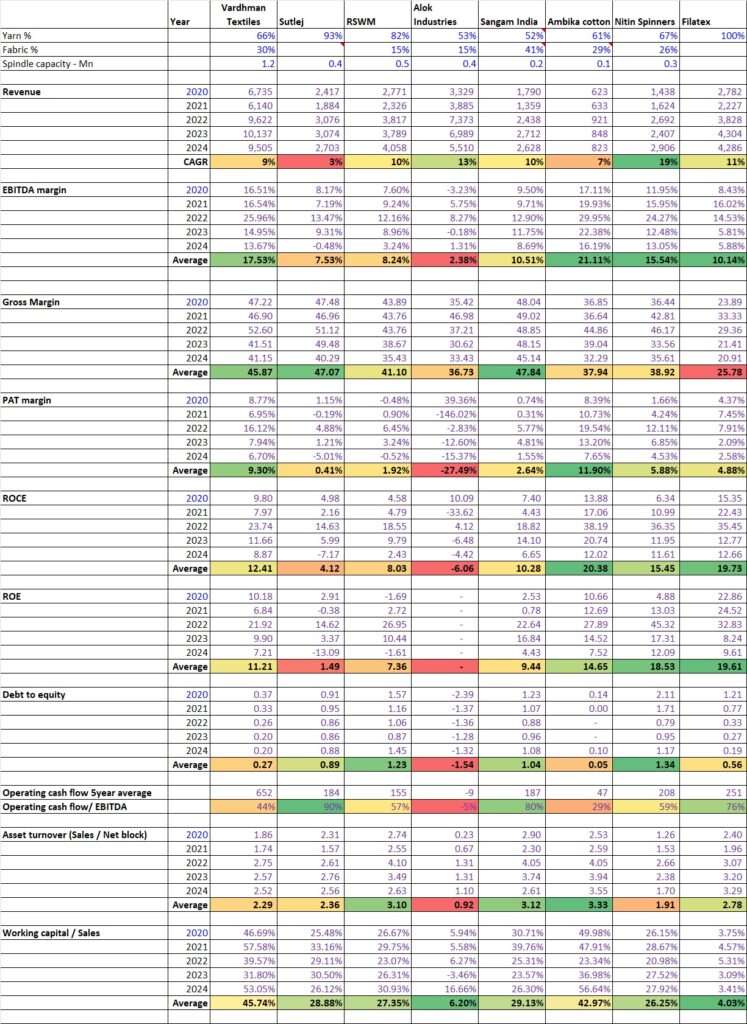

The table below provides comparison of textile yarn companies in India. An important thing to note is that the yarn companies are present in either cotton yarn or synthetic yarn and both have different financial advantages.

Also, though the industry goes through cycles, stronger companies outperform the weaker ones in them. It is clearly evident from the table below. Companies which manage their costs well – employee, power, sales and marketing, admin are able to do well despite having similar gross margins. Also, companies which are able to efficiently turn their assets and use capital effectively, generate higher ROCE as evident below.

As can be seen, some companies outperform others even during the worst periods of the business cycle. Further study reveals that the companies which outperform have certain advantages like – lower power cost due to captive plants, better machinery with latest technology, advantage over raw material, well managed employee costs, higher asset turns which improve efficiency. The comparison of textile yarn companies above reveals which are the strongest and best managed businesses in this space.

For more such industry analysis – click here.