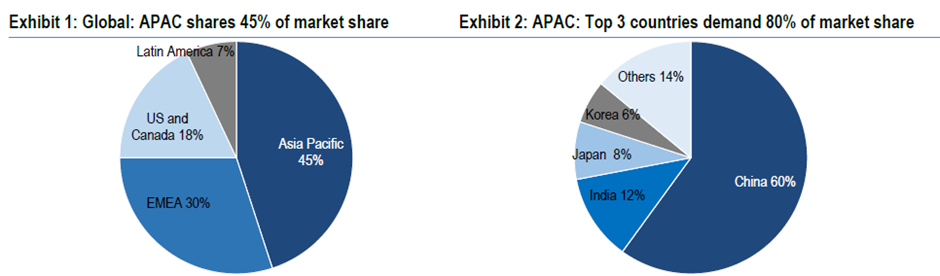

The Indian paints industry, as against the global paints and coatings industry, which generates revenue of ~US$160bn, the Indian paint industry is valued at ~US$7.1bn as on FY20.

Asia Pacific (APAC), the world’s largest coatings market with 45% market share and valued at US$71bn+ in 2019, has been growing faster than the global and matured markets on account of relatively higher growth in the economy, especially in China and India.

China is the largest part of the APAC market, comprising nearly 60% of volume and value. Including the next two largest markets, India and Japan, the top three markets account for over 80% of the volume and value of the APAC region.

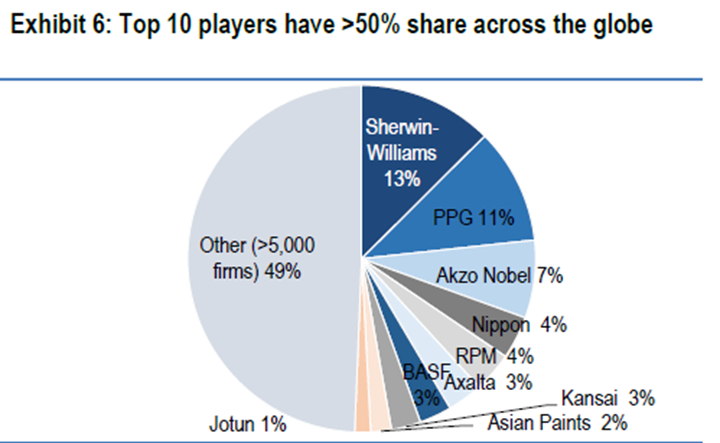

Globally, the top 10 companies dominate the market with more than 50% market share. However, APAC and China remain fragmented with regional and international players co-existing in these markets. The Indian paint market, unlike APAC and China, is an oligopolistic market with the top 4 players controlling a little less than 70% market share of the overall domestic paint industry.

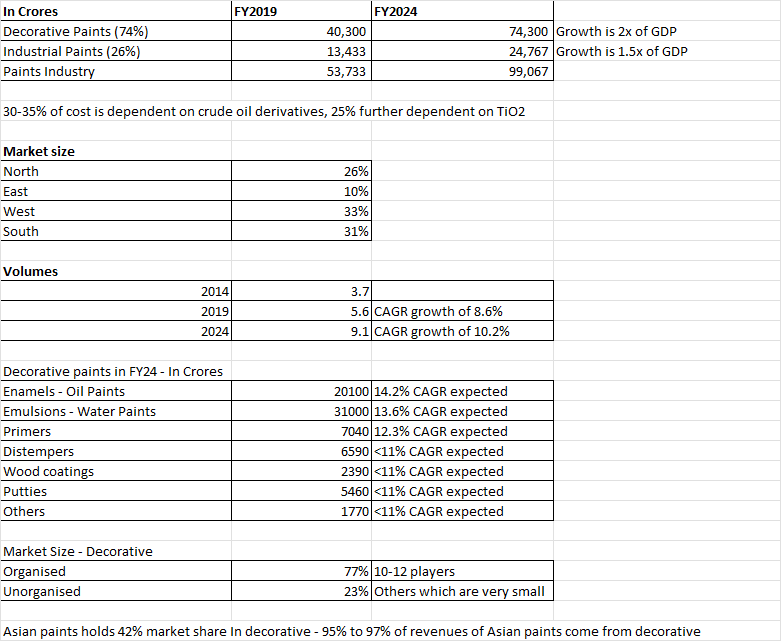

India Market:

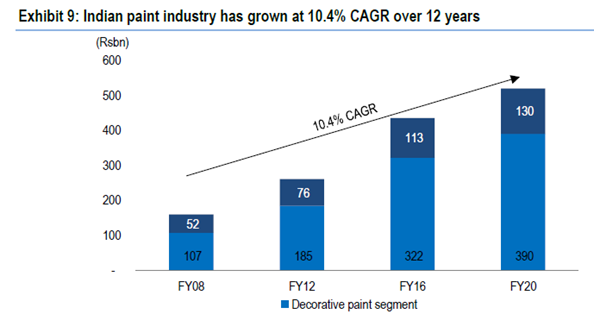

Indian market size currently is around $8-$9B which is around 65000 crores. The industry generally historically has grown at 1.5x of GDP growth and is projected to grow at similar rates. The current capacity of the industry is around 10 million kilo litres. The current consumption of paints in India is around 5.5 million kilo litres. Generally, a capex of 8000-10000 crores is required to add 1 million kilo liters of capacity.

Growth of the industry:

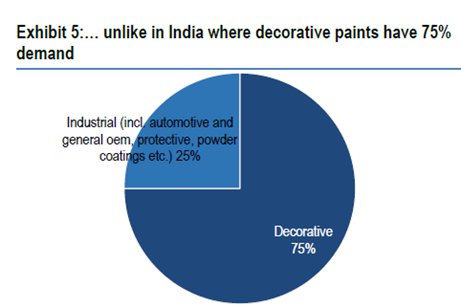

The growth rates projected by most industry reports is that decorative paints grow at 2x of GDP and industrial paints grow at 1.5x of GDP.

In FY26, Paints industry is expected to grow to 1 lakh crore with decorative paints constituting around 75000 crores and industrial paints constituting around 25000 crores.

In volume terms, this would mean India would consume paints of nearly 9 million kilo litres by FY26. The current capacity is around 10 million kilo litres, which is slated to grow to around 12.5 million kilotonnes.

Following are the key markets break-up

| Market size | |

| North | 26% |

| East | 10% |

| West | 33% |

| South | 31% |

Break-up of decorative paints:

| Decorative paints in FY26 – In Crores | ||

| Enamels – Oil Paints | 20100 | 14.2% CAGR expected |

| Emulsions – Water Paints | 31000 | 13.6% CAGR expected |

| Primers | 7040 | 12.3% CAGR expected |

| Distempers | 6590 | <11% CAGR expected |

| Wood coatings | 2390 | <11% CAGR expected |

| Putties | 5460 | <11% CAGR expected |

| Others | 1770 | <11% CAGR expected |

Within the industry, the organized sector which consists of 10 players constitutes around 77% whereas unorganized constitute around 23% of the revenues. Following is the high-level market share in decorative paints category:

| Decorative paints market share as per FY19 | |

| Asian | 42% |

| Berger | 12% |

| Kansai | 7% |

| Akzo | 5% |

| Indigo | 2% |

| Others | 33% |

*As per latest reports, Asian paints market share has gone past 50% at the cost of others.

Decorative paints by application type:

| Application type: | |

| Exterior | 39% |

| Interior | 36% |

| Roofing | 6% |

| Flooring | 5% |

| Others | 14% |

22% of the market is fresh painting and 78% market is repainting.

| Revenue growth (FY10-FY20) | |

| Asian Paints | 12.80% |

| Berger | 13.10% |

| Kansai Nerolac | 12.10% |

| Akzo Nobel | 12.50% |

| Indigo | 41.90% |

Global Paint Industry:

Top companies by revenue:

Product types:

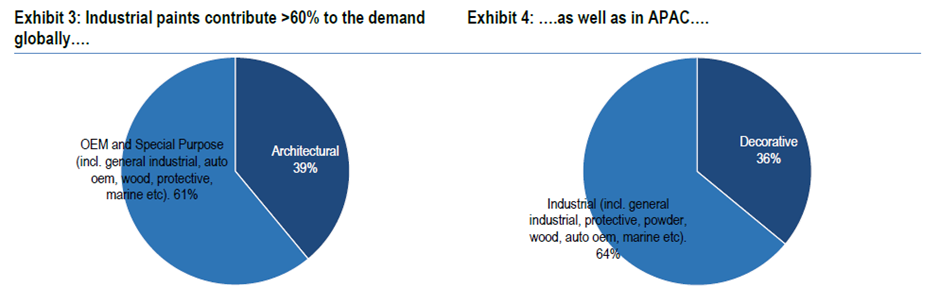

The 2 main segments in the paint industry are:

Decorative paints and Industrial paints

Globally – Decorative paints is a smaller size than industrial paints

In India, however the industrial paints are a smaller size:

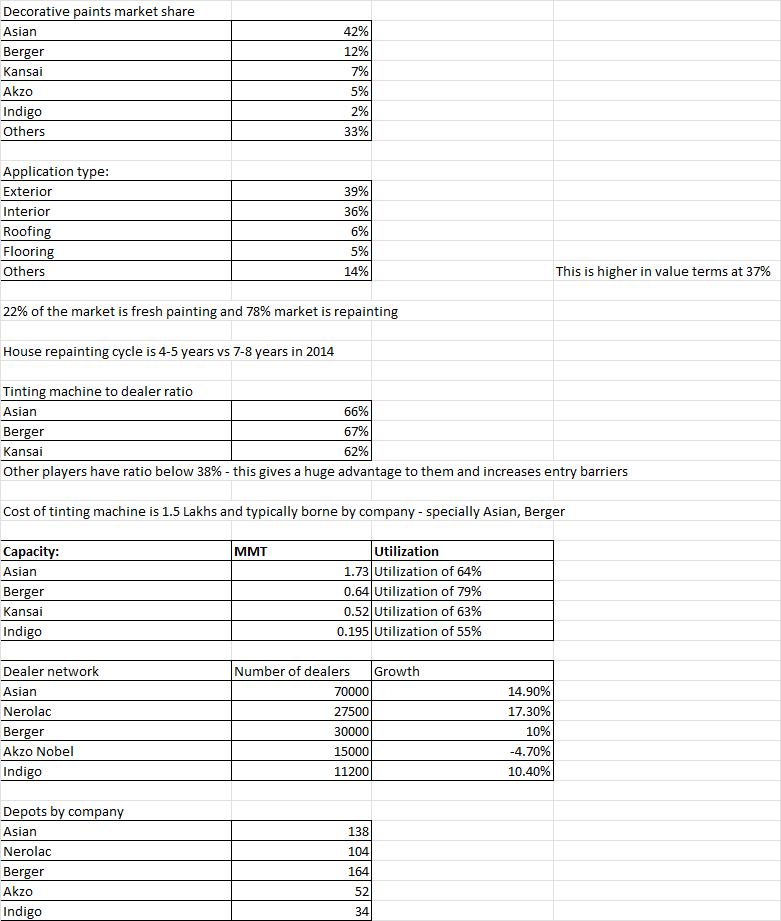

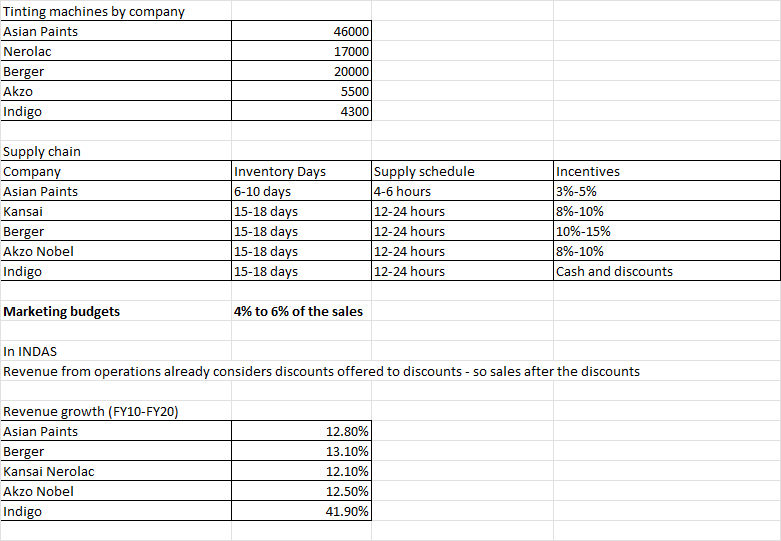

Some more key data points about the paints industry and players in India