The Indian tire industry is one of the biggest contributors to the GDP of India. Currently, India sells around 22 crore tires – of these 2-wheeler tires are around 11 crores, 4-wheeler tires are 6 crores, Commercial vehicles are around 3 crores and tractors at around 0.7 crores.

Also, the replacement demand is around 14 crore tires and OEM demand is 8 crore tires.

Companies make more margins in replacement than OEMs due to better bargaining power with OEMs. So, companies which have a higher share of replacement demand make more money in the long run. However, to cater to the replacement demand, companies need to invest in building a strong dealer network.

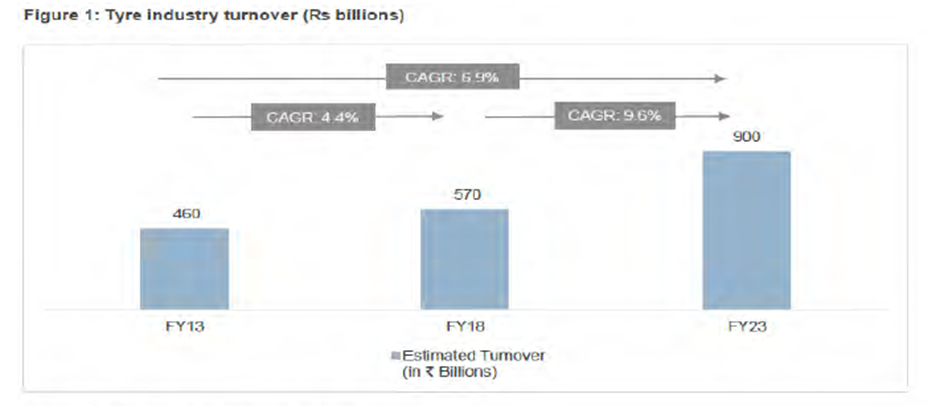

The current turnover of the tire industry is around 90,000 crores which is around $10Bn. The industry has grown from 460 crores in FY13 to 900 crores in FY23 growing at a CAGR of 7%. Recent 5 years, the industry has grown at a CAGR of 9.5%.

Below is the high level break up of the replacement cycle in tires.

| In crores | Average life | Number of tyres | Vehicles | Lifetime | Total tyres sold | Replacement required |

| 2 wheelers | 8 years | 2 | 2.2 | 15 | 66 | 8.3 |

| Passenger vehicles | 6 years to 8 years | 4 | 0.4 | 15 | 24 | 3.4 |

| CVs | 3 years to 5 years | 6 | 0.1 | 15 | 9 | 2.3 |

| 3 wheelers | 3 years to 5 years | 3 | 0.1 | 15 | 4.5 | 1.1 |

| Replacement demand | 15.1 |

In FY31, based on our estimation, we feel that replacement demand will reach 20 crores and OEM demand will reach around 11 crores thus growing at 5% CAGR in volume terms. Adding another 3% in price increase, we estimate the industry to grow at 8% CAGR in nominal terms in the next 8-10 years.

Tire weight varies between 8 kgs and 20 kgs. Following is the market share by segment in value terms.

| MHCV | 47% |

| PV | 24% |

| 2W/3W | 12% |

| LCV | 9% |

| Tractor | 7% |

| Other | 1% |

| India Tyre demand | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| In million units | 152 | 167 | 178 | 192 | 177 | 169 | 205 | 217 | 5.2% |

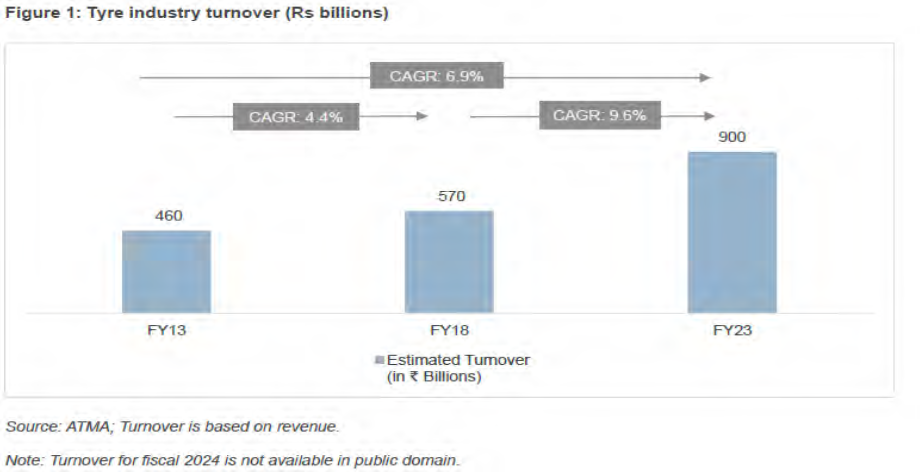

Export of tires from India

India exports around 23,000 crores worth of tires in FY23. In fiscal 2024, the top export markets for Indian tires were the US, Germany, Brazil, Italy, UAE, France, Philippines, Netherland, UK, Bangladesh, and Canada. The US continues to be the largest market for Indian tires, accounting for 18% of the total tires exported from the country during the year.

The competitive performance and affordability of Indian tires, combined with the global shift towards diversifying supply chains away from China, have positively impacted export growth. The establishment of manufacturing units by Indian OEMs abroad is also boosting the acceptance of Indian tires in international markets. Moreover, increased investments in technology and innovation are expected to further solidify the position of Indian tire manufacturers globally.

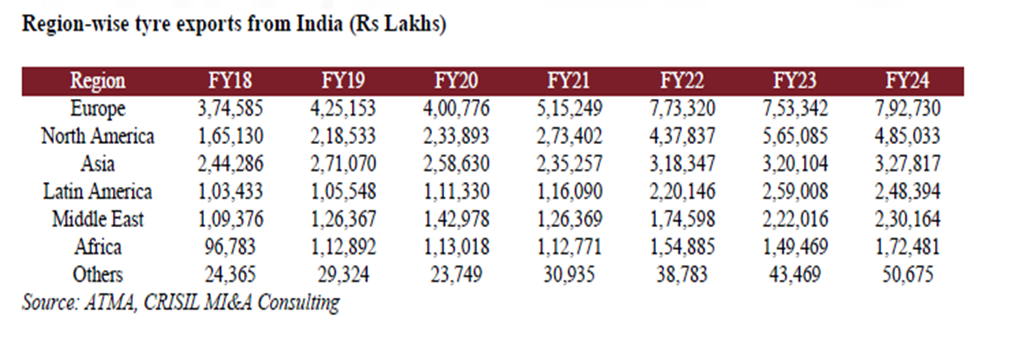

Import of tires

Tire imports are declining on the back of government regulations that favor domestic players.

The tire Imports in India went up by 19% in FY24. The rise in imports comes on the back of 15% growth in the previous year. Tires over Rs 2,500 crore landed in India during the period benefiting from low rates of duty under FTAs signed by the country.

In fiscal 2023, tires worth Rs 2,131 crore were imported into the country. In volume as well as value terms, PCR (Passenger Car Radial) tires accounted for the largest share.

OTR/ Industrial tires account for the largest share in overall tire imports in India in value terms. The share of both PCR and TBR (Truck and Bus Radial) came down in fiscal 2024 while that of Motorcycle tires went up in comparison to the previous year.

In September 2017, anti-dumping duty (ADD) to the tune of $245.35-$452.33 per ton was imposed on pneumatic radial tires above 16-inch in size, mainly affecting the truck and bus radial (TBR) and PCR segments for five years. In June 2019, countervailing duty (CVD) to the tune of 9.12-17.5% was imposed on Chinese pneumatic radial tires above 16-inch in size for five years. Further, in June 2020, the government put tire imports under the restricted category, which severely impacted imports, potentially benefitting domestic players in the replacement segment. Additionally, in September 2020, tires were removed from the Duty-Free Import Authorization list. Accordingly, share of tire imports from China, Vietnam and Thailand declined considerably across segments, resulting in a significant dip in total imports.

PCR tire imports continued to remain positive in the past due to demand for high-end tires as well as imports by multinational corporations such as Michelin, Pirelli, Hankook and Falken. However, with import restrictions in place, the import of PCR tires will remain a key monitorable soon.

For more industry analysis – Click here.