The impact of water deficits across the world has taken center stage given the global climate change focus. Though this topic is not directly linked to financial markets, there is an indirect impact of global warming and water deficits on financial markets. Recently, there has been an increase in prices of a lot of agricultural commodities and hence feared inflation due to the rainfall deficits being experienced by a lot of countries. Below we study how the water deficit may impact financial markets indirectly.

Impact of water scarcity – Below are the key impacts that one must be cognizant of

a. Impact on agriculture and hence reduction in GDP

Agriculture forms an important component of GDP for a lot of agrarian countries. Hence a reduction in rainfall may impact agriculture and hence the GDP.

b. Impact on per capita income and consumption

A large population is directly or indirectly dependent on agriculture and hence a reduction in agriculture implies lesser per capita income which in turn reduces their per capita consumption. Overall, reduced per capita consumption indirectly reduces demands for a lot of discretionary goods.

c. Supply side inflation

Lesser rainfall may lead to lesser production of certain agriculture products. This may lead to supply shocks which may lead to inflation. The worst part is that the inflation is driven by supply side and not demand side. While monetary policies are effective to tackle demand side inflation, supply side inflation is much more stubborn and hence difficult to manage.

d. Huge pressures on central banks and governments

Higher inflation, Lower GDP and lesser per capita income are basically 3 nightmares together for both governments and central banks to tackle together. Tackling even a single problem is difficult and all 3 coming together could really stretch the creative abilities of policymakers and bankers to again re-energize the economy.

e. Social impacts

The worst impact may be from social side – which could include food scarcity, hunger and malnourishment, social anxiety and unrest. Besides, the overall lack of basic resources puts severe strain on the economies ability to thrive.

f. Impacts on corporate earnings

Lastly, higher inflation increases costs for corporates – raw materials, employee costs as well as manufacturing expenses. Besides, lower per capita consumption impacts their revenues as well. So overall, poor rainfall impacts corporate profitability in the long run though the impacts are slow and steady over a medium term.

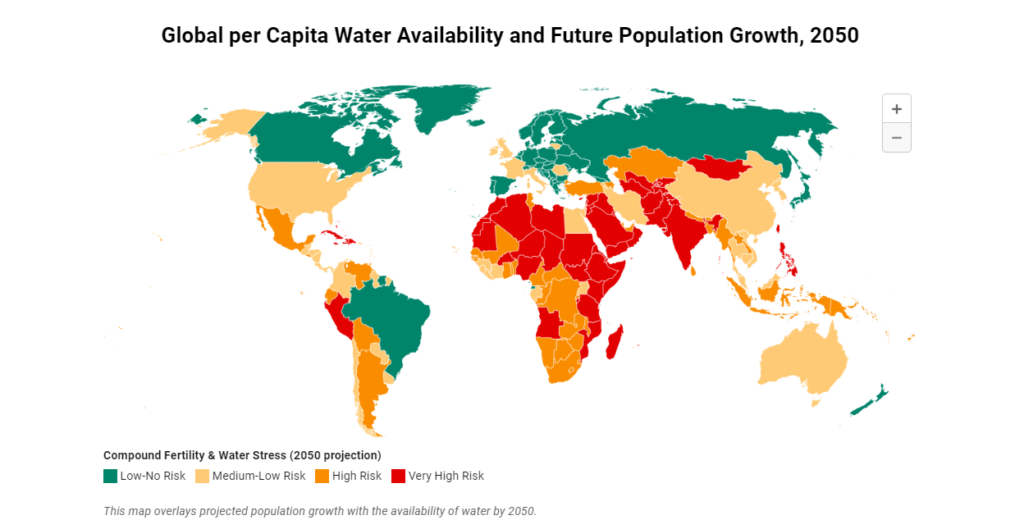

Below chart shows the various regions of the world and the possibility of water deficits by 2050 – as per the world bank report

The above chart indicates the countries where there is a very high risk of rainfall deficit by 2050. Countries which are at high risk will need to plan mitigation steps currently to avoid any major negative economic surprises.

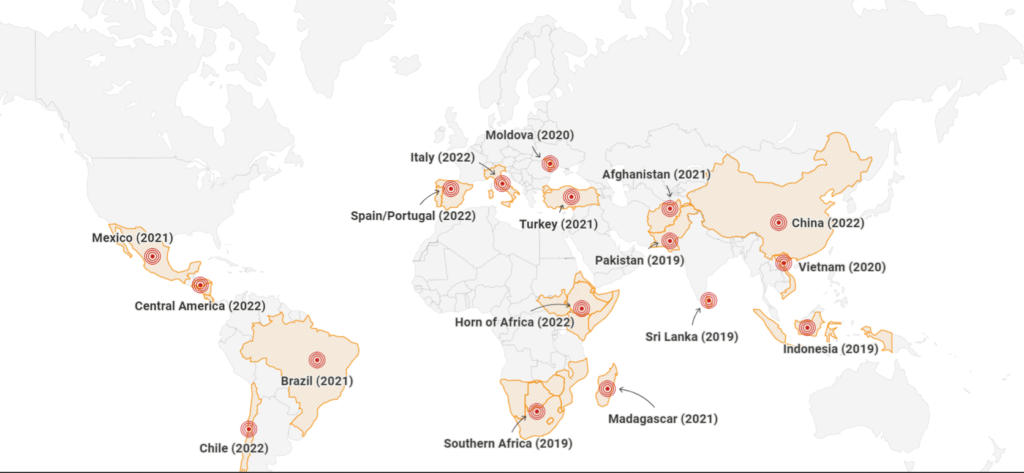

Below are the recent desertification candidates due to water deficits

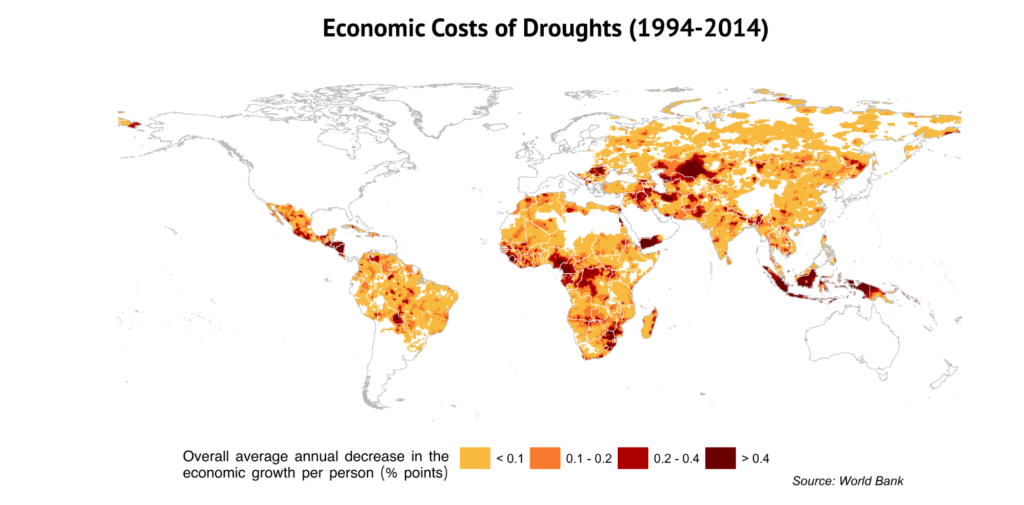

Impact of drought on GDP per capita

As discussed earlier, there are economic costs due to droughts. Above chart shows how various regions of the world have been financial impacted by droughts.

Here is a link to the detailed world bank article on rainfall deficits. More articles on the research framework which can be used for identifying good investments.