Indian automobile industry is an integral part of India’s GDP. Manufacturing constitutes 13%-14% of India GDP. With the focus on make in India and manufacturing capabilities, India would likely take this to a much higher percentage of the GDP. With agriculture GDP growing in very low single digits; For India to grow at more than 8%, Manufacturing GDP must grow at least in low double digits or even mid-teens for the next few years.

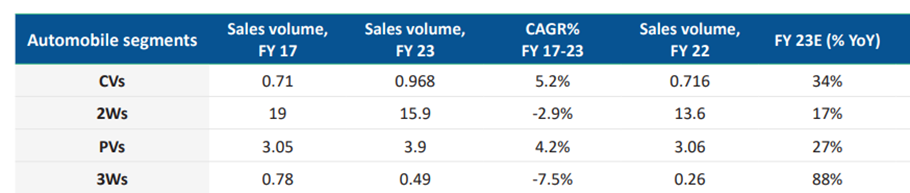

Within manufacturing GDP, 50% comes from automobile and auto ancillary space. Also, if we look at high level numbers:

India sells around 9 Lakh Commercial vehicles (near the highest level annually) vs China selling 50 lakh commercial vehicles and USA selling 1.4 crore vehicles near its peak. If India needs to come close to China/ USA GDP in 10 years from now, our peak must be close to their peaks, as commercial vehicles is one of the back bones of GDP growth (Logistics plays a key enabler in GDP expansion).

On the other hand, the passenger vehicles sold in India is close to 40 Lakhs per year which is almost 10% of China ; which sells close to 3 crore vehicles a year. Indian population has surpassed China which implies demand for personal mobility will continue to pick up given the sheer population size of the country.

To summarize, both passenger vehicles and commercial vehicles are likely to see significant growth in the future and it is likely that both will grow in mid-teens for the next few years.