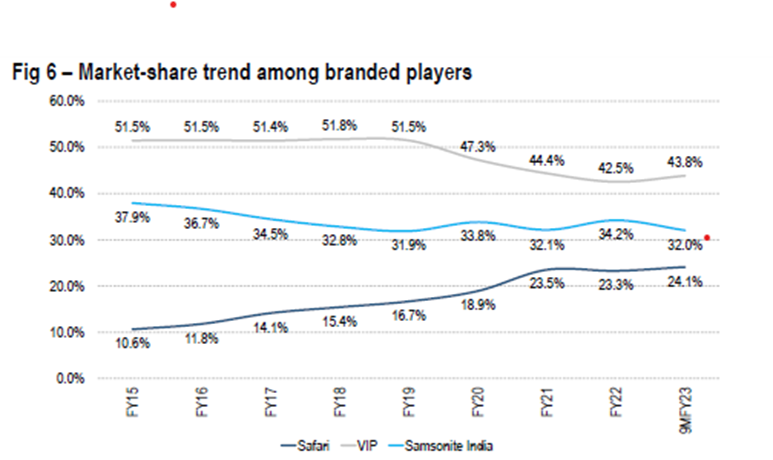

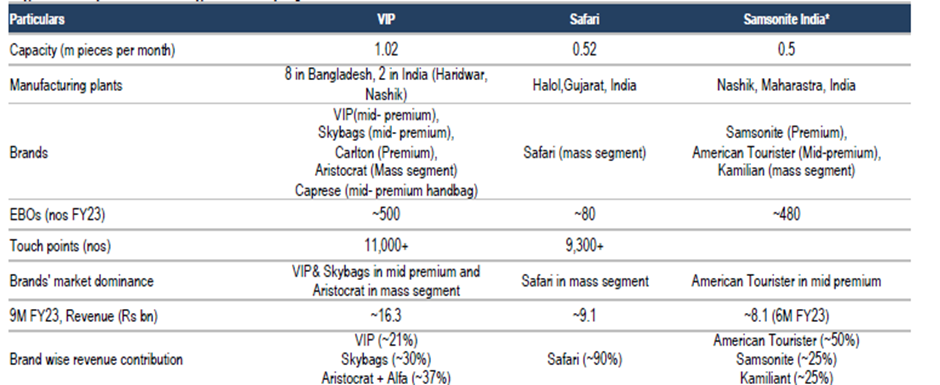

The Indian luggage sector is oligopolistic, especially in branded space. VIP had a 43.8% market share in 9M FY23, Safari ~24.1% and Samsonite ~32%, collectively contributing most of the branded Indian luggage.

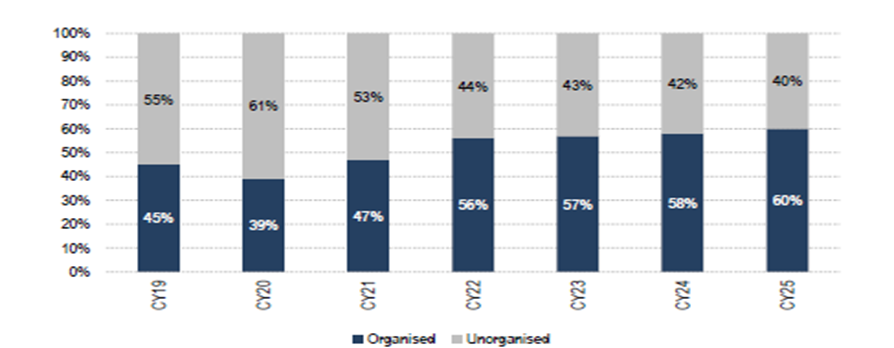

The sector, which in the past was dominated by non-branded luggage has shifted markedly to branded luggage (45% in FY20, 56% now).

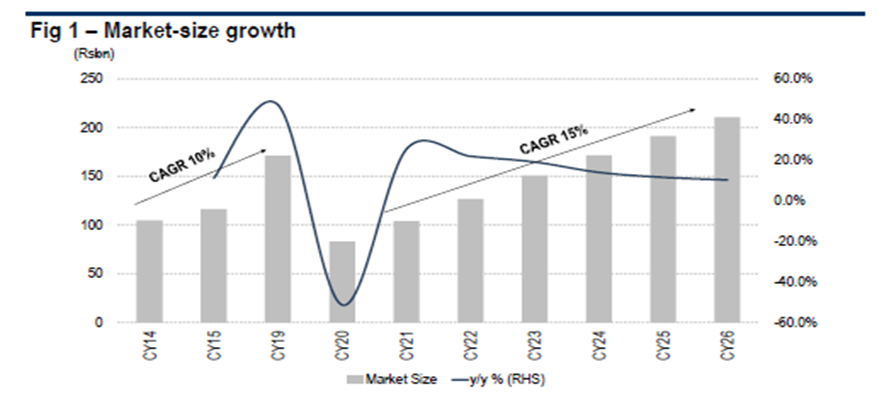

The Rs100bn Indian luggage and backpack categories clocked a ~14.2% CAGR pre-pandemic (FY15-FY19) and is set for a ~15% CAGR ahead. The sector’s overall long-term outlook is robust with travel returning hugely, opening of offices, and a strong upswing in marriage demand.

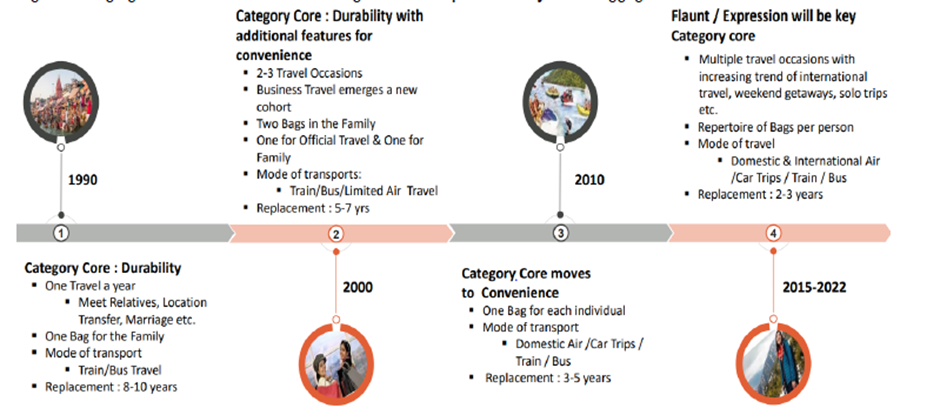

Other structural factors driving the sector’s growth are an accelerated shift in consumer preference from non-branded to brands, ownership of many bags and shorter replacement cycles.

The implementation of GST levelled the field for branded and non-branded manufacturers, the sector which in the past was dominated by the latter (through low-priced luggage and tax evasion). Supply disruptions across the globe and high ocean-freight rates rendered avenues of supply for non-branded manufacturers increasingly unviable. This supply gap benefited the branded segment, whose share rose from 45% in FY20 to 56% now.

About the industry

The now ~Rs 100bn Indian luggage and backpack segment registered a 14.2% CAGR over FY15-FY19 (pre-pandemic) and is set to clock a ~15% CAGR ahead. The overall long-term outlook for the segment is very robust with travel returning in a huge way, schools and offices opening and a strong upswing in marriage demand.

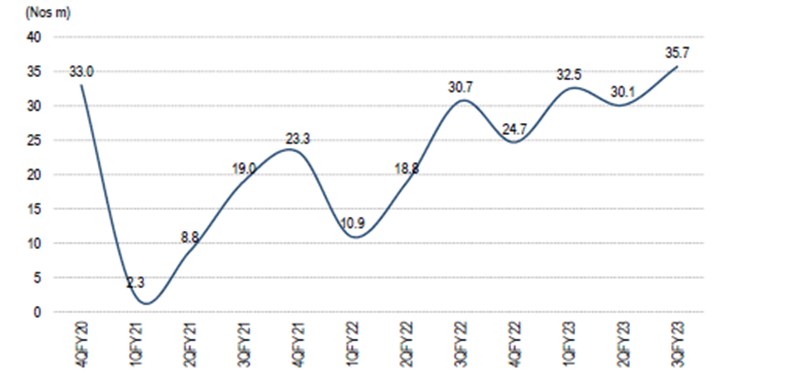

Domestic air-passenger traffic, a proxy for travel and luggage demand has picked up, post-Covid, surpassing FY22 and FY21 levels and almost touching pre-Covid FY20 levels. From Apr’22 to Feb’23, domestic air-passenger traffic hit ~122.7m, ~44% growth from FY22.

Consumer-preference shift, fueling branded luggage growth

The Indian luggage segment is oligopolistic especially in branded labels; VIP, Safari and Samsonite collectively contributing most of the market share in branded luggage in India. Dominated by the informal segment in the past, the Indian luggage sector has significantly shifted to the formal, or branded luggage. For branded and informal manufacturers, GST levelled the sector, dominated by the latter in the past (through low-priced luggage and tax evasion).

Evolution of luggage industry

Market Segmentation

The luggage sector is segregated into premium, mid-premium and mass categories, followed by backpacks and handbags.

Premium category starts at Rs6,000+ for cabin luggage. Some in this category are Carlton (VIP Inds.), Samsonite, Delsey, Swiss Gear, Victorinox, Mokobara (a D2C brand).

They are tilted toward hard luggage and differentiate themselves through warranties, features and new-tech luggage. In the Indian branded space (or “labels”), Samsonite enjoying a premium to its Carlton competitor.

Mid-premium luggage starts at Rs3,500+.

In this category are VIP, Skybags (VIP Inds.), American Tourister (Samsonite), Wenger, Tommy Hilfiger, Uppercase (a D2C brand) and Wildcraft. Leading brands here are VIP, Skybags and American Tourister, with the latter two competing in fast-moving, light and stylish luggage.

VIP and Skybags differentiate in warranties apart from features, whereas American Tourister differentiates in features (its bags offer water-protection zips).

Those in the mass category compete at Rs1,800+, with price gaps. Apart from the non-branded (or non-labelled) ones, they are Aristocrat, Safari and Kamiliant (an American Tourister brand). Channel checks tell us Safari leads, with Aristocrat offering lower prices and the longest warranty (part of VIP’s strategy to capture market share).

Prices of backpacks start at Rs1,000+ (the mass category), and Rs4,000 to Rs8000+ in the premium category with a standard one-year warranty.

Labels here are Skybags, Safari, Wildcraft, American Tourister, Fastrack, Mokobara and Samsonite. Prices of the last two start at ~Rs4,000 and Rs8,000+ respectively. Skybags, Safari, Wildcraft and American Tourister are leaders with Wildcraft offering the longest warranty.

Prices of handbags start at Rs1,500+. In this category are Caprese, Lavie, Esbeda and Hidesign. Caprese would focus on the premium category and its higher prices.

Global industry size

The luggage Market size is valued at US$ 50 Bn in 2024 and is expected to reach US$ 90 Bn by 2033, growing at a compound annual growth rate (CAGR) of 6% from 2024 to 2031.

Global Luggage Market- Drivers

Increasing Tourism and Business Travel:

Increasing globalization and economic development have led to a rise in international tourism and business travel over the past decade. As more people travel for leisure and work around the world, demand for luggage to conveniently transport personal items has also grown significantly.

With international tourist arrivals rising from 0.76 Bn in 2010 to over 1 Bn in 2020 according to United Nations World Tourism Organization data, travellers require suitable bags, backpacks and trolleys to pack for their trips abroad. Growing global business interactions have prompted frequent travel among professionals from various industries. Whether for short business meetings or extended client visits, these people depend on luggage to easily carry documents, laptops and other daily necessities while on the move.

This upsurge in tourism and commercial travel across borders has opened up huge opportunities for the global luggage industry. A wide variety of bags catering to different trip durations and purposes have entered the market. Ranging from compact carry-on bags suitable for quick weekend getaways to large suitcases for extended family vacations, innovative products are addressing the diverse luggage needs. Smart features such as double wheel systems, multi-device charging, and global lost-and-found registration have enhanced user convenience.

The increased economic opportunities and higher disposable incomes in developing nations have also contributed to this growth. Therefore, the consistent expansion of the travel industry aided by growing affluence, easy connectivity and changing cultural preferences is a major driver propelling the global luggage market ahead. Although international travel was impeded during the pandemic, the overall long term outlook for this industry and luggage sector remains positive as mobility resumes backed by widespread vaccination.

Global Luggage Market- Opportunities

Demand for Lightweight and Durable Bags:

The demand for lightweight and durable bags is a huge opportunity for growth in the global luggage market. Over the past few years, there has been a strong shift towards more sustainable and eco-friendly bag options across both business and leisure travel. Customers are increasingly prioritizing bags that are lightweight for ease of carrying but also hold up well over repeated use. This preference for lighter yet resilient bags aligns well with the trends in global travel patterns. According to the World Tourism Organization (UNWTO), international tourist arrivals grew by 4% in 2020 despite the pandemic compared to 2019. As travel continues recovering globally, luggage manufacturers that offer innovative yet durable lightweight bags stand to benefit tremendously.

Such bags meet the needs of present-day travelers well. Their lighter weight means less stress on travelers who often juggle multiple bags, devices and documents while rushing through busy airports or hauling luggage up many train station or hotel stairs. However, the sturdiness of these new materials like carbon fiber, polycarbonate and high-density nylon ensure the bags hold up against the bumps of frequent travel. This valuable combination of traits has seen some bag companies featuring these qualities grow revenues by over 15% year on year according to their recent financial reports.

Emergence of Online Retailing: The emergence of online retailing provides tremendous opportunities for growth of global luggage market. As more people conduct their shopping online out of convenience and choice, luggage brands now have alternative channels to directly reach consumers anywhere and anytime. With just a click, consumers can browse through various luggage designs, styles, sizes and price points from the comfort of their homes. People no longer have to visit physical stores which have limited inventory on display or depend on the availability of particular products locally.

Online retailing helps luggage brands to build global presence and cater to diverse consumer demands. Shoppers searching for specific features or the latest collections can easily find and purchase them online instead of waiting for or missing out on products in stores. Especially post pandemic, as international travels resume, online sites are projected to become the preferred choice for travelers to purchase luggage needed for upcoming trips. These provide seamless shopping experience without worrying about the luggage getting sold out by the travel dates.

Raw material used for making luggage:

Since the cost of three important raw materials—polypropylene, polycarbonate, and polyamide—declined by about 20%, margin improvement would have been even sharper if organized players had invested more in marketing and promotions. For the record, 40–45% of the cost for baggage manufacturers is accounted for by the primary raw material costs, which are mostly determined by the price of petroleum.

Hard-side luggage has a rigid protective shell made from materials such as ABS, polycarbonate, or polypropylene. Hard side luggage materials offer maximum protection for suitcase contents and can withstand rough baggage handling. While stronger than most soft-side bags, hard-side luggage can be more difficult to fit into crowded overhead compartments, as you cannot compress the bags to fit in small spaces.

Soft-side luggage, in contrast, is made from nylon, polyester, canvas, or other flexible materials. Soft-side bags are not as rigid than hard-side suitcases but are easier to stow as carry-on.

Hard Luggage vs. Soft Luggage:

Hard luggage is made up of polycarbonate, ABS or polypropylene. Polycarbonate or ABS have replaced polycarbonate as the go to material as they are sturdy as well as lightweight i.e. modern day luggage trolley bags. Soft luggage is made up of vinyl, polyester or cotton, etc. and consists of backpacks, duffle bags, laptop bags, etc.

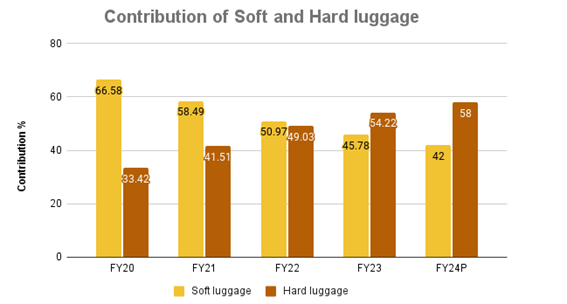

Soft luggage dominates the market with ~75% share. The hard luggage is manufactured locally with VIP being one of the largest manufacturers of hard luggage while soft luggage is imported. China is the global hub for manufacturing soft luggage due to massive cost advantages. While the proportion of soft-luggage has increased over the years, recent trends suggest that hard-luggage is back in trends amongst youth due to its alluring designs and durable nature.

Key numbers:

India’s luggage industry stands at around 10000 crores; which has grown at around 12%-15% CAGR over the last 5 years. It is slated to grow at another 15% over the next 5 years

The global industry stands at $50 billion and is expected to grow at 6%-7% CAGR.

This implies luggage industry of India is around 0.03% of the GDP. Global luggage industry is around 0.05% of the GDP implying India has lesser than global average penetration of luggage.

Out of the 10000 crores industry, organized sector is nearly 50% and unorganized is 50%. The organized sector has grown over the years driven by premiumization, reliability, lifestyle decisions and economies of scale. Also, implementation of GST made a lot of unorganized players unviable.

Within this 50% organized, that is 5000 crores – VIP has around 43% market share followed by Samsonite at 30% and Safari at 15% market share. The market is truly oligopolistic with 3 players commanding more than 85% of the organized market.

The average cost of luggage in the organized sector is around 2000; implying 2.5 crore units are sold by the organized sector alone. If we combine the unorganized market as well, this would imply around 6 crore units sold every year. This means 1 in every 5 households in India buys 1 luggage or backpack annually. This number is staggering given how the country has evolved from luggage being bought only on marriages to it being bought one in every 5 years!

For more details on the luggage industry – click here.