About the company

Go Fashion is the leader in India’s highly unorganized women’s bottom-wear segment (pegged at INR 135bn) and the first to launch an exclusive branded portfolio in the space.

Led by increasing preference for modular clothing and high pace of formalization, the organized women’s bottom-wear category (pegged at INR 31bn) is estimated to grow at a CAGR of 24.3% (faster than organized women’s wear CAGR of 19%) over FY20-25E.

The size of the opportunity apart, on-ground execution is a critical element for success in fashion retail. While identifying the category rightly was half the job done, Go Fashion decided to exclusively focus on it and aced the execution aspect by a) providing a well-diversified range of quality products at affordable prices, and b) building a pan-India EBO-focused distribution model with impressive store economics (high sales per sq. ft of INR 19,000-21,500 and store level EBITDA margin of 32-34%). An in-place execution template, lack of formidable competition and the company’s focus on newer growth drivers (online channel and new product extensions) provide assurance on the future runway for growth.

The Saraogi family has been in the garments business since 1990. While looking for newer opportunities, the underlying thought process was to identify categories where the competition was lower and products that sold easily. That’s when the Saraogi noticed the business opportunity in the women’s bottom-wear segment. We believe Go Fashion’s choice of category and then its decision to exclusively focus on it were key drivers for ‘Go Colors’ to become the largest D2C brand in the women’s bottom-wear market in India. Below are three key factors that make women’s bottom-wear category attractive and led to the birth of Go Fashion in 2010.

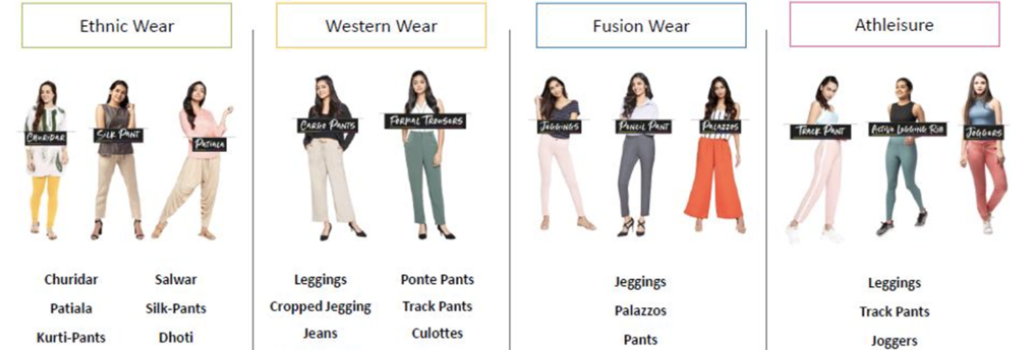

Increasing preference for modular clothing – Shift from Sarees/salwar to trendier apparel: With evolving trends in women’s wear, the concept of Mix & Match has become an important part of self-styling with women buying contrasting tops and bottom-wear rather than buying full suit sets. With this shift in consumer preference, the sale of ‘separates’ clothing has also increased, which is one of the key drivers for the women’s bottom-wear category.

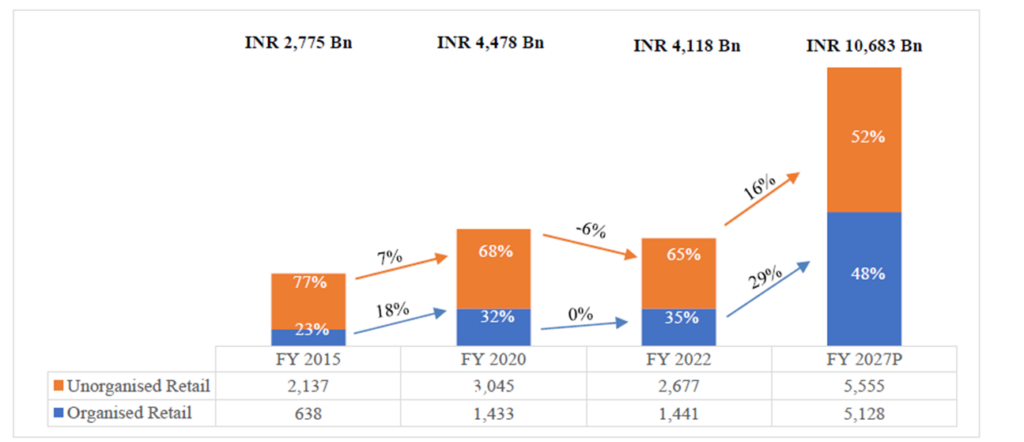

Highly fragmented category with large unorganized segment and absence of focused pan-India players: As highlighted earlier, women’s bottom-wear is highly fragmented with the unorganized segment having a high share. There were hardly any national level brands in the bottom-wear segment considering its relatively smaller size among the sub-segment within the women’s wear category.

Also, larger brands preferred to focus on more fashion-oriented product offerings compared to bottom-wear. As a result, consumers had limited options in this sub-segment when it came to buying branded products of consistent quality.

Risk of obsolescence is low given the functional/core essential nature of the product: Compared to other sub-segments in women’s wear, bottom-wear products are largely core essentials in nature and are better placed to withstand fluctuations in demand. It is a universal category not subject to seasonal fashion trends, which largely eliminates the obsolescence risk in the business.

Once the opportunity was identified, it was critical for Go Fashion to build capabilities to capitalize on them. Hence, it focused on a few key factors like a) crafting a well-diversified quality product portfolio with a value for money positioning, b) getting store economics right and building a pan-India distribution network, and c) building robust supply chain and design capabilities. Below, we highlight some of these key aspects that enabled Go Fashion to leverage the first mover advantage and capitalize on the opportunity in the women’s bottom- wear category

Well-diversified portfolio with value for money positioning: While identifying the right category was one of the key aspects, it is not the only ingredient for success. It is also equally essential to identify the target consumer segment, and get the product and pricing right accordingly.

Go Fashion targeted largest consumer segment in the category with premium quality offering at affordable prices: Go Fashion decided to address a specific segment – mid to upper market customer, which accounts for the largest share of the category. Further, it also ensured pricing is affordable (83% of the portfolio mix is priced at INR 1,049 or lower), thereby democratizing the bottom-wear category.

Offered well-diversified product portfolio, with largest SKU range amongst peers: Women’s bottom-wear is a horizontal category that allows creation of multiple extensions compared to other categories like tops, kurta, innerwear, and sleepwear. Go Fashion has crafted a well-diversified product portfolio offering universal/every- occasion wear at affordable price points. The company has a presence in key categories like Ethnic, Fusion & Western wear, each accounting for around one-third of the sales mix. The portfolio comprises 3,000+ SKUs, and 50 bottom-wear styles in a range of >120 color’s covering the entire spectrum of women’s requirements across age groups and body types. This wide portfolio helps Go Fashion to cater to the larger addressable market and also cushions it from any kind of disruption/vagaries of fashion trends in any particular sub-categories.

Shareholding Pattern:

Industry Research:

India’s textiles sector is one of the oldest industries in the Indian economy, dating back to several centuries. The industry is extremely varied, with hand-spun and hand-woven textiles sectors at one end of the spectrum, with the capital-intensive sophisticated mills sector at the other end. The fundamental strength of the textile industry in India is its strong production base of a wide range of fiber/yarns from natural fibers like cotton, jute, silk and wool, to synthetic/man-made fibers like polyester, viscose, nylon and acrylic.

The decentralized power looms/ hosiery and knitting sector form the largest component of the textiles sector. The close linkage of textiles industry to agriculture (for raw materials such as cotton) and the ancient culture and traditions of the country in terms of textiles makes it unique in comparison to other industries in the country. India’s textiles industry has a capacity to produce a wide variety of products suitable for different market segments, both within India and across the world. In order to attract private equity and employee more people, the government introduced various schemes such as the Scheme for Integrated Textile Parks (SITP), Technology Upgradation Fund Scheme (TUFS) and Mega Integrated Textile Region and Apparel (MITRA) Park scheme.

The Indian textile and apparel industry is expected to grow at 10% CAGR from 2019-20 to reach US$ 190 billion by 2025-26. India has a 4% share of the global trade in textiles and apparel. India is the world’s largest producer of cotton. Estimated production stood at 362.18 lakh bales during cotton season 2021-22. Domestic consumption for the 2021-22 cotton season is estimated to be at 338 lakh bales. Cotton production in India is projected to reach 7.2 million tonnes (~43 million bales of 170 kg each) by 2030, driven by increasing demand from consumers. In FY23, exports of readymade garments (RMG) including accessories stood at US$ 16.2 billion. It is expected to surpass US$ 30 billion by 2027, with an estimated 4.6-4.9% share globally.

Production of fibre in India reached 2.40 MT in FY21 (till January 2021), while for yarn, the production stood at 4,762 million kgs during the same period. Natural fibres are regarded as the backbone of the Indian textile industry, which is expected to grow from US$138 billion to US$195 billion by 2025. India’s textile and apparel exports (including handicrafts) stood at US$ 44.4 billion in FY22, a 41% increase YoY. During April-November in FY23, the total exports of textiles stood at US$ 23.1 billion. India’s textile and apparel exports to the US, its single largest market, stood at 27% of the total export value in FY22. Exports of readymade garments including cotton accessories stood at US$ 6.19 billion in FY22. India’s textiles industry has around 4.5 crore employed workers including 35.22 lakh handloom workers across the country.

The future of the Indian textiles industry looks promising, buoyed by strong domestic consumption as well as export demand. India is working on various major initiatives to boost its technical textile industry. Owing to the pandemic, the demand for technical textiles in the form of PPE suits and equipment is on the rise. The government is supporting the sector through funding and machinery sponsoring. Top players in the sector are achieving sustainability in their products by manufacturing textiles that use natural recyclable materials. With consumerism and disposable income on the rise, the retail sector has experienced a rapid growth in the past decade with the entry of several international players like Marks & Spencer, Guess and Next into the Indian market. The growth in textiles will be driven by growing household income, increasing population and increasing demand by sectors like housing, hospitality, healthcare, etc. The technical textiles market for automotive textiles is projected to increase to US$ 3.7 billion by 2027, from US$ 2.4 billion in 2020. Similarly, the industrial textiles market is likely to increase at an 8% CAGR from US$ 2 billion in 2020 to US$ 3.3 billion in 2027. The overall Indian textiles market is expected to be worth more than US$ 209 billion by 2029.

Industry analysis

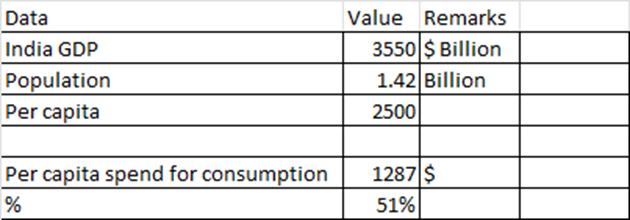

Demographic data of India

India is now the largest population in the world and the India consumption story is currently evolving at a rapid pace. Below are some numbers about how India spends currently.

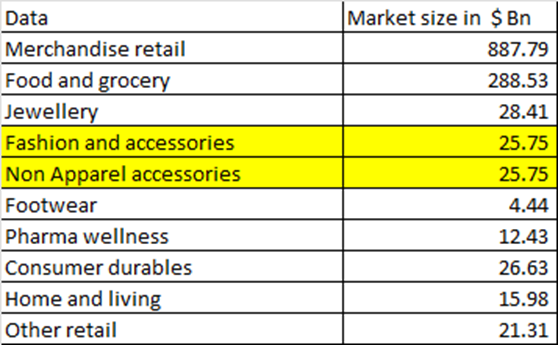

India GDP per capita is around 2500$ of which 51% of it is consumed and hence per capita spend in consumption is around $1287. Below is the break – up of $1287.

It is interesting to see that per capita spending is mainly in food and grocery. This is an indication of lack of discretionary spending ability in India which will keep evolving over a period. As an economy moves to richer state, the per capita spend in food and grocery almost stagnates and the spending in other discretionary areas like apparel, fashion, footwear, consumer durables increase.

Below is the market size of these industries

As India moves to higher GDP per capita; the spending in discretionary items may increase at a rate faster than GDP growth given that spending in food (which is currently the biggest) will not increase at the same rate.

Fashion

The current fashion industry is around $50 B that is around 4.2 Lakh crores. The share of unorganized market is around 65%; the share of brick and mortar is around 15% and share of e-commerce is around 20%.

Within this, the industry is divided between men, women and kids:

| Total market size | 400000 | Crore |

| Men | 164000 | |

| Women | 148000 | |

| Kids | 84000 |

In terms of products, following is the break-up of men apparel industry

| In k crore | |

| Shirts | 47 |

| Trousers | 33 |

| Suits/ coats/ Safari | 6 |

| Winter wear | 10 |

| Active wear | 6 |

| T shirts | 15 |

| Denim | 25 |

| Inner wear | 15 |

| Others | 16 |

Urban vs Rural

| Apparel market | |

| Urban | 60% |

| Rural | 40% |

| City | In crore |

| Top 2 | 51,852 |

| Next 6 and Tier 1 | 57,777 |

| Tier 2 | 44,938 |

| Tier 3 | 92,345 |

| Rural | 1,64,837 |

| Total | 4,11,749 |

Women Fashion

Women fashion industry is around 1.5 lakh crore of which bottom wear is around 25000 crores and within that the organized market is around 11400 crores.

The expected growth rate of the industry is 12% and the branded space is expected to grow at 24%. This is mainly driven by higher purchasing ability, improved distribution and reach of branded players and higher influence from various forms of social media and higher earning capacity.

Global Women’s Trousers Market size was valued at USD 212.70 billion in 2022 and is poised to grow from USD 222.91 billion in 2023 to USD 324.35 billion by 2031, growing at a CAGR of 4.80%.

Women’s bottom-wear, with a market size of INR 139bn (as of 2020), accounts for 9.3% of the women’s apparel market. With rise in modular clothing, women are increasingly preferring the Mix & Match concept and buying contrasting tops/bottoms instead of a full suit. They are now wearing certain bottom-wear universally. For example, jeggings and palazzos can go along with western tops, t-shirts, and shirts as well as ethnic kurtas and kurtis. As a result, the women’s bottom-wear market is expected to clock a CAGR of 13.4% to reach INR 254bn by FY25 and is among the fastest-growing categories in the women’s-wear space. The share of Ethnic – Salwar, Patiala & Churidars (28%) is the highest overall in the women’s bottom-wear category followed by Western – Denim at 29%. Western – Sleepwear Pyjamas, and Ethnic – Leggings are at 18% each.

Strong pace of formalisation in women’s bottom-wear segment:

Organised and branded segment to grow at a much faster pace: Historically, consumers who wanted branded products of consistent quality in the bottom-wear market have had very limited options as the market has been highly unorganised. The overall women’s bottom-wear market is still dominated by the unorganised sector; in FY20 its share was 78% compared with 33% for the organised segment. However, this is expected to change in the next few years; propelled by tailwinds, the organised women’s bottom-wear market is expected to reach INR 98.5bn and have 39% share in the overall bottom-wear market by FY25, implying a CAGR of 25.3% over FY20-FY25E. The share of branded women’s bottom-wear rose from 19.9% (INR 16.2bn) in FY15 to 34% (INR 47.7bn) in FY20 at a high CAGR of 25.1%. The branded women’s bottom-wear market is expected to see continued high growth in future as well with its share rising further to 47.8% (INR 119bn) by FY25.

Market share by brand

Go fashion is the largest player in the women bottom wear industry with 8% market share.

Strengths

Go Fashion enjoys leadership position and has built capabilities to capture the opportunity in the fast-growing organised women’s bottom-wear segment:

Go Fashion was the first to launch an exclusive bottom-wear collection under the brand name ‘Go Colors’ in the organised market that created a first-mover advantage and was recognised as a category creator for bottom-wear in India. It offers bottom-wear products across all categories, including ethnic, western wear, fusion and denims and has one of the largest bottom-wear product offerings in women’s apparel. A combination of a well-diversified portfolio, multi-channel pan-India distribution network supported by strong unit-economics, and robust back-end infrastructure has been instrumental in Go Colors establishing its brand equity and becoming the largest direct- to-consumer Indian brand in women’s bottom-wear.

Offered well-diversified product portfolio, with largest SKU range amongst peers:

Women’s bottom-wear is a horizontal category that allows creation of multiple extensions compared to other categories like tops, kurta, innerwear, and sleepwear. Go Fashion has crafted a well-diversified product portfolio offering universal/every- occasion wear at affordable price points. The company has a presence in key categories like Ethnic, Fusion & Western wear, each accounting for around one-third of the sales mix. The portfolio comprises 3,200+ SKUs, and 70 bottom-wear styles in a range of >150 colours covering the entire spectrum of women’s requirements across age groups and body types. This wide portfolio helps Go Fashion to cater to the larger addressable market and also cushions it from any kind of disruption/vagaries of fashion trends in any particular sub-categories.

Continued focus on new products and building adjacent categories with evolving fashion trends in bottom-wear:

Apart from driving growth in core segments like leggings and churidars, over the past decade, Go Fashion has also focussed on leveraging its brand strength to extend into other adjacent categories (Trousers, Harem, Patiala, Plazzos) which now account for 60% of its sales. In leggings and churidars, even while there has been growth in absolute terms, the salience in overall sales has come down from 78% earlier to 55% currently. Its in-house design team and data analytics capabilities help the company to understand changing fashion trends and accordingly manage the inventory at the backend. The company’s expertise in this is visible from its ability to identify the shift from churidars to leggings and realign the portfolio accordingly.

Impressive unit economics enables rapid expansion through EBO channel thereby driving brand visibility and profitability:

Store economics is a critical ingredient to ensure scalability of the business model. Go Fashion’s steadfast focus on aspects that mattered most to women consumers, viz., wide range and quality products with value-for-money proposition are essential to ensuring superior store economics. In determining the store roll-outs, it assesses optimum store size and layout and lease arrangements that are typically long-term in nature and/or revenue share arrangements. Its ability to identify and determine the optimum location and size of a store as well as manage rental costs and the marketing leverage of EBOs are critical to ensuring visibility among target customers and sustaining store profitability. Given the limited fashion element, the apparel products of Go Fashion can be stocked up in racks. This requires limited store space and the company operates through retail stores of average size over 400-500 sq ft (average size of 404 sq ft for FY22). Also, brand strength, wide range and essential nature of the product allow the company to have higher share of full-priced sales (97% of EBO sales in FY22). As a result, the company is able to consistently generate best-in-class sales per sq ft and have superior gross margin (store level gross margin of c.68%) among key women’s apparels companies and, in particular, amongst EBOs in India.

Deepen penetration in high potential market and drive efficiencies through cluster-based distribution expansion model:

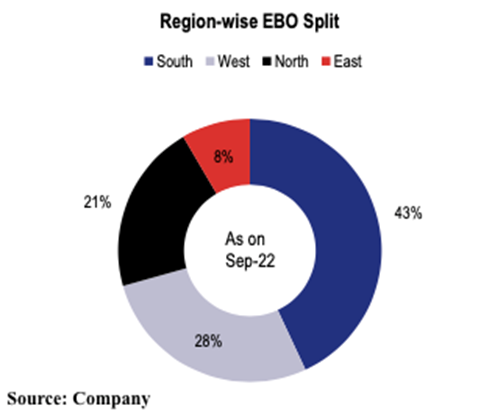

Over the last decade, the company has created a large direct-to-consumer distribution network across India. In terms of EBOs, as of Sep’22, South is its largest market, accounting for 42% of overall stores, followed by West and North that account for 29% and 23% respectively. Go Fashion follows a cluster-based and company owned company operated (COCO) model for its EBO expansion. It identified 135 urban locations and focused on deeper penetration in these markets through rollout of stores within reasonable proximity. Also, of the total EBO network of 589 stores, 57% are in the top 10 cities. The resultant network effect enhances brand visibility, allows better operational control, and facilitates ease of inter-store stock movements, capitalising on supply chain efficiencies, resulting in lower marketing spends and operating costs per store, ensuring higher unit level profitability.

In-house expertise in developing and designing products:

The company develops products in-house based on demand for such products and the sale of similar products that it tracks and monitors through the ERP system. It designs products keeping in mind trends in fashion, fabric, textiles, wearability, stitch and pricing. Its in-house design team comprises 12 professionals, who along with the merchandising, marketing and procurement teams are focused on developing innovative design concepts across categories.

Asset-light and technology driven approach to manufacturing and supply chain management:

Go Fashion outsources manufacturing operations to job workers (moderating fixed costs). It has an extensive sourcing network, comprising 85 suppliers and 59 job-workers spread across 12 states and UTs. The sourcing team works closely with suppliers, supervising manufacturing, tracking capacity and output and conducting inspections for quality checks to ensure production requirements are met and finished products are procured in a timely manner. Further, the entire procurement and supply chain operation is automated through the ERP system, thereby streamlining the process, providing flexibility and reducing dependence on single vendor and helps minimising product shortage.

Economics and operating model

The company operates Company owned company operated stores model. Also it sells through large format stores. Below is the growth rate of the Exclusive brand outlets.

| Particulars | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

| Number of EBOs | 333 | 448 | 449 | 503 | 630 | 714 |

| Cost per EBO in crores | 0.35 | 0.375 | 0.375 | |||

| Revenue per EBO in crores | – | – | – | 0.60 | 0.79 | 0.81 |

| Particulars | 2022 | 2023 | 2024 |

| Number of LFS | 1473 | 1750 | 2189 |

| Revenue per LFS in crores | 0.07 | 0.09 | 0.09 |

Break-up of EBO, LFS and Online

| Particulars | 2022 | 2023 | 2024 |

| EBO Sales | 73% | 74% | 73% |

| LFS Sales and MBO Sales | 24% | 23% | 24% |

| Online Sales | 3% | 3% | 3% |

Currently, they are present in 160 cities in India.

The average sale price is 752 per unit.

Also, below is the growth rates of same stores and same cluster.

| Particulars | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

| Same stores sales growth | 20% | 11.40% | 17% | 36% | 0% | |

| Same cluster sales growth | 64% | 10% |

| Particulars | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

| Advertising as % of revenue | 1.82% | 2.54% | 1.26% | 3.04% | 2.10% | |

| Full price sales | 98% | 83% | 97% | 95% | 95% |

Global expansion

Franchise agreement

Go Fashion (India) signed a five-year franchise agreement with Apparel Group for the “Go Colors” brand.

Management Profile:

Prakash Kumar Saraogi is the Managing Director of our Company. He is a promoter of our Company and has over 28 years of experience in garment manufacturing, fashion industry and retail industry. He holds a bachelor’s degree in chemical engineering from Anna University, Chennai.

Gautam Saraogi is an Executive Director and the Chief Executive Officer of our Company. He is a promoter of our Company and has over 10 years of experience in consumer retail, marketing, brand building and garment manufacturing. He holds a bachelor’s degree in commerce from University of Madras, Chennai and an executive diploma in marketing management from Loyola Institute of Business Administration, Chennai. He has received a token of appreciation for his contribution to the Chennai Retail Summit 2018.

Rahul Saraogi is a Non-Executive Director of our Company. He is a promoter of our Company and has over 10 years of experience in the garment industry. He holds a bachelor’s degree in science from University of Pennsylvania, Philadelphia, United States. He is the founder director of Atyant Capital Advisors Private Limited.

Ravi Shankar Ganapathy Agraharam Venkataraman is a Non-Executive Nominee Director of our Company. He holds a bachelor’s degree in computer science and engineering from Bharathidasan University, Tiruchirapalli and a post graduate diploma in management from the Indian Institute of Management, Ahmedabad. He has over 15 years of experience in private equity funds. Previously, he was associated with McKinsey & Company, Inc. Presently, he is associated with Sequoia Capital India LLP, where he acts as the managing partner.

Srinivasan Sridhar is the Chairperson of our Board and an Independent Director of our Company. He holds a bachelor’s degree in science from Bangalore University, a diploma in systems management from University of Bombay, Mumbai and master’s degree in science from Indian Institute of Technology, Delhi. He has over 38 years of experience in commercial and development banking and is an associate of the Indian Institute of Bankers. Previously he was the chairman and managing director of National Housing Bank and Central Bank of India, the executive director of Export Import Bank of India and was also associated with the State Bank of India. He has been felicitated with honorary fellowship by the Indian Institute of Banking and Finance in recognition of his invaluable contribution in the field of banking and finance.

Rohini Manian is an Independent Director of our Company. She has a bachelor’s degree in science from Northeastern University, Boston, Massachusetts. She has over 8 years of experience in real estate and management space. Previously, she was associated with Radiance Realty Developers India Limited. Presently, she is the director of Global Adjustments Services Private Limited.

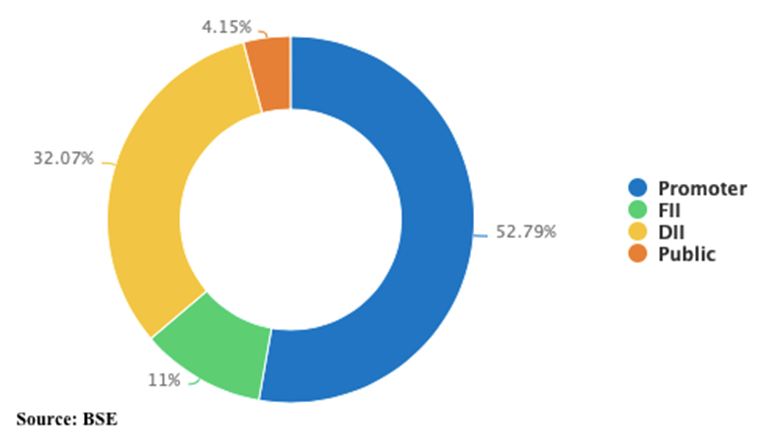

Pledging

The promoter holding is around 52.78%; FIIs hold 11.8%; DIIs hold 32.82%; the public holding is just 2.62% – promoter holding is around 16.3% which is a key monitorable. The promoter has taken a loan of 150 crores and pledged the shares. They have been talking about releasing the pledge in conference calls for the last 8 quarters but have not executed it yet.