HEG Limited is an India-based company that is engaged in the manufacturing and sale of graphite electrodes, which are used in electric arc furnaces (EAFs) for steel production. It is a part of LNJ Bhilwara Group which also has presence across IT Enabled services, power generation & textiles. It operates the largest single-site integrated graphite electrodes plant in the world with a manufacturing capacity of 80,000 tonnes per annum.

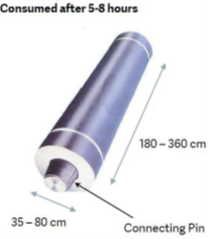

Graphite electrodes are critical components in the steel-making process. They are used to conduct electrical energy in the furnace, which heats up the raw materials and melts them into steel. HEG Ltd’s graphite electrodes have a high level of electrical conductivity, thermal resistance, and mechanical strength, which makes them ideal for use in steel manufacturing.

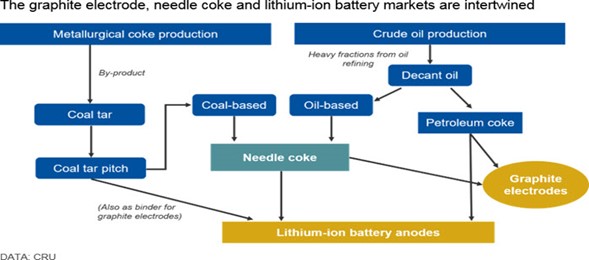

The main raw material used by HEG Ltd for the production of graphite electrodes is needle coke, which is a type of petroleum coke. HEG Ltd sources needle coke from various suppliers, both domestic and international, and has long-term contracts in place to ensure a stable supply.

HEG Ltd’s customers are mainly steel producers, who use the company’s graphite electrodes in their electric arc furnaces. The company’s clients are spread across various geographies, including India, Europe, Asia, and the Americas. The company supplies graphite electrodes to steel manufacturers around the world. in FY21, 36% of its sales came from top 10 steel majors in the world.

The company is also planning to start a capex of 1000 crores to manufacture anode electrodes. Anode electrodes are used in EVs and once the plant is ready, it will be the first plant to cater to this demand domestically.

Products

In FY22, graphite (including other carbon products) accounted for ~98% of revenues

and power accounted for 2% revenues. The company has a presence in 30 countries around the world. In FY22, exports accounted for 63% of revenues.

The company owns and operates its only manufacturing plant located at Mandideep in Madhya Pradesh. It is the largest single-site Graphite Electrode producing facility in the world. Its facility has a land coverage of ~170 acres

Capacity Expansion

Company has recently completed capacity expansion which will increase its capacity from 80,000 tonnes per annum to 100,000 tonnes per annum at a cost of 1200 crores. Company expects this to be operational from mid April’23. Company expects to operate at about 70% utilization for next two quarters.

Captive Power Capacity

The company has a captive power generation capacity of 76.5 MW which comprises of 2 thermal power plants and a hydroelectric power facility. It leads to sustained supply of reliable energy to its manufacturing plant and the excess power is sold to the market

Investment in Associate companies

The company has investments of 300-400 crores in Bhilwara Energy Ltd (BEL) which is a part of its parent group. Its investments translates to a stake of ~49% in BEL.

Bhilwara Energy Ltd – It holds significant stake in 2 hydro-electric projects in Himachal Pradesh :- Malana Power Co. Ltd – It operates a 86 MW hydroelectric project which was commissioned in 2001. It is a JV between BEL and Statkraft, Norway wherein BEL holds 51% stake

AD Hydro Project Ltd – It operates the 192 MW Allain Duhangan Hydro Power Project located in Kullu, Himachal Pradesh. It is a 100% subsidiary of Mallana Power Company Ltd

Global demand scenario

Graphite Electrode is used in electric arc furnace-based steel mills for conducting current to melt scrap iron and steel and is a consumable for the steel industry. The principal manufacturers are based in USA, Europe, Middle East, India, China, South East Asia and Japan.

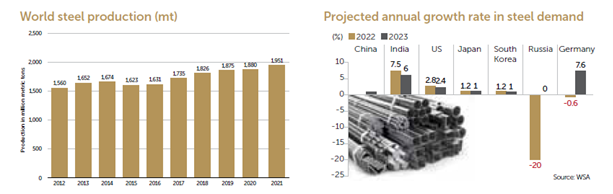

Graphite Electrode demand is primarily linked with the global production of steel in electric arc furnaces which is one of the two basic methods for steel production i.e. – [1] Bessimer Oxygen Furnace (BOF); and [2] Electric Arc Furnace (EAF).

According to World Steel Association (WSA), the EAF steel industry has grown at 4.5% compound annual rate since 2015. The fundamental reason behind this recovery has been China beginning to restructure its steel industry, encouraging consolidation and shutting down archaic BOF capacities.

China has also begun to comply with environmental regulations to improve air quality impacted by CO2 emissions associated with the burning of coal in BOF steelmaking. In addition, trade restrictions in developed economies such as North America and Western Europe for protecting their domestic steel industries against imports from BOF steel producing countries, which have resulted in a significant decrease in Chinese steel exports.

According to China’s Customs and Baiinfo, Chinese steel exports declined from 112 million MT in 2015 to 67 million MT in 2021. This resulted in increased steel production outside of China, benefiting EAF steel production. China’s share in EAF production, which was only 6% of global steel making till 2014 through EAF, had increased to 10% upto 2021 and is estimated to become higher going forward as per S&P Platts report.

EAF Steel Sector

Unlike the blast furnace route of steel making, the EAF route uses steel scrap as the key input – Every tonne of scrap used for steel production helps reduce 1.5 tonne of carbon dioxide,eliminates the need for 1.4 tonne iron ore, 740 kg of coal, 120 kg of limestone. These attributes Position the EAF route as the preferred route for steel making in a world. Across the world (excluding China), 45-47% of steel is made through the EAF route. In China, it was about 6% some years ago – it has creeped upto about 12% currently, which is slated to increase to 20% of its total steel manufacturing capacity. The migration to EAF steelmaking is expected to accelerate across the globe especially in the US and Europe over the coming years as advanced economies are working hard to achieve a net zero-carbon position in the coming decades

Electrode Sector Summary

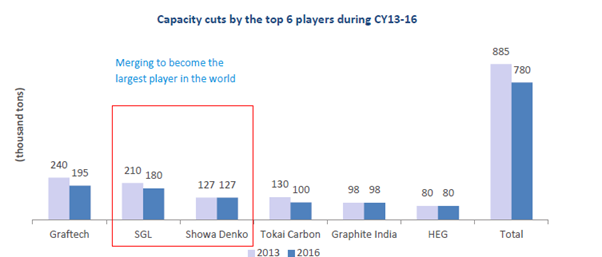

In past years from 2010-2017, electrode prices had dropped to unviable levels due to lower demand for electrodes compared to capacity. As a result of which 6 plants in the western world closed down taking out 200,000 tons of excess capacity.

When the capacity got balanced, came the sudden clampdown on Steel industry and Graphite industry in China due to pollution concerns. As the western world electrode capacity was already balanced with demand as a result of closures and also because western world steel plants started producing more due to drop in steel exports from China, there was a sudden spurt in demand of electrodes which led to shooting up of electrode prices.

In the year of 2017 and 2018, other suppliers outside China increased their production levels to meet the additional demand. Meanwhile Chinese electrode players also modified their plants to meet the new pollution norms and brought back their capacity. At the same time the EAF did not grow as expected in China. This led to electrode supply becoming more than electrode demand and thus the normalization of electrode prices around middle of 2019. As the electrode supply was less in 2018, most of the steel companies overbought electrodes creating excess inventories.

When the electrode supply eased and prices started to fall, all the steel companies started to correct their inventory levels from beginning of 2019. By the end of 2020, the excess inventories with the customers got corrected and the consumption resulted in real demand for Graphite electrodes. At the same time, the COVID impact on economy started to wear out and consumption of steel returned to pre COVID levels.

Since the start of 2021, all graphite companies started working at higher capacity utilization levels which continues till date. The pricing of electrodes kept increasing quarter by quarter for last 5 quarters. Although the key raw material prices also kept increasing quarter by quarter besides other inputs like pitches, metcoke, furnace oil, LNG , overseas freight etc, still the electrode prices were able to absorb the additional costs and turn out decent operating margins.

There are lot of new EAF capacities coming up in US in next 3-4 years. At the same time, due to decarbonisation pressures in developed economies like Europe, the trend is to shift some to Blast furnace production to EAF. China too remains on the growth path for EAF albeit slower than expected.

Abnormal Profits in 2019

During FY18-19, the graphite electrode manufacturers earned abnormal profits due to sharp rise in prices backed by the closure of 20% of global capacity and increase in steel production through EAF route outside China

Graphite Electrodes Price Trend

The price trend of graphite electrodes over the last ten years has been volatile and marked by significant fluctuations.

In 2012-2013, graphite electrode prices were stable and remained at low levels due to oversupply in the market

In 2014, prices started to rise due to supply disruptions caused by environmental restrictions on Chinese graphite electrode producers

In 2015-2016, prices continued to rise due to increasing demand from the steel industry and a shortage of needle coke, the primary raw material used to manufacture graphite electrodes

In 2017, prices spiked to historical highs due to a supply shortage caused by the closure of several Chinese graphite electrode manufacturers and rising demand from the steel industry

In 2018, prices started to decline due to increased production capacity and supply coming online, as well as a slowdown in demand growth from the steel industry

In 2019, prices continued to decline due to oversupply in the market, with some manufacturers reducing production to balance supply and demand

In 2020, prices started to rebound due to supply disruptions caused by the COVID-19 pandemic, which led to the closure of several graphite electrode manufacturers and a reduction in production capacity

In 2021, prices have remained high due to strong demand from the steel industry and ongoing supply disruptions caused by the pandemic

Overall, the price trend of graphite electrodes over the last ten years has been characterized by periods of stability, volatility, and fluctuations, driven by changes in supply and demand dynamics, production capacity, and raw material prices

Graphite Anode for Li-Ion Batteries

HEG Ltd has announced plans to invest INR 2,000 crore to build a facility to manufacture graphite anode for lithium-ion batteries in India. The company will build the plant in two phases. It expects the first phase to become operational by 2025 with an investment of INR 1,000 crore and cater to 10-12 GWh of cell manufacturing capacity. In the second phase, HEG plans to double the plant capacity with another INR 1,000 crore.The investment will be executed through HEG’s newly incorporated, wholly-owned subsidiary The Advanced Carbons Company (TACC). HEG aims to finish both phases in the next 5-7 years, leveraging its decades of experience in the graphite and advanced carbon chemistry fields.

The anode plant will have a production capacity of 20,000 metric tonnes per year.

Anode is one of the most crucial elements in the production of Li-ion battery cells, accounting for roughly 10-15% of the cost. For every GWh of Li-ion cell production, 1,100 tonnes of graphite anode is needed. Only China and Japan are the major producers of anode materials at the moment. More than 90% of the market is controlled by businesses in these two nations, stated HEG.

HEG intends to build TACC as a cutting-edge facility on more than 100 acres of land, where it would set up an anode plant. The building will have a specialized innovation centre for creating new carbon derivative materials, such as graphene and carbon nanotubes, for use in green energy applications.

Company expects turnover to Capex ratio of 1:1 on this project & the EBITDA margins on this business should be significantly higher than the current electrodes business.

This means 1000crores of capex in phase 1 could generate 1000 crores of revenue. Phase 1 expected to be operational by Q2FY25.

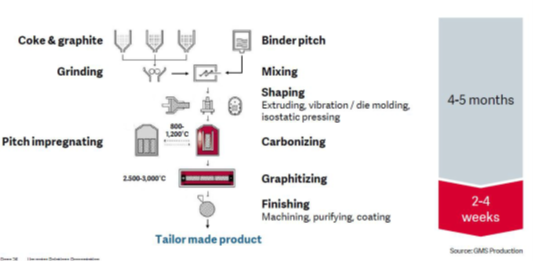

Manufacturing Process of Graphite Electrodes

Graphite Electrodes are primarily made from Needle Coke. Needle Coke is between 50%-70% of the raw material cost for Graphite electrode. Following is the process for manufacturing for Needle coke.

Needle coke is made from Coking coal and Crude oil and hence both its input raw material prices are volatile. Also, needle coke is a key raw material in Lithium ion battery anodes as well. Any spike in demand in the Lithium-Ion battery anode demand causes an increase in Needle coke as well. This in turn increases the raw material cost for Graphite electrodes.

Following are the major global players in the production of Needle Coke:

| Phillips 66 | Petrocokes Japan (Japan) |

| Petrochina International Jinzhou Co. (China) | Baosteel Group (China) |

| JX Holdings Inc. (Japan) | Sinosteel Anshan (China) |

| Hongte Chemical Industry (Group) Co. (China) | Cchem Co. (Japan) |

| Mitsubishi Chemical Company | Indian Oil Company |

Needle coke is converted to Graphite electrode by the following process:

Graphite Electrode is produced by carbonizing mixed coke (Needle Coke and Calcined Petroleum Coke) substances with binder pitch at 1,000°C in a baking furnace. When this carbon is graphitized in an electric furnace at 3,000°C, the amorphous carbon body takes on the structure of crystalline graphite. The material is usually pitch impregnated and re-baked to enhance electrical and mechanical properties before graphitization.

Needle Coke accounts for ~40% of the cost of manufacturing UHP Electrodes while Coal Tar Pitch accounts for 13% of the cost. The entire manufacturing process is power intensive, accounting for 15-18% of the cost of production, majority of which is consumed in the pitch impregnation and graphitizing process.

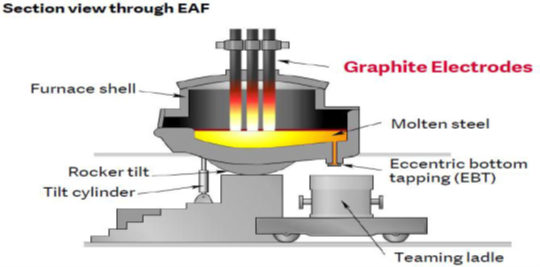

Application of Graphite rods in steel production: Below is the sectional view of Electric arc furnace:

On an average, 1 tonne of steel requires 3kgs of Graphite electrode. So assuming that 1800 Million tonnes of steel are produced currently and with an average of 25% of them being electric arc furnaces, the requirement for Graphite electrode will be 1800*25%*3*1000 Tonnes of Graphite that is 1.35Million tonnes of Graphite Electrodes. Between HEG and Graphite India, we produce close to 180k tonnes of Graphite electrodes.

The key driver to the upside is going to be increased electric arc furnace penetration (which is very likely) and increase in graphite realizations as it is an indispensable product in the furnace. So the demand is very likely to sustain over the long term.

Financial Information

| FY16 | FY17 | FY18 | FY19 | FY20 | FY21 | FY22 | |

| EBITDA Margin | 31% | 26% | 62% | 71% | 0% | -5% | 24% |

| PAT Margin | 19% | 14% | 40% | 46% | 3% | -2% | 18% |

| RoCE | 14% | 12% | 53% | 97% | -1% | -5% | 12% |

| RoE | 20% | 15% | 58% | 80% | 2% | -1% | 10% |

The ROE for the business is relatively better than its peer Graphite India but still fluctuates wildly & significantly shot up when the prices move up significantly for the graphite electrodes. That happened in 2018 and 2019 due to closure of multiple plants prior to the consolidation as the business got unviable. The overall capacity came down from 885k tonnes to 780k tonnes in 2012-2016 period.

Economics of the business

As per HEG, 20 kTonne capacity requires 1200 crore of investment, Generally the average EBITDA per tonne is 50000. So 20k Tonne would generate 100 Crore of EBITDA. Hence it would take 12 years for the capex to get recovered. Also, given the high inventory and working capital cycle as can be seen in the below table, the realization frequency and asset turnover is not very high.

| FY15 | FY16 | FY17 | FY18 | FY19 | FY20 | FY21 | FY22 | |

| No. of Days of Inventory | 102.04 | 127.62 | 89.50 | 67.88 | 72.44 | 170.72 | 168.70 | 162.11 |

| No. of Days of Creditors | 32.73 | 17.78 | 30.03 | 32.71 | 21.04 | 22.73 | 74.76 | 74.25 |

| No. of Days of Debtors/sales | 102.95 | 109.49 | 125.26 | 129.10 | 65.71 | 67.84 | 84.09 | 97.68 |

| Operating Cycle | 172.25 | 219.33 | 184.74 | 164.27 | 117.10 | 215.83 | 178.03 | 185.53 |

| Working Capital / Sales | 47% | 60% | 51% | 45% | 32% | 59% | 49% | 51% |

For more ideas – click here