Indian tire industry

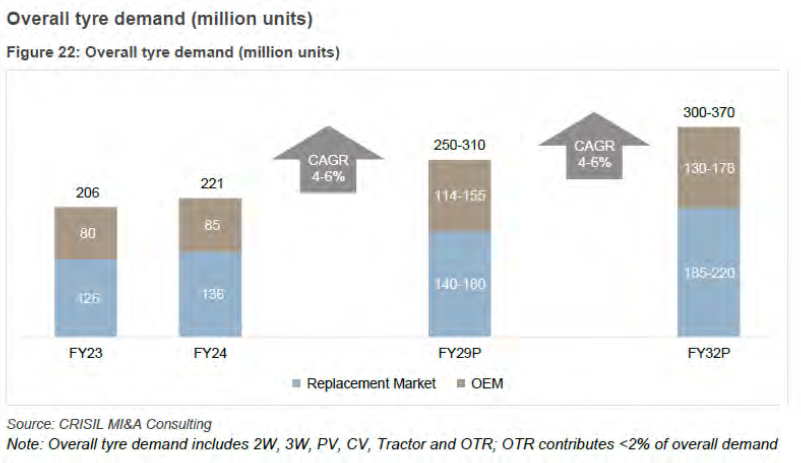

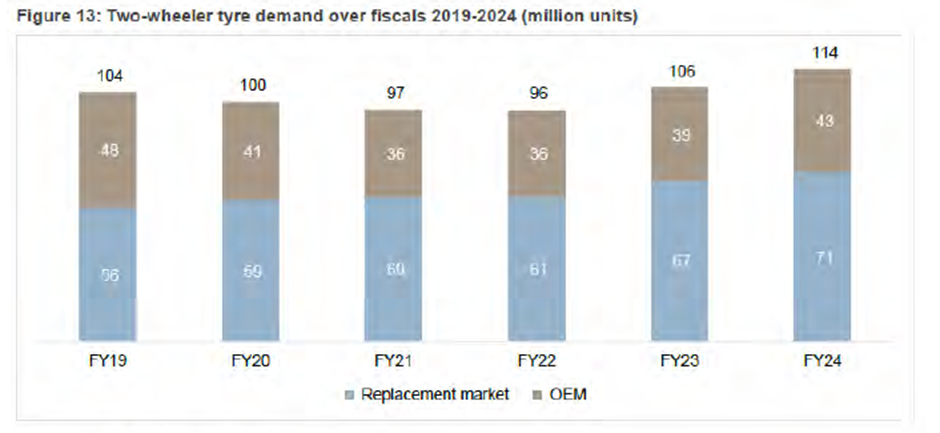

Currently, India sells around 22 crore tires – of these 2-wheeler tires are around 11 crores, 4-wheeler tires are 6 crores, Commercial vehicles are around 3 crores and tractors at around 0.7 crores.

Also, the replacement demand is around 14 crore tires and OEM demand is 8 crore tires.

Companies make more margins in replacement than OEMs due to better bargaining power with OEMs. So, companies which have a higher share of replacement demand make more money in the long run. However, to cater to the replacement demand, companies need to invest in building a strong dealer network.

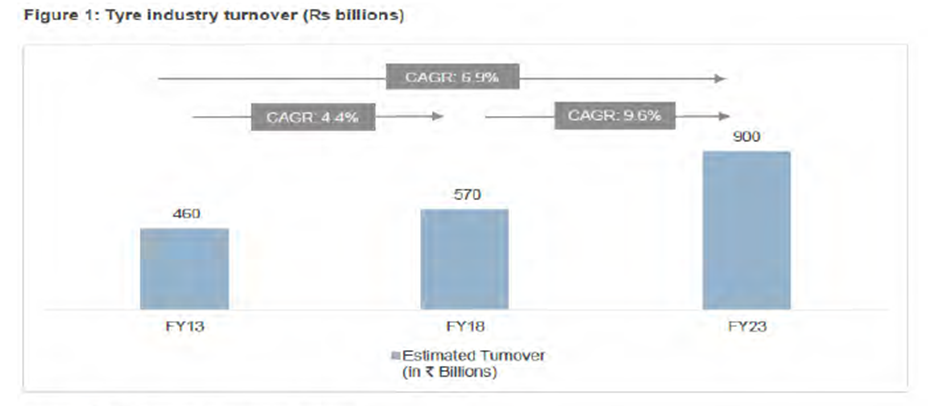

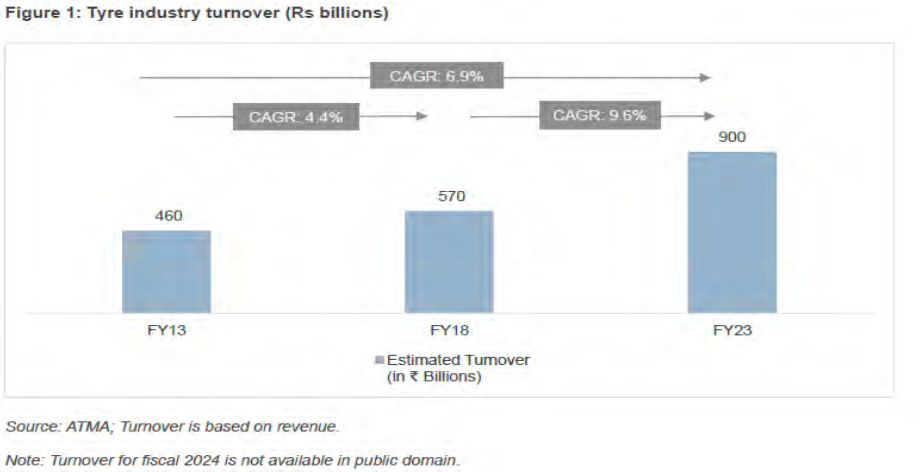

The current turnover of the tire industry is around 90,000 crores which is around $10Bn. The industry has grown from 460 crores in FY13 to 900 crores in FY23 growing at a CAGR of 7%. In the past 5 years, the industry has grown at a CAGR of 9.5%.

Below is the high level break up of the replacement cycle in tyres.

| In crores | Average life | Number of tyres | Vehicles | Lifetime | Total tyres sold | Replacement required |

| 2 wheelers | 8 years | 2 | 2.2 | 15 | 66 | 8.3 |

| Passenger vehicles | 6 years to 8 years | 4 | 0.4 | 15 | 24 | 3.4 |

| CVs | 3 years to 5 years | 6 | 0.1 | 15 | 9 | 2.3 |

| 3 wheelers | 3 years to 5 years | 3 | 0.1 | 15 | 4.5 | 1.1 |

| Replacement demand | 15.1 |

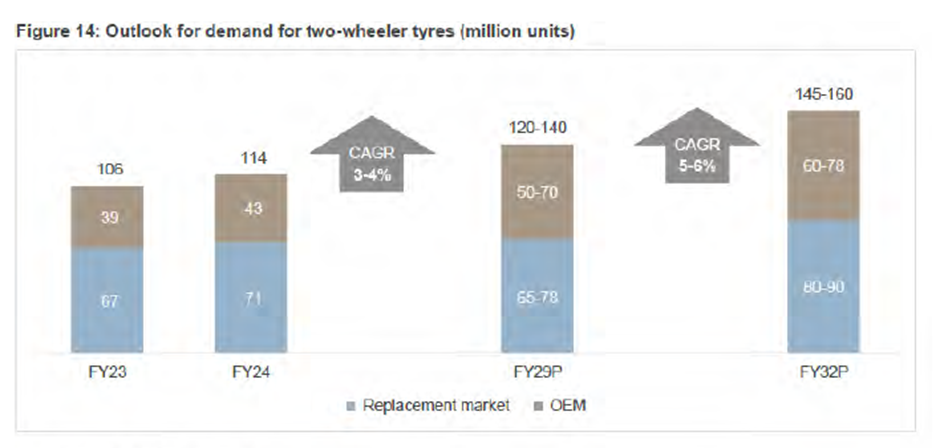

In FY31, based on our estimation, we feel that replacement demand will reach 20 crores and OEM demand will reach around 11 crores thus growing at 5% CAGR in volume terms. Adding another 3% in price increase, we estimate the industry to grow at 8% CAGR in nominal terms in the next 8-10 years.

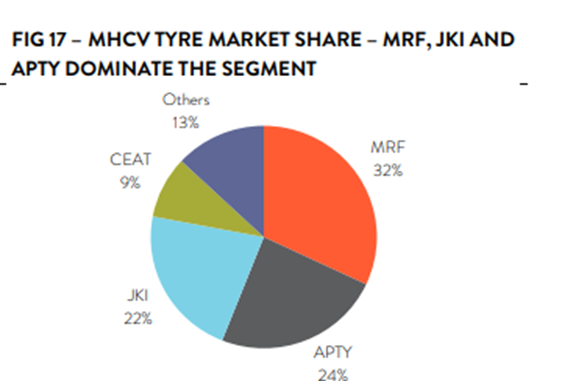

Tire weight varies between 8 kg and 20 kg. Following is the market share by segment in value terms.

| MHCV | 47% |

| PV | 24% |

| 2W/3W | 12% |

| LCV | 9% |

| Tractor | 7% |

| Other | 1% |

| India Tire demand | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| In million units | 152 | 167 | 178 | 192 | 177 | 169 | 205 | 217 | 5.2% |

Export of tires from India

India exports around 23,000 crores worth of tires in FY23. In fiscal 2024, the top export markets for Indian tires were the US, Germany, Brazil, Italy, UAE, France, Philippines, Netherland, UK, Bangladesh, and Canada. The US continues to be the largest market for Indian tires, accounting for 18% of the total tires exported from the country during the year.

The competitive performance and affordability of Indian tires, combined with the global shift towards diversifying supply chains away from China, have positively impacted export growth. The establishment of manufacturing units by Indian OEMs abroad is also boosting the acceptance of Indian tires in international markets. Moreover, increased investments in technology and innovation are expected to further solidify the position of Indian tyre manufacturers globally.

Import of tires

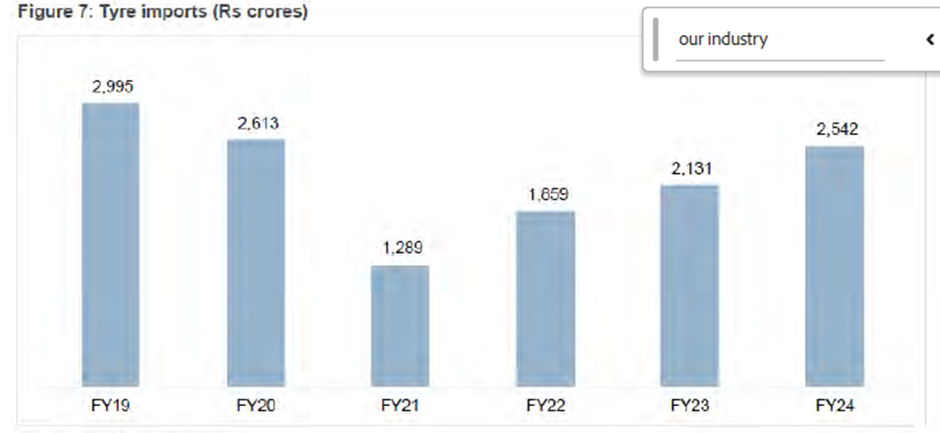

Tire imports are declining on the back of government regulations that favour domestic players.

The tire Imports in India went up by 19% in FY24. The rise in imports comes on the back of 15% growth in the previous year. Tires over Rs 2,500 crore landed in India during the period benefiting from low rates of duty under FTAs signed by the country.

In fiscal 2023, tires worth Rs 2,131 crore were imported into the country. In volume as well as value terms, PCR (Passenger Car Radial) tires accounted for the largest share.

OTR/ Industrial tires account for the largest share in overall tire imports in India in value terms. The share of both PCR and TBR (Truck and Bus Radial) came down in fiscal 2024 while that of Motorcycle tires went up in comparison to the previous year.

In September 2017, anti-dumping duty (ADD) to the tune of $245.35-$452.33 per tonne was imposed on pneumatic radial tyres above 16-inch in size, mainly affecting the truck and bus radial (TBR) and PCR segments for five years. In June 2019, countervailing duty (CVD) to the tune of 9.12-17.5% was imposed on Chinese pneumatic radial tyres above 16-inch in size for five years. Further, in June 2020, the government put tyre imports under the restricted category, which severely impacted imports, potentially benefitting domestic players in the replacement segment. Additionally, in September 2020, tyres were removed from the Duty-Free Import Authorisation list. Accordingly, share of tyre imports from China, Vietnam and Thailand declined considerably across segments, resulting in a significant dip in total imports.

PCR tyre imports continued to remain positive in the past due to demand for high-end tyres as well as imports by multinational corporations such as Michelin, Pirelli, Hankook and Falken. However, with import restrictions in place, the import of PCR tyres will remain a key monitorable soon.

Raw material

The primary raw material used in tyres is rubber. Below is the break up of the key raw materials

| Rubber | 47% |

| Fabrics | 10% |

| Carbon black | 18% |

| Chemicals | 8% |

| Other | 17% |

This can be further classified as follows:

| Natural rubber | 33% |

| Synthetic rubber | 15% |

| Crude derivatives | 41% |

| Tyre cord/ fabric | 12% |

Synthetic rubber requirement is 30% higher for radial vs bias tires

Rubber prices are correlated to crude price.

Segments

2 wheelers

Improving urban sentiments owing to a pick-up in overall public mobility, with the resumption of work-from-office and physical classes in educational institutions, and positive rural sentiment backed by an anticipated normal monsoon, are expected to support two-wheeler sales this fiscal.

4 wheelers

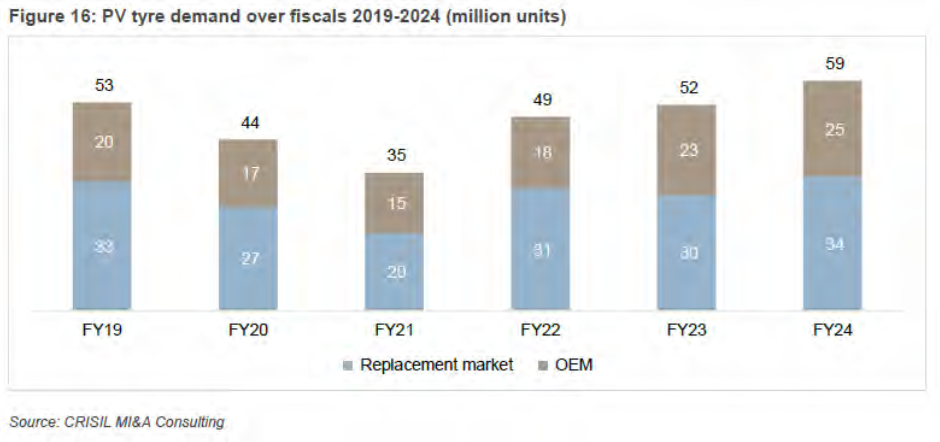

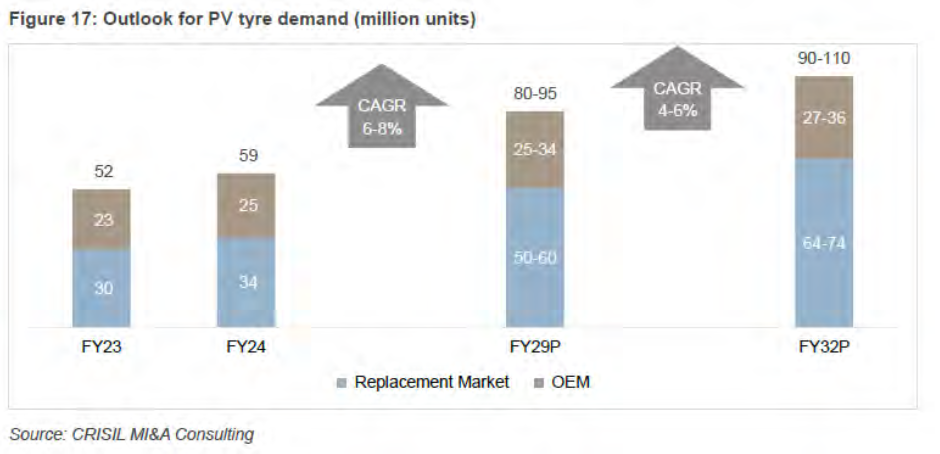

Passenger vehicle sales are expected to be driven by the expansion in the addressable market, urbanisation, low penetration, modest increase in the cost of acquisition and fast-paced infrastructure development. We also expect automobile manufacturers to focus on rural markets and expand their distribution network in semi-urban and rural areas.

The passenger vehicle sales are projected to grow by 5-7% in fiscal 2025 over a strong base created by 3 consecutive years of healthy growth. A rise in income levels along with an increase in finance penetration coupled with good traction in newly launched UV models is expected to bode well for the industry.

Better financial conditions, the launch of higher-end utility vehicle models by OEMs and improving demand sentiments are expected to drive 5-7% growth in fiscal 2025. Additionally, the high sales in the PV segment in fiscal 2022 are expected to result in higher tire sales in fiscal 2025 and 2026.

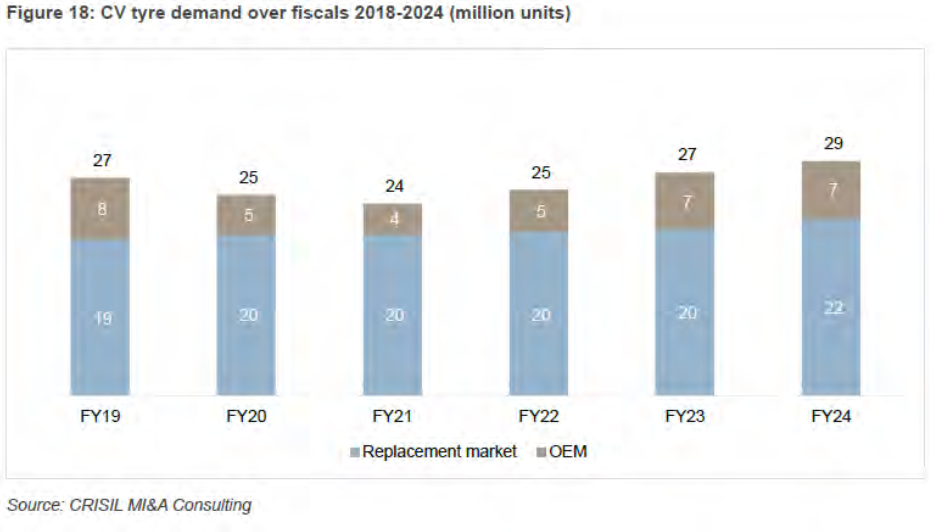

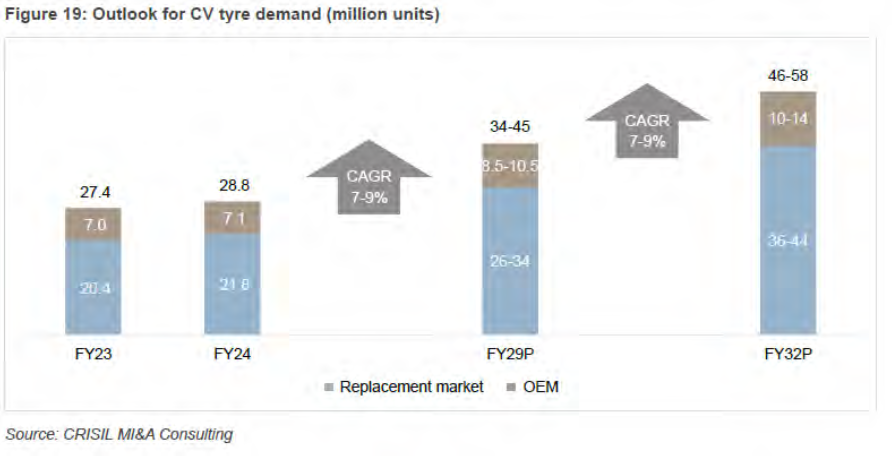

Commercial vehicles

The tyre demand from OEMs catering to the MHCV segment is projected to decline by 4-6% in fiscal 2025 due to a projected decline in the Medium and Heavy Commercial Vehicle (MHCV) sales segment by 2-4% in fiscal 2025. The projected higher decline in sales in higher tonnage vehicles is expected to lead to a larger decline in tyre sales in fiscal 2025. The decline in the volume up for replacement and the oversupply of tonnage in the system will hinder the volume growth. The higher tonnage available in the system is restricting volume growth in the current fiscal as the trend towards higher tonnage vehicles is expected to continue implying tonnage growth will be in line with GDP but volumes will be limited.

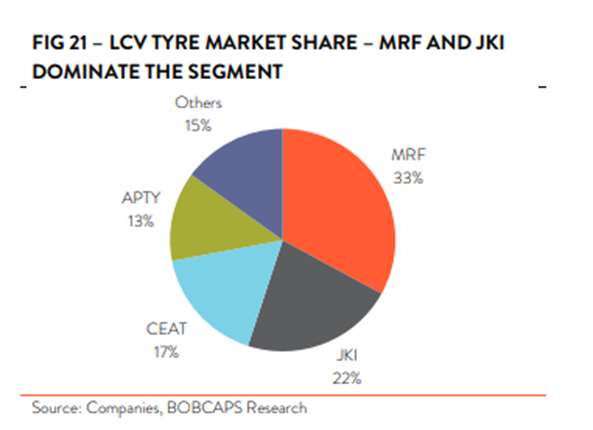

Tyre demand from OEMs catering to the LCV segment is projected to decline by 8-10% in fiscal 2025. Though overall LCV sales are estimated to grow by 0-2% due to an increase in sales of LCVs and pickups by 2-4%, the ULCV segments which have higher tyre sizes are estimated to decline by 35-40% due to subdued volumes up for ULCV replacements which peaked in fiscal 2023.

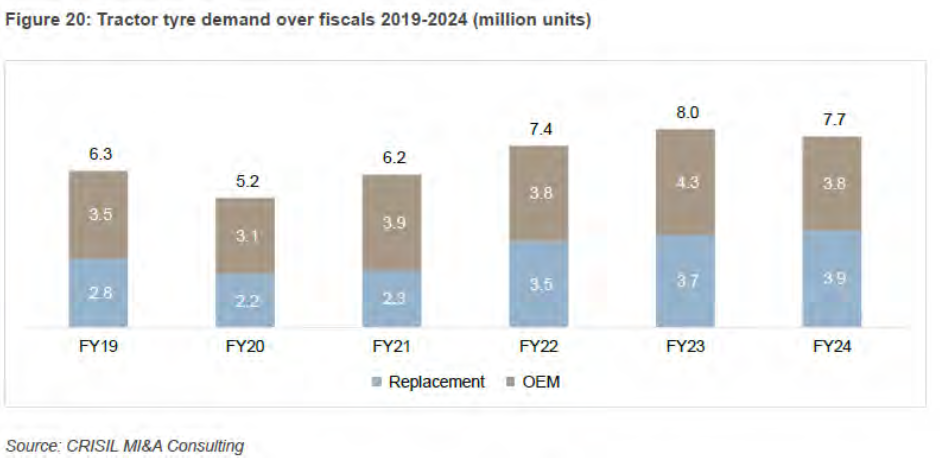

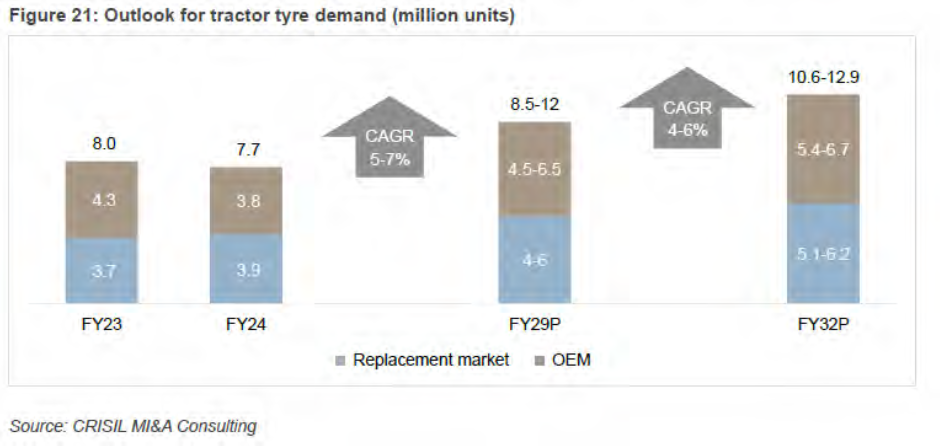

Tractors and OTR

OEM tractor tyre demand is projected to record an 3-5% growth in fiscal 2025 on account of higher tractor purchases which are estimated to grow by 4-6. Subdued rural sentiments due to erratic rainfall and high input costs have led to a decline in farmer sentiments.

Tyre demand from the tractor segment is expected to be stable in the long run as the government has set a target to augment farm incomes, provides direct income support to farmers and owing to improvement in land productivity through issuance of soil health cards. The government’s renewed thrust on enhancing irrigation intensity is expected to support tractor growth and increase mechanization. Tractor manufacturers have started offering rental services via mobile applications, which will also prop up demand for tractors in the long term.

Types of tyres

Radial vs Bias

Radial Tires on Bikes – Advantages and Disadvantages

It is often believed that radial tires are much better than bias tires.

Until about 50 years ago, bias ply tires were pretty much the only option available for vehicles. They were reasonably good in doing what they were made for, but engine technology was evolving fast during those times, vehicle speeds were increasing at a rapid pace, and the old design of the bias ply tires wasn’t quite able to cope with the extreme demands of the newer machines. Bias ply tires had extremely stiff tire walls, as the entire thickness of their plies ran from sidewall to sidewall, making their construction stiff, and unyielding to undulating surfaces. This made the ride of the vehicle very bouncy and jarring, especially at high speeds. Bias ply tires also ran hot, as they were not able to dissipate heat efficiently. The tough sidewalls also meant that the contact patch wasn’t sufficient when performance motorcycles were leaned over.

The carcass of bias ply tires consists of nylon belts which uniformly run from the base of one sidewall to the base of other sidewall at a 30-to-45-degree angle with the central tread line. These nylon belt layers overlap each other, and cover the entire area of the tire, including the sidewalls and tread. What that means in effect is that the stiffness of the sidewall is largely the same as the crown, or the tread area, making it a pretty stiff construction overall. With those tough sidewalls, the bias ply tires have their own advantages in terms of bearing heavy load, but they also have many disadvantages, including poor heat dissipation, insufficient contact patch, profile deformation at high speeds, and an unyielding, stiff response over uneven surfaces.

Radial tires were born to address some of these problems. Unlike bias ply tires, radial tires had steel belts which ran radially, or at 90 degrees to the direction of tire travel, giving them their name. Even when these tires have additional plies or steel belts, they are arranged in the same direction, making all the plies run parallel to each other. In addition to these steel belts, there are additional reinforcement layers in the tread area, which can be made of different materials, including steel, nylon or kevlar among others. What that means is that the stiffness of radial tires on the sidewalls is independent of the stiffness these tires offer in the tread area, or the crown of the tire. In effect, the sidewalls of a radial tire are often softer than its tread, allowing for more flex, and therefore better response and grip over various terrains. Having witnessed several technological enhancements over more than 40 years, radial tires have reached a highly evolved state and offer some clear advantages over the traditional bias ply tires. Depending on the materials used in the cord ply of the radial tires, they can be classified as all-steel radial ply, half steel radial ply or fibre radial ply tires.

Advantages of radial tyres

Radial tyres, in general, work well in applications where high speed, mid corner handling and faster rate of heat dissipation are the key requisites. These tyres, owing to their more flexible sidewalls, also offer a fantastic transverse contact patch, allowing the rider to lean in their motorcycle more aggressively. Here we have listed some of the major advantages radial tyres offer over their bias ply counterparts.

- With their flexible sidewalls, the surface contact area of radial tyres is larger than bias tyres. While the footprint of a radial tyre isn’t as long as a bias ply tyre, it is much wider, offering better grip while taking corners at sharp angles. These tyres are more suitable for cornering at higher speeds as the sidewalls can flex depending on the change in weight on the tyre when the bike is leaning into a corner. The tyre can quickly go back to its original shape once the motorcycle comes out of the corner and straightens up.

- Radial tyres offer better grip not just around corners, but also in a straight line, both at high and low speeds. This also helps during braking and prevents the vehicle from skidding in wet conditions.

- The pressure in the contact area on a radial tyre is more evenly distributed as compared to a bias ply tyre, allowing for a more uniform wear over time.

- Just like the pressure, the heat is also uniformly distributed inside a radial tyre. This is why radials run cooler than bias tyres. The steel belts on radial tyres do a better job of dissipating heat than the nylon plies on bias tyres. Even at high speeds, the heat is not concentrated in one direction or one particular area of the tyre. This prevents the tyres from bursting at high speeds and increases the overall safety, and life of the tyre.

- The sidewalls, as explained earlier, are independent of the cord ply and the crown, and hence, are more flexible. This enables the tyre to soak up any irregular deformities on the surface. This makes the ride quality more compliant, and cushioned, especially at higher speeds.

- The material on the crown, or tread is harder in radial tyres, and coupled with the steel cord ply, the tread strength of a radial tyre is higher. This means that the tyre wears out slowly and lasts longer. Also, because of the harder tread material, the puncture resistance of the tyre, at least on the crown, is also relatively higher.

- Since the cord ply of radial tyres radiate around the centre of the tyre, the plies are independent of the crown and other layers of the tyre. This results in low friction between the components and reduced rolling resistance. When there is lower rolling resistance, the overall fuel efficiency of the bike is enhanced.

- At high speeds, the profile of a bias tyre gets deformed to an extent that it affects handling. Radial tyres, however, stay more stable at high speeds, due to their reinforced crown belt, allowing for better stability and control at high speeds.

Disadvantages of radial tyres

While radial tyres have many advantages, they do have some disadvantaged. Let’s take a look at what they are.

- The biggest disadvantage of radial tyres is the risk of lateral deformation. Radial tyres, though strong, do not perform as well when put under excessive weight. There is a risk of the tyre deforming or bulges forming on the sides if the vehicle is saddled with a lot of heavy load and proper pressure is not maintained. Due to this characteristic of radial tyres, they are often avoided in trucks and other heavy commercial vehicles.

- Another disadvantage is again related to the softer sidewalls. If the vehicle is heavily loaded, say with two riders and a lot of heavy luggage in the form of panniers and top boxes, due to the lower lateral stiffness the bike might tend to sway. However, this will happen only in extreme cases where the weight carried is overly heavy, and optimum tyre pressure isn’t maintained.

- The production cost of radial tyres is higher as the process is more complex, requires more expensive materials and consumes more time. Although, it can be argued that the cost savings radial tyres offer somehow balance the extra premium.

As evident, the advantages radial tyres offer over their bias ply counterparts heavily outweigh their negatives. Radial tyres are a far better option for your motorcycles as compared to bias ply tyres, which are often considered obsolete for performance motorcycles. Not only do radial tyres perform better, but also work towards making your rides a lot more comfortable, enjoyable and safe.

What is the difference between a Radial Tyre and a Bias Ply Tyre?

Passenger car tyre is a steel-rubber-fabric component that surrounds a wheel’s rim. According to their construction, car tyres are divided into bias and radial. To understand the difference between these types of tyres, it is necessary to study their features, benefits and drawbacks.

What is a Bias Ply Tyre?

This type of tyre consists of a rubber-fabric casing and airtight inner tube. In working condition, the inner tube is inflated under a certain pressure. The sidewall of a bias ply tyre is a symmetrical construction that consists of an even number of crossed plies.

A bias ply tyre has a structure in which the ply cords extend to the beads and are laid at alternate angles substantially less than 90° to the centreline of the tread. Cord is usually made of synthetic fabrics (nylon, polyether etc.). A bias ply tyre is more resistant to impacts and cuts. When running a rough road, its carcass demonstrates such features as strength and endurance.

Benefits and drawbacks of Bias Ply Tyres

However, this tyre has its drawbacks. Among the most obvious are the following:

- significantly shortened operational lifetime;

- lower load carrying capacity;

- low wear resistance;

- relatively weak grip with asphalt road ;

- more difficult car handling;

- carcass made of synthetic materials that have a lower thermal conductivity;

- relatively large weight.

Basically, bias ply tyres are made for poor road conditions (heavy-duty tyres with adjustable pressure, and others). Today they are used for special-purpose equipment (excavators, tractors, etc.) and trucks.

What is a Radial Tyre?

In the radial design, the threads of the carcass cord are not crossed, but arranged radially (meridional), i.e. the cord threads are directed parallel to each other. The number of cord layers can be odd. This tyre can be tubed or tubeless. The sidewall of a radial tyre consists of one or more cord layers with almost parallel threads. Synthetic polyamide fabric that provides greater strength, high elasticity and lightness of the tyre carcass is used. The upper layers of the carcass of these tyres are covered with a belt, for the manufacture of which a strong steel cord is used. Usually, passenger car radial tyres are tubeless. In tubeless tyres, an inner liner is used instead of a tube. The shock absorbing ability of a tyre is achieved by tube inflation and tyre flexibility.

Benefits and drawbacks of Radial Tyres

Main benefits of radial tyres are the following:

- long-term operational lifetime;

- ability to withstand increased physical stress;

- ensuring optimal vehicle stability;

- reduced rolling resistance (this contributes to saving fuel consumption);

- high thermal conductivity of carcass;

- good traction with asphalt road;

- comparatively low weight.

In addition to the advantages, this type of tyres has some drawbacks: relatively high cost, vulnerability of sidewall to mechanical stress and damage.

Global benchmarks

The global tyre industry size is around $130 Billion. Indian market size is $9 Bn and is expected to grow to $22Bn by 2032.

World over, Passenger car radial is the biggest market with 50% market share. In India, Truck and bus radial is around 50% market share.

For more industry analysis – click here