Relationship between repo rate and nifty

{“visual”:false,”title”:””,”text”:”Repo rate and Nifty are inversely related as can be seen from the above graph. \r\n\r\nThe above image shows data since 2013. The correlation factor between Nifty index and the repo rate is -0.81.\r\n\r\nIn an inflationary environment, central banks are compelled to raise rates to reduce the inflationary impact.\r\n\r\nThis leads to higher cost of capital for all companies as well reduced capital expenditure investments due to higher cost of funds.\r\n\r\nBesides, the consumers tend to spend lesser as there is lesser money in their hands in a higher interest rate scenario which increases their borrowing costs.\r\n\r\nSo high inflation is always a risky environment for equity investors and one must monitor it closely.\r\n\r\n\r\n\r\n\r\n\r\n”,”legacy”:false}

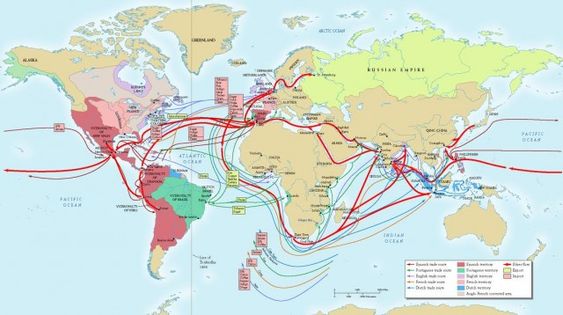

The above image shows data since 2013. The correlation factor between Nifty index and the repo rate is -0.81.

In an inflationary environment, central banks are compelled to raise rates to reduce the inflationary impact. The repo rates are the primary tool the central banks use to manage the money flow in the economy.

This leads to higher cost of capital for all companies as well reduced capital expenditure investments due to higher cost of funds. Higher cost of funds due to higher repo rates impedes investments from the companies thereby slowing down their growth. Also, lesser production from companies leads to lower supply of goods which further stokes inflationary pressure.

Besides, the consumers tend to spend lesser as there is lesser money in their hands in a higher interest rate scenario which increases their borrowing cost. Also, most borrowers need to pay higher rate of interest for their loans (which is again linked to repo rates) leading to lesser availability of capital for them to be able to spend on consumption.

So high inflation is always a risky environment for equity investors and one must monitor it closely.