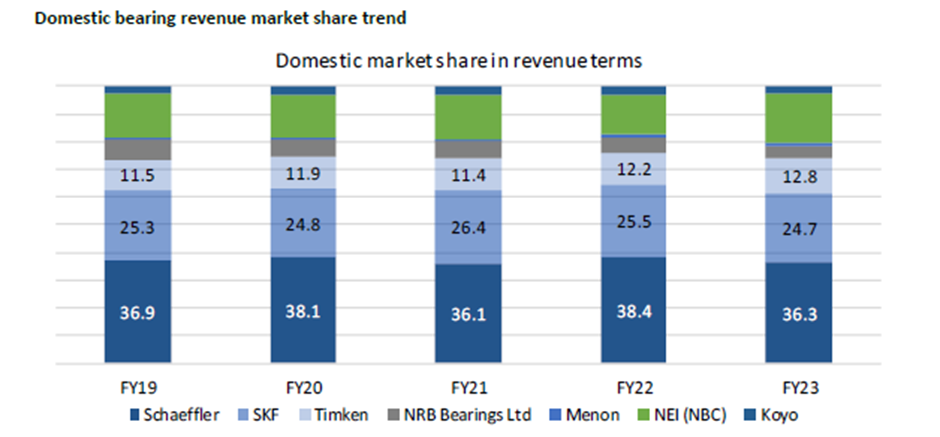

Schaeffler, SKF and Timken are the 3 biggest players in the Indian bearings space and all 3 of them are global MNCs with significant history and technology prowess to continue delivering solutions which cannot be replicated easily by other players.

Bearings industry has a strong case for investment primarily due to the following factors:

A) India’s robust capex cycle (Government’s budgeted capex is 3.2%/3.4% of GDP in FY24E/FY25E), focusing on infrastructure, manufacturing, and renewable energy, supported by increased budget outlays and PLI schemes (~Rs2tn). Bearings exhibit substantial potential due to their widespread utilization across various industries.

B) Overall Auto demand (55-60% bearing contribution) outlook remains positive, driven by anticipated GDP growth, increasing mobility needs, electrification and improving infrastructure.

C) Localization efforts, driven by import substitution and heightened demand in the capital expenditure upswing, promise scalability.

D) Expanding exports on the back of India’s cost-effective setup, attracting global corporations to establish it as an export hub. This shift is augmented by supply chain improvements, enhancing the quality and reliability of Indian-manufactured bearings, poising the sector for substantial growth.

The thesis for investments in bearings industry stems from the following key factors:

India Capex cycle to drive Industrial bearing consumption:

The Indian Bearing industry is more inclined towards Automobiles with ~55% share vs. a global average of ~45%. Auto bearings are commoditized while those used in the Industrial segment require high performance and high reliability. Now, with increasing demand in Rails (~$250bn orders in work ongoing as per investindia.com), manufacturing, and renewable energy, followed by government capex push and PLI schemes ($23bn incentive), the demand for industrial bearings is expected to increase, improving the product mix towards better profitability and scale benefits will follow through going forward. Rolling stock orders over the last 1.5 years could generate Rs75bn of bearing demand, and Wind power capacity installation plan till 2030 could generate Rs100bn+ bearing demand.

Imports substitution and localization:

Import substitution of specialized bearings, cost-competitive manufacturing, improving the supply chain of raw materials, and bearing ancillaries are driving MNCs to set up plants and assembly lines in India. It also includes the relocation of lines from the USA and Europe. According to ICRA, about 40% of the country’s bearing consumption is estimated to be met through imports and largely comprises high performance industrial bearings. This proportion has been declining as MNCs are focusing on enhancing localization.

Exports: Make in India for the world:

To take advantage of India’s cost-effective labor, multinational companies (MNCs) increasingly utilize Indian units as their global sourcing partners. Employee expenses account for approximately 10% of sales in India, compared to around 25% in developed countries. This cost advantage attracts MNCs to establish units in India, mainly when the volume of certain product SKUs justifies the investment.

As CV Cycle nears the last peak, replacement demand to drive growth:

In Commercial Vehicles (CVs), Government infrastructure capex, improved highway road network, replacement demand of ageing fleet and healthy GDP growth is expected to drive sales. Domestic CV demand moves in a cycle which normally lasts for 6 years. The current cycle started in FY22 and FY25 could be the peak as per previous 3 cycle trend. CV production is expected to be 3% below in FY24 vs the precovid high. Truck (M&HCV) sales have high correlation with GDP growth, and given the expectations of 6% plus growth, trucks demand is expected to remain healthy. As per ICRA estimates, the average age of M&HCVs increased to ~10 years in FY2023, the highest in the past two decades and hence we expect replacement demand to support M&HCV sales, given the ageing fleet. Also, the average tonnage per truck is also improving over the years and drives the revenue, for instance, the average was 30 Tonnes (GVW) as per ICRA and it is up ~43% vs FY19 average. The light CV segment is expected to be driven by e-commerce led last mile connectivity requirements. Lastly, bus segment is growing on a low base as it was the most impacted segment in Autos. In the medium term we expect CV volume growth at 5-7%.

Following are the top players in the Indian bearings market:

About the company

Schaeffler India encompasses the Indian operations of Schaeffler Group. The post-merger combined entity offers a vast and diversified mix of products to its automotive and industrial customers. Schaeffler India manufactures these products across its four state-of-the-art facilities in India.

The Company also has two dedicated R&D facilities in India that roll out innovative products for the Indian market. Through its thriving after-market network, the Company serves its customers across both the automotive and industrial segments. The company also provides best-in-class training services to important groups such as garages and fleet workshops under the automotive aftermarket and industrial distribution segments. The Company enjoys a prominent position in all its business segments. It has a balanced revenue mix between its automotive and industrial businesses.

Established in 1946, Schaeffler Group is a global automotive and industrial supplier. It manufactures high-precision components and systems for engine, transmission and chassis applications in the automotive segment. The Group also produces rolling and plain bearing solutions for a variety of industrial applications.

The Group owns majority stake in Schaeffler India. With effect from 2018, INA Bearings India Private Limited and LuK India Private Limited merged with Schaeffler India Limited (erstwhile FAG Bearings India Limited). The objective of the merger was to consolidate the Group’s India businesses and optimise the potential of the merged entity. Schaeffler AG, the Group’s flagship company, is a publicly listed stock corporation incorporated under the German law, with its registered office in Herzogenaurach.

Business area of the company

Schaeffler is actively engaged in innovating and shaping the global pace of change. With innovative technologies, products, and services for CO₂-efficient drives, electric mobility, Industry 4.0, digitalization, and renewable energies, the company is a reliable partner for making motion and mobility more efficient, intelligent, and sustainable.

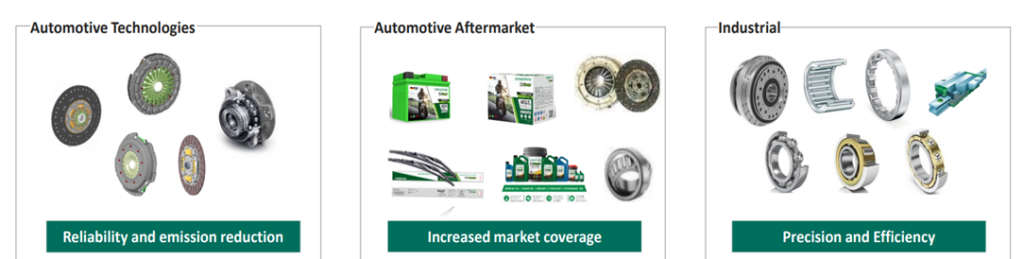

Products & solutions

Automotive OEM:

- Chassis components and systems

- Clutches and transmission systems

- Engine components and precision products

- Drives for hybrid and Electric Vehicles (EVs)

Industrial:

- Rolling and plain bearings

- Linear guidance system

- Maintenance products

- Maintenance services

- Mechatronics

- Digital services

Automotive Aftermarket Replacement parts for:

- Transmission

- Engine components

- Chassis components

- Intelligent solutions for Repair and service points via platforms such as REPXPERT

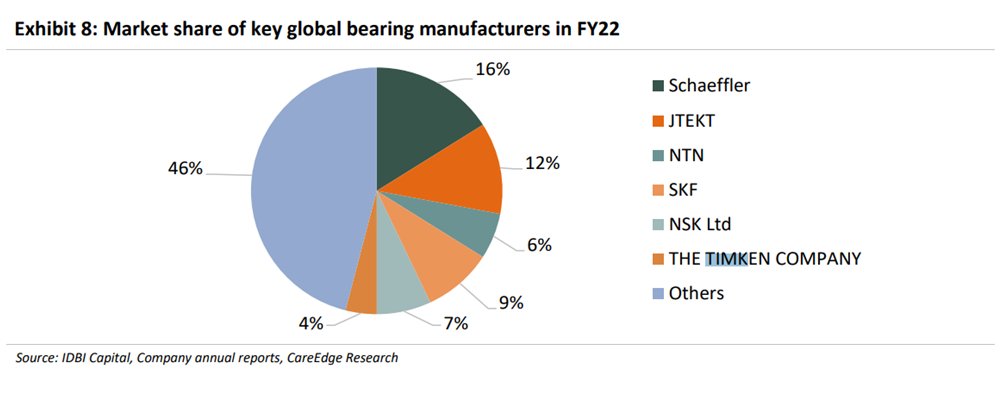

About the global bearings industry

- The global bearing market has an estimated value of between 42.81USD and 44.81USD billion.

- SKF estimates that the global bearing market grew by 6% to 9% in 2022. The growth was seen in both industrial and automotive markets, but slightly higher in industrial.

(Source: SKF FY22AR Pg no.- 31)

- In 2022, the global bearing market expanse is anticipated to grow at a CAGR of 10.6% from 2023 to 2030.

(Source: https://www.grandviewresearch.com/industry-analysis/bearings-market).

- The global bearing market will surpassed USD 50 bn and is projected to attain a CAGR of 8.5% from 2022 to 2032. In comparison, the Indian bearing market is expected to experience a higher CAGR of 11.3% from 2022 to 2027, with an estimated market value of USD 3.4 bn. The market’s growth is attributed to the increasing demand for ball bearings in industries such as automotive, construction, and mining equipment.

( Source: SKF India annual report)

Indian bearings industry:

- Indian bearings market accounted for a share of about 4.4% in the global bearings market in 2022.

(Source: SKF FY22AR Pg no.- 32)

- It is expected to grow the usage of bearings in several applications such as mining, automotive, infrastructure development and construction.

- TAM could grow at higher rate of 8-10% CAGR.

- It is estimated that more than 50% of the consumption of bearings in the country is met through domestic production. Meanwhile, less than 40% of the demand is met through imports and it has been declining due to increasing localization by multinational players operating in the domestic bearing industry.

(Source: IC Bearing Components)

Target industries:

Automotive:

- Bearings are used in an automobile are wheels, steering, pumps apart from internal combustion engines etc.

- The global automotive bearing market size was valued at $14.35 billion in 2022 & is projected to grow from $14.76 billion in 2023 to $19.46 billion by 2030, exhibiting a CAGR of 4% during the forecast period.

(Source:- https://www.fortunebusinessinsights.com/automotive-bearings-market-102229)

- The automotive industry in India is valued at over $222 billion and it makes up 8% of the country’s total exports and accounts for 7.1% of the GDP.

(Source:- Schaeffler technologies AR)

Auto Industry context and performance:

- The Automotive Market for India was valued at USD 100 billion in 2021 and is anticipated to hit USD 160 billion in 2027, inscribing a CAGR of 8.1% over the forecast period (2022-2027). The automobile sector accounts for 7.1% of India’s GDP and 49 % of the manufacturing GDP.

- Hence, the automobile sector in India is a significant driver of macroeconomic growth and technological advancement. Being a significant driver in the bearing market, it is said to propel India bearing market size from US$ 1,772.6 Mn in 2021 to US$3,374.4 Mn by the end of 2027.

(Source: Timken annual report)

Industrial sector:

- The Index of Industrial Production (IIP) grew by 3.1% to 133.5 in September 2022, as against the 2% forecast by the Ministry of Statistics & Programme Implementation (MoSPI).

- This growth was achieved on the back of rising manufacturing and mining output. There has been a significant increase in capital and infrastructure spending which is a strong indicator of the confidence the industry has in the changing tides of the Indian economy and its growing demand.

- In September 2022, the manufacturing sector grew by 1.8% to 134.3, mining output increased by 4.6% to 99.5, and power generation was up 11.6% to 187.5.

- The performance of the core industries is key to industrial growth as they make up around 40% of the IIP. These are electricity, steel, refinery products, crude oil, coal, cement, natural gas, and fertilizers. Government data revealed that the combined index of eight core industries grew 7.9% in September 2022, compared to the 4.1% rise in August 2022 and 5.4% in the year-ago period.

- Core output during the April- September of FY23 rose 9.6% against 16.9% a year ago.

(Source:- Schaeffler technologies AR Pg no. 47)

Automotive Aftermarket industry:

- It delivers innovative repair solutions in original-equipment quality. We offer comprehensive services to garages by conducting practical training seminars to enhance competency within the repair network.

- The Indian Automotive Aftermarket industry is forecasted to grow at a CAGR of 3.8% and reach $19.05 billion by 2025.

- With the average life of cars seeing an increase from 9.78 years to 11.33 years, people are now willing to spend on auto components like wheels, tyres, gears, suspension modifications, etc. Servicing needs have also increased, and there has been more demand for AV accessories.

(Source:- Schaeffler technologies AR Pg no. 49)

Market size of both the types of bearings:

Ball bearing: The global ball bearing market size was valued at $19.08 Bn in 2019 and is projected to reach $21.90 Bn by 2027, with a CAGR of 2.1 % during forecast period(2020-2027)

(Source:- https://www.fortunebusinessinsights.com/industry-reports/ball-bearing-market-101250 )

Roller Bearings: Roller Bearings Market Size was valued at US$ 21.05 Bn in 2018 and expected to reach US$ 26.71 Bn at 3.0% CAGR Forecast 2026.

(Source :- https://www.fortunebusinessinsights.com/industry-reports/roller-bearings-market-101249 )

Target industries where bearings are used and the possibility of growth in these industries:

- Railways: Auxiliary, Axel Box, Engine, Final Drive, Gear Box, Main Tractor motion, propeller shaft, transmission, wheel etc

- Aviation & Aerospace: passenger aircraft bodies, freight aircraft, helicopters, drones, aerospace engines, conveyors etc. This segment includes defense segment as well.

- Automotive: Passenger cars, passenger trucks, bus, commercial trucks, scooters, bikes, bicycles, etc

- Agriculture: Agriculture Trucks, Tractors, Loaders, Hay And Forage Equipments, Planting Machines, Floaters Tillage Machine etc.

- Electrical & Electronics: Alternators, Blowers, Compressors, Fans, Machine Tools, Power Tools, Pumps, Acs, Rolling Mills, Semiconductor Manufacturing, Computer Fans etc

- Construction: Cranes, Hydraulic Excavators, Asphalt Pavers, Motor Graders, Wheel Loaders, Off-Highway Trucks etc

- Mining: Crushers, Shaker Screens, Pulverisers, Shuttle Cars, Feeders, Mining Trucks, Excavators etc

- Others: This category includes the industries not classified above including wind sector.

Revenue Segments:

| Revenue Mix | 2022 |

| Automotive Technologies | 39% |

| Automotive Aftermarket | 9% |

| Industrial | 35% |

| Exports & Others | 17% |

| Products • Chassis components and systems • Engine components and precision products • Clutches and transmission systems • Drives for hybrids and EVs | Segments catered to Commercial vehiclesPassenger vehiclesTractors | Automotive Technologies Reducing fuel consumption and emissions |

| Replacement parts for • Transmission • Engine components • Chassis components Intelligent solutions for • Repair and service points via platforms such as REPXPERT | Repair garagesFleet workshops Multi-brand garagesRetail markets | Automotive Aftermarket Repair solutionscomprehensive services to garages by conducting practical training seminars to enhance competency within the repair network |

| • Rolling and plain bearings • Linear guidance system • Maintenance products • Maintenance services • Mechatronics • Digital services | RailwaysWind energyIndustrial automationTwo-wheelersOff-highwayRaw materialsPower transmissionIndustrial distribution | Industrial wide portfolio of bearing solutions |

Product Segments:

Order book:

- Rs.2000 Cr plus EV order.

Outlook:

- Revenue – Double digit growth

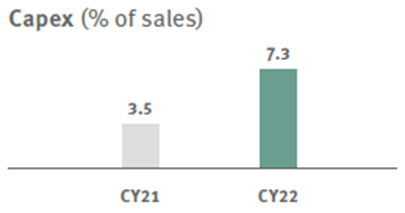

Capex:

- plan to invest Rs.3,000 million in Hosur over the next few years

- Rs.1500 Cr. In next 3 years.

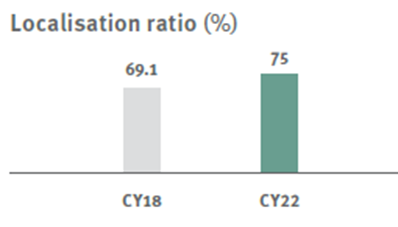

Localization:

)

Factory Locations and utilization

| Maneja, Gujarat – 85% |

| Savli, Gujarat |

| Pune – 80% |

| Hosur, KN – 80% |

Acquisitions:

Koovers platform

- Largest automobile spare platform

- Supplying to 5000 independent aftermarket workshop

- Aug at Rs. 142 Cr.

- 2% penetration in automotive aftermarket expected to reach by 2030.

Melior Motion GmbH

- The company, which generated revenue of around 23 million euros in 2021, has over 100 employees and is located in Hameln, Germany. It is currently planning another production site in China.

- Europe and China are currently the main sales markets of Melior Motion GmbH.

- The company was established in 2017 and traces its origins back to the Stephan-Werke founded in 1908, which was acquired by Premium Ltd. in 2011.

- Melior Motion GmbH and its predecessors have been developing precision gears for robotics manufacturers and applications in industrial automation for over 30 years.

- After many years of collaborating with Kuka, the new, innovative precision gearbox was qualified for two industrial robots as well and is currently installed in two axes of the KR Cybertech and six axes of the KR Iontec. As a result of these products’ success in the market, which is driven by the features of the new drive concept in particular, Melior Motion GmbH will considerably expand its production capacity in 2022.

Ewellix Group

The Ewellix Group is a leading manufacturer and supplier of linear actuators with over 50 years in the business. The company combines leading-edge design and development with proven expertise in manufacturing, customer-centric applications engineering, and digitalization. Its core products include actuators, lifting columns, robot range extenders, ball and roller screws, and linear guides (monorail guidance systems and linear ball bearings).

These products are used in a wide range of applications and equipment types, including medical technology, mobile machinery, assembly automation, robotics, and various other areas of industry.

- Ewellix has six production and customizing sites across the USA, Europe and Asia, operates 16 sales offices in 15 countries, and works with a network of about 550 sales partners.

- The company reported revenues of approximately EUR 216 million for 2021 and is currently expected to post revenues of about EUR 250 million for the 2022 financial year.

Parent Company:

- Schaeffler AG (Schaeffler) is a developer, manufacturer, and supplier of precision products for diverse applications. The company offers a wide range of products including rolling bearings, spherical plain bearings, plain bearings, mechatronics, linear products, and precision components. The company markets these products under the brands names of INA, LuK and FAG.

- Schaeffler Group has a ~74% controlling interest in the form of equity stock.

- 75:25 Revenue division between Automotive Technologies and Industrial businesses in Schaeffler Group.

- With its approximately 170 locations worldwide, 77 production facilities in 22 countries, 20 research and development centers, and a tight-knit sales and service network, the Schaeffler Group ensures customer proximity.

Locations:

Shareholding Pattern:

Management team:

- Harsha Kadam – CEO & Managing Director (President – Industrial Business)

Mr. Harsha Kadam is CEO and Managing Director of Schaeffler in India. In addition, Mr. Kadam is also responsible for Schaeffler’s Industrial business in India.

Mr Kadam has studied Mechanical Engineering at Bangalore University and later acquired further qualification in business management, specializing in Marketing, Finance & HR.

He joined Schaeffler in 2018, as President – Industrial Business, a role he continues to hold. Prior to Schaeffler, Mr. Kadam was the CEO of AGI Glaspac (India). Before AGI Glaspac, he was with SKF India till December 2016 as Director, Automotive Business and held several key leadership positions in the organization across manufacturing and sales, for over 20 years. Mr. Kadam has more than 25 years of experience in functions including Sales, Manufacturing, Product Design and Development.

- Satish Patel – Director-Finance & CFO

Mr. Satish Patel is Director-Finance & CFO of Schaeffler India Limited. In his role, he is responsible for the Finance & IT functions of the company.

Mr. Patel is associated with the company since 1992 and has a vast experience of over 28 years in the field of controlling and finance management. Mr. Patel brings in rich experience in the areas of controlling, budgeting, accounting, taxation, corporate finance, treasury, risk management, internal controls, strategy, governance, and corporate affairs. He has played a crucial role in strategy development and execution as well as M&A matters. He also oversees IT & digitalization function of the company. He is a key member of the Executive Leadership Team of Schaeffler India. He has held various incremental leadership positions during his long tenure with the company and has been in the leadership role since over 15 years.

- Mr. Avinash Gandhi – Chairman & Independent Director

Mr. Avinash Gandhi, holds a Bachelor’s degree in Mechanical Engineering and has a vast experience in the Automobile Industry. Mr. Gandhi ceased to be a Director and Chairman of the Board of Directors of the Company effective February 6, 2023 on account of expiry of his term.

Salary and commissions:

(in Rs. Cr.)

| Name | Salary & Performance Bonus | Allowance & Perquisites | Company’s contribution to funds | Total |

| Mr. Harsha Kadam (Managing Director) | 2.17 | 0.7 | 0.15 | 3.03 |

| Mr. Satish Patel (Director – Finance & CFO) | 0.86 | 0.67 | 0.14 | 1.67 |

Related party transactions and royalty:

| In Rs. Cr. | 2018 | 2019 | 2020 | 2021 | 2022 |

| Total Sales | 222.31 | 212.83 | 213.63 | 362.08 | 586.65 |

| Total Purchases | 516.49 | 528.38 | 477.67 | 662.00 | 768.32 |

| Dividend Paid | 14.50 | 69.53 | 81.10 | 88.06 | 185.36 |

| Puchase of finished goods | 719.55 | 592.52 | 495.73 | 838.46 | 886.47 |

| Revenue | 4,562.00 | 4,361.00 | 3,762.00 | 5,561.00 | 6,867.00 |

| Total Sales to Revenue | 4.87% | 4.88% | 5.68% | 6.51% | 8.54% |

| Total Purchases to Revenue | 11.32% | 12.12% | 12.70% | 11.90% | 11.19% |

| Total Dividend Paid to Revenue | 0.32% | 1.59% | 2.16% | 1.58% | 2.70% |

| Puchase of finished goods Paid to Revenue | 15.77% | 13.59% | 13.18% | 15.08% | 12.91% |

Financials:

| Particulars | Dec-18 | Dec-19 | Dec-20 | Dec-21 | Dec-22 | 4 Year CAGR |

| Sales | 4,561.51 | 4,360.63 | 3,761.84 | 5,560.51 | 6,867.42 | 0.11 |

| Sales growth | 15.76% | -4.40% | -13.73% | 47.81% | 23.50% | |

| EBITDA | 740.29 | 634.60 | 536.82 | 972.77 | 1,296.45 | 0.15 |

| EBITDA Margin | 16.23% | 14.55% | 14.27% | 17.49% | 18.88% | |

| EBITDA growth | 8.32% | -14.28% | -15.41% | 81.21% | 33.27% | |

| Net profit | 419.80 | 367.64 | 290.97 | 629.12 | 879.21 | 0.20 |

| PAT Margin | 9.20% | 8.43% | 7.73% | 11.31% | 12.80% | |

| PAT Growth | 8.06% | -12.42% | -20.85% | 116.21% | 39.75% | |

| EPS | 26.86 | 23.52 | 18.62 | 40.25 | 56.25 | |

| EPS Growth | -42.55% | -12.42% | -20.85% | 116.21% | 39.75% | |

| Profitability Ratio: | ||||||

| ROCE | 26% | 19% | 13% | 25% | 29% | 3% |

| ROE | 16% | 12% | 9% | 17% | 21% | 7% |