Aarti Industries is one the largest specialty chemicals company in India. Below is a quick summary about it.

Key points

The global chemical industry is around $4 trillion with specialty chemicals being $1 trillion and the commodity chemicals being $ 1 trillion.

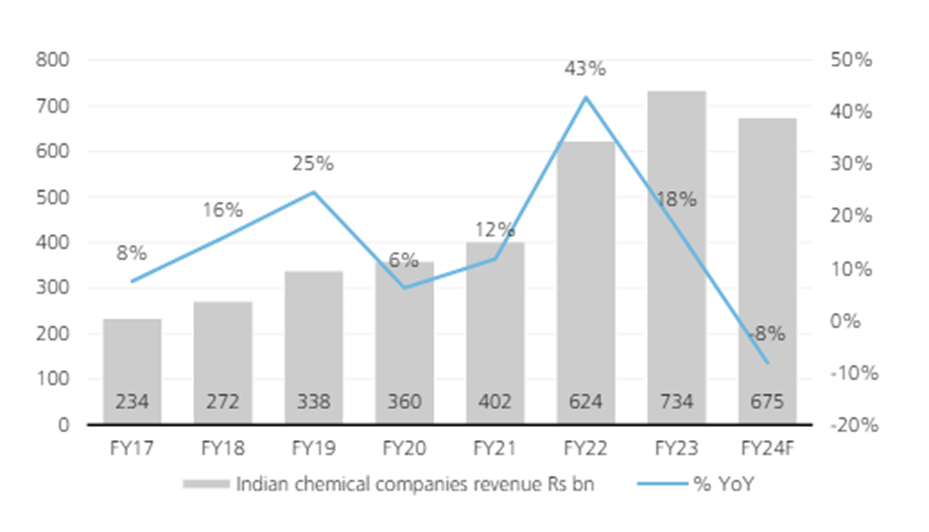

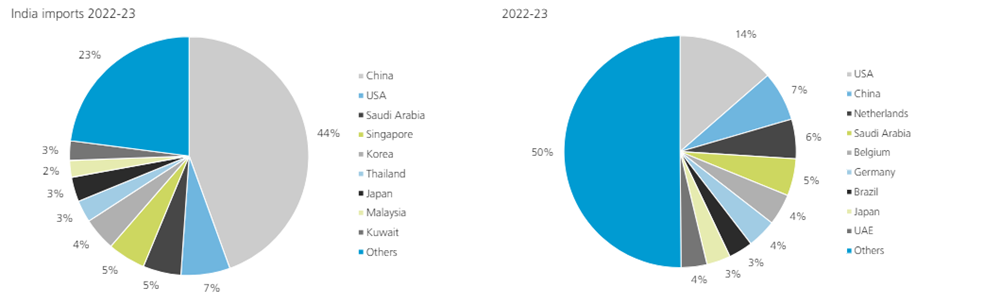

Of this $4 trillion chemicals industry, India has 4% ie $160 billion size. This is primarily exports to USA – 14%, China – 7%, Netherlands – 6%; rest of the world constitutes 50% of India’s exports. In India, the specialty chemical to commodity chemical ratio is around 50% implying a specialty chemical industry of $80 billion.

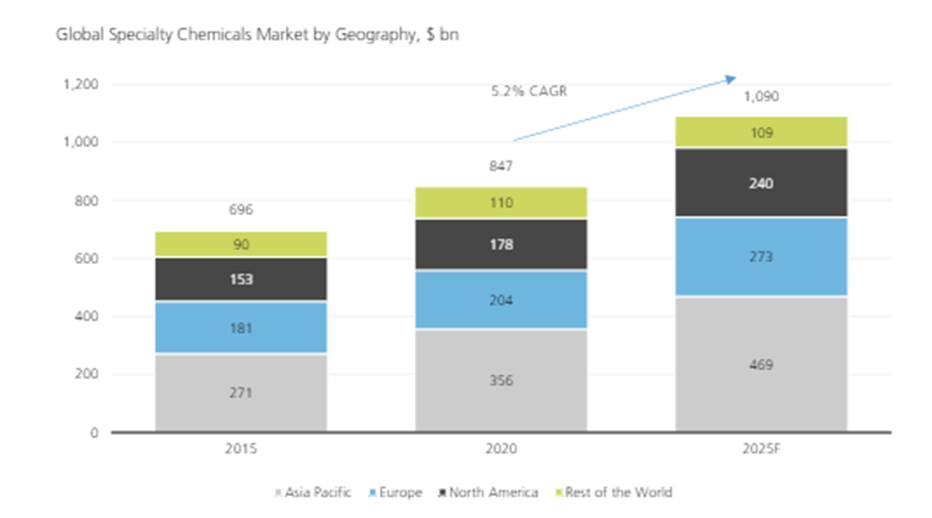

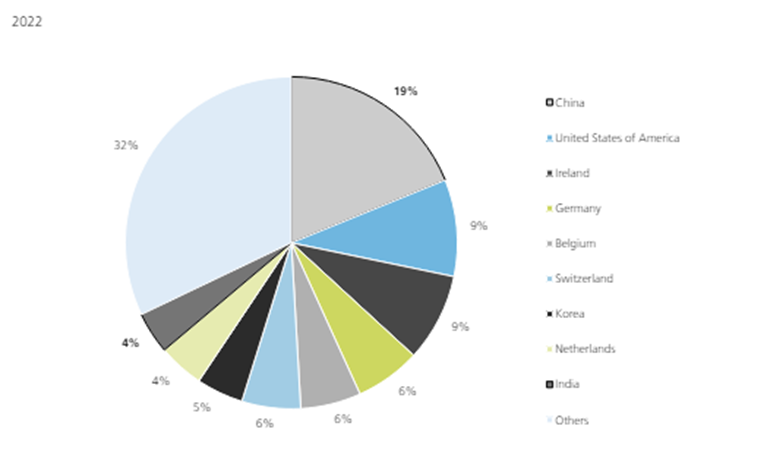

The specialty chemicals is slated to grow at 5%-6% CAGR implying that the market size will be $1.5 Trillion. With India being just $80 billion, there is significant headroom for growth and hence the growth rates in India will be large. China is around 19% of the global specialty chemicals market.

If we do a hypothetical calculation with regards to the industry potential for India, we can expect India to reach 8%-10% in a realistic case of the global specialty chemical size given the following constraints from the world

- Lack of investment in developed countries in specialty chemicals due to factors like high labor, electricity costs, more pollution norms, lower demand than developing markets

- China imposing curbs on the domestic industry to rationalize the pollution and harmful impacts of mass production

- Demand being driven by higher population in countries like India which will consume more specialty chemicals.

- Rapid increase in the knowhow and technical capabilities of Indian companies which take time to build but have a multiplier effect once the critical mass is present.

This would lead to the market size of $150B from current $80B which would imply a CAGR growth in double digits.

With India establishing a global footprint; the growth rates could be extremely promising.

Within specialty chemicals, Aarti industries is present primarily in the Benzene value chain. The strength of Aarti industries is the following

- Technocrat management with a strong history and track record

- Ability to use the entire value chain of isotopes of Benzene created across various downstream applications

- Backward integration

- Relatively complex chemistry and hazardous products handling which is a barrier to entry for various players

- Integrated plants with captive power

- CRAMS services ensuring client stickiness and participation from the start of the molecule construction

The key risks include

- High amount of debt required for capex leading to high leverage

- Client relationships and long-term contracts lead to exposure to client risk if the client decides to opt out

- High working capital required when the underlying prices rise

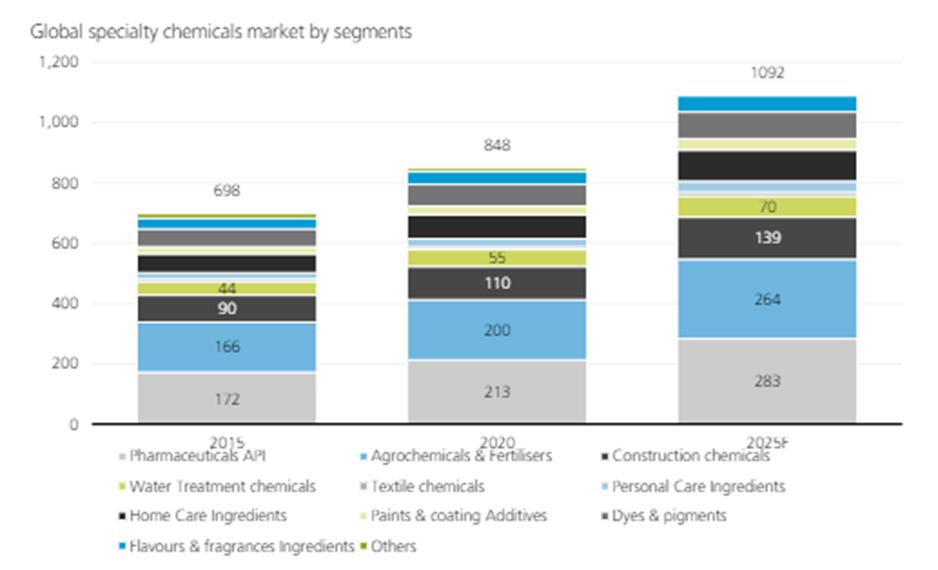

The company charges a “cost +” per kg from client and hence generally their margins are protected in absolute terms. The following are the key products of Aarti industries – Nitro chloro benzene, di chloro benzene, phenyl diamides, nitro toluene, sulphuric acid value chain which are primarily used in agro chemicals (22%), pharma, paints & dyes (12%), textiles and fabrics, air fresheners, polymer additives (10%) and oil refineries.

About the company

Aarti Industries limited, the flagship company of the Aarti group, manufactures organic and inorganic chemicals at its major facilities in Vapi, Jhagadia, Dahej and Kutch, in Gujarat and in Tarapur in Maharashtra.

Established in 1984, Aarti Industries is a leading Indian manufacturer of Specialty Chemicals and Pharmaceuticals with a global footprint. Chemicals manufactured by Aarti are used in the downstream manufacture of pharmaceuticals, agrochemicals, polymers, additives, surfactants, pigments, dyes, etc.

The company has a strong market position in the Nitro chloro benzene-based specialty chemicals segment.

The company also commissioned a Greenfield Nitrotoluene facility in Jhagadia in fiscal 2018 and two units for high-value specialty chemicals in Dahej in fiscal 2020.

In fiscal 2017, it commenced calcium chloride facilities in Jhagadia and a multipurpose ethylation unit at Dahej.

The company also has four full-fledged R&D centers, recognized by the Department of Scientific and Industrial Research, Government of India.

In fiscal 2020, it commissioned its flagship research and technology center in Navi Mumbai called the Aarti Research and Technology Centre, which will house about 250 scientists and engineers.

Business area of the company

Aarti Industries is engaged in manufacturing and dealing in speciality chemicals and pharmaceuticals.

Business model

The company makes nitro chloro benzene, dichloro benzene, phylene diamides, nitro toluene and sulphuric acid & derivatives.

The key application for nitro chloro benzene is in the dyes/ pigments/ industrial solvent and paracetamol.

The key application of dicholoro benzene is in air freshners, disinfectants, polymers and agro products.

Phenylene diamides are primarily used to provide high temperature stability, strength and supply polymer additives, dyes and pigments

Nitro toluene is primarily used in agricultural and pharma products.

Sulphuric acid is used in automobiles batteries, explosives, fertilizers, mineral processing and oil refining.

Business Segments:

Specialty chemicals:

Under this segment, the company has integrated operations across the Benzene, Sulphur, and Toluene product chains, and is ranked among the top three players globally for the manufacture of Nitro Chloro Benzene (NCB) and Di-chloro Benzenes (DCB).

The company is also the only manufacturer of Nitro fluoro aromatics using the Halex process and the only manufacturer of Phenylenediamines (PDA) value chain in India. Most of its speciality chemical products are primarily along the benzene-based value chain. Other chemicals such as sulphuric acid and its derivatives, single super phosphate, Toluene-based derivatives, calcium chloride granules, fuel additives, and phthalates are also part of its manufacturing portfolio.

Pharma:

The company uses its world-class expertise and modern manufacturing infrastructure to develop APIs, Intermediates, and Xanthine derivatives for the pharmaceutical and food/beverages industry.

It also has its own backward integrated intermediaries for most of the APIs that are manufactured. APIs accounted for 35% of revenues of the Pharma division, Intermediates for 29% & and the Xanthine derivatives accounted for the rest 36% of revenues of the segment for FY22. Remarkably, the company stands amongst the top 4 manufacturers for 75% of its product portfolio.

Revenue by country

Domestic – 48%

Rest of world – 28%

EU – 6%

North America – 11%

China – 4%

Japan – 3%

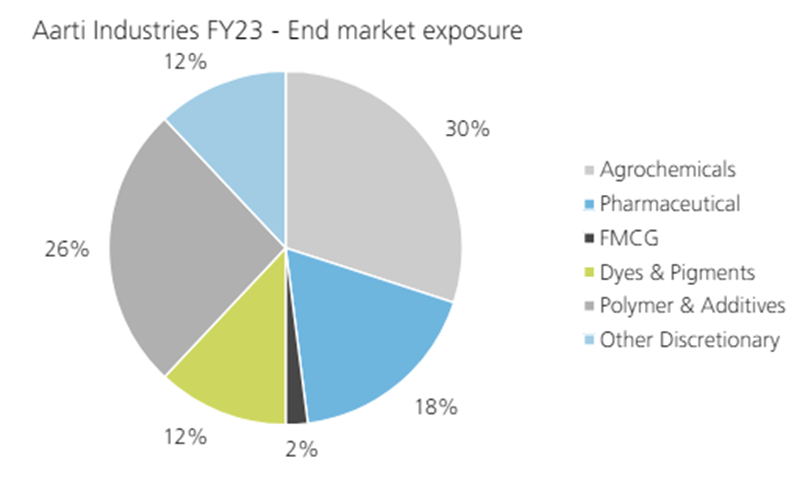

The end consumer of the products of the company are agrochemicals, pharmaceuticals, FMCG, Dyes and pigments, polymer additives and other discretionary. The break up of the products of the company are as follows:

Other key details about the company

Established market position with diversified segmental and geographical revenue contribution

AIL has maintained its dominant market position in the Nitro-chlorobenzene (NCB) and Di-chloro Benzene (DCB)-based specialty chemicals segment. AIL also operates in other chemical value chains such as toluene and Sulphuric acid. It has been gradually ramping up capacity utilization of all product lines. AIL is the largest producer of benzene derivatives in India, and a major player among global manufacturers, with a 25-40% global market share across various products. AIL supplies diverse end-user industries such as polymer additives, pigments, dyes, paints, pharmaceuticals, agrochemicals, fertilizers, and fast-moving consumer goods, and is thereby insulated from downturn in any particular industry. Also, around 48% of fiscal 2023 revenues is from exports, providing geographical diversity.

High integration of operations and strong relationship with suppliers enable effective mitigation of supply chain issues

AIL enjoys high economies of scale as it is the largest producer of NCB, DCB and Nitrotoluene in the domestic market and has built up a large and flexible manufacturing capacity. Operating efficiency is also supported by strong research and development (R&D) capability. Integrated operations to manufacture higher-order derivatives of benzene & toluene, along with the ability to change the product mix according to the demand-supply scenario, and continuous process improvement for maximizing the share of value-added benzene derivatives enable AIL to sustain comfortable operating efficiency. AIL has virtually nil dependence on China for its key raw materials due to high level of backward integration and strong relationship with domestic suppliers. In fiscal 2023, the company entered into long term offtake agreement with Deepak Fertilizers and Petrochemicals Corporation Ltd for sourcing of Nitric Acid (supply commencing from April 01, 2023, onwards). The said agreement eliminates the need to invest in backward integration.

The main edge of Aarti over its peers is the diversification in making different isomers of different variant like para, ortho, meta from 1st step reactions and having complete downstream chain in each of the isomers with varied end user application. Although, competition can try to replicate the first step of reactions but it’s very difficult to balance the end isomers ratio in continuous process and using it effectively in different end user industries like how is managed by Aarti Industries. Even it is difficult for chinese players to replicate the same reactions & balancing the isomers in a single integrated complex as done by Aarti.

Also, global scale & world scale facilities, talent management, Innovation in R&D, integrated operations, supply security & sustainaibility are the 5 pillars of strength for the company which the company has developed over period of time

Difference between commodity chemicals and specialty chemicals

Commodity chemicals are common chemicals that can be produced in bulk quantities by a large number of chemical manufacturers. The production quality of these chemicals varies little, being developed in a very standardized form with exact compositional matches.

Specialty chemicals, on the other hand, are more exclusive when it comes to the manufacturers able to produce them. These chemicals are geared toward specific services and customer needs, rather than general use.

Specialty chemicals are often restricted to specific manufacturers because of patents, but as those patents expire and market demand grows, specialty chemicals can become commodity chemicals over time.

Specialty Chemicals

Examples of specialty chemicals include antibiotics, adhesives, or pesticides, as they are made in low volumes to address particular needs. For instance, antibiotics are tailored to address the issues of a specific disease. Because of this niche use, antibiotics are only made in low volumes as they become necessary. However, as chemical research and development advances, specialty chemicals become much more efficient to produce and may transition into a commodity chemical.

Commodity Chemicals

A commodity chemical that has become completely interchangeable is known as a “fungible” material. This means there is absolutely no difference between one manufacturer’s product and another. This is the biggest difference between specialty chemicals vs commodity chemicals, as the commodity chemical is entirely standardized, and you know exactly what you will get from it. An example of a fungible chemical is natural gas.

Client Base:

The company has a client base of 700+ domestic clients and 400+ global clients. Its clients belong to many industries viz. Pigments & Paints, Polymers, Agro intermediaries, Pharmaceuticals, and others. The company’s client list includes Clariant, Sunchemical, Huntsman, Sudarshan, BASF, Toray, Bayer, UPL, Coromandel, Cipla, Sun Pharma, Lupin, Zydus, Dr. Reddy’s, 3M, Dabur & many more.

Manufacturing facilities:

The company has 15 manufacturing plants for its specialty chemicals division & 5 plants for its pharmaceuticals division. In total, it has 20 manufacturing facilities which are all located in western India with close proximity to ports for easy export. Its manufacturing units are located in the states of Gujarat and Maharashtra.

Out of 5 pharma plants, 2 plants are USFDA approved for manufacturing which makes it a preferred supplier of drugs. It also owns 5 co-gen power plants & a solar capacity of ~700 KW.

Jhagadia plant

The Jhagadia plant is built on 137 acres of land. The base structure is built on RCC column which gives it durability and compatibility as compared to steel structure. The company has freehold land availaible of 25-30 acres in Jhagadia plant. The Jhagadia unit contributes approx. 40-45% of the total gross block.

Nitration:

The company has 50,000 TPA nitration capacity of 2,5 DCNB which is used to manufacture 2,5 DCA. This 2,5 DCA is sold outside as well as used captively to make 2,5 DCP which is eventually used in 1st LT contract of Rs40bn. Hydrogenation: Into the hydrogenation unit of 36,000 TPA, the company manufactures various chemicals like 2,6 DCA, PCA; 2,4,5 TCA, MCA; 3,4 DCA; 3,5 DCA; 2,4 DCA and many other hydrogenated compounds. The raw materials used are benzene & toluene derivatives. The most common end user industries are dyes, pigments, polymer additives etc.

Nitro-toluene:

The company has 30,000 TPA Nitro-toluene capacity which will be expanded to 45,000 TPA in the next 18-24 months. Current utilization is approx. 90-95%. For nitro-toluene, the raw materials used are toluene & Nitric acid. Approx. 1 ton of toluene gives 1.25 ton of nitro-toluene. Nitro-Toluene is used to make nylon, polyurethanes and plastic soda bottles. Moreover, it is also used in pharmaceuticals, agrochemicals, cosmetic nail products, dyes and organic chemicals.

Phenylene Diamine (PDA):

The company has capacity of 12,000 TPA which was expanded from 3,000 TPA in FY15. The current utilization is around 50-60% which is underutilized. PDA is manufactured using reduction of di-nitrobenzene. During this process, total 3 isomers are made like meta, para & ortho in which 85% is meta isomer, 10% is para & 5% is ortho. The Para PDA is used in application of hair dye. Overall PDA is mainly used in manufacturing dyes, engineering polymers, speciality additives, photography and medical applications. Weak demand led to lower utilization, however, going ahead with expected improvement in demand. As per our analysis, PDA imports in India have declined by 67% YoY on YTD basis & average realization have declined by ~29% to Rs 299 per kg on YTD basis.

Captive Power Plant (CPP) & ETP:

The company has CPP installed with capacity of 4.5 MW in house which is completely used captively. The CPP requires coal which is mostly dometic & Indonesian coal. Current coal prices are Rs 8-9 per kg. The total power demand of Jhagadia plant is 12 MW. The remaining 7.5 MW demand is met though other sources. The company also has 2 installed boiler with 30 tons capacity each. The complete site is Zero discharge with ETP investment of ~Rs1bn.

3rd LT contract of $125 million: The company had signed 10-year supply contract for a new specialty chemical intermediate for a global chemical major with a total contract value of $125 million. Product was co-developed with the customer over 4 years to make it an economically viable product from lab to commercial scale. The capacity is currently operating in batch process and will be converted into continuous process over the period of time. The chemistry involves multiple stages wherein hydrogenation is one of them which has end user application in majorly in high performance polymers.

Speciality Chlorination:

The company has speciality chlorination capacity of 3600 TPA which is currently operating at 60-70% utilization levels. These are basically benzene downstream derivatives. This is a high value business with higher spreads of ~3-4x than normal chlorination segment. This segment caters mainly to agrochemicals segment.

New projects firing up growth:

The company has taken another land of ~95 acre at an investment of ~Rs900-950mn (including site development) which is almost 5km away from Jhagadia plant. The land parcel will house the chloro-toluene value chain, multipurpose plant & some newer range of value-added specialty products. The capex potential at the site is Rs25-30bn. As per management EC has been obtained and the civil works work at the ground has just started. Expected commercialization would be gradually from H2FY25.

Asset Restoration & Upgradation: The company has completed its asset restoration which led to increase in life of assets and with minimal intervention to existing operations. Approx. 75-80% of the total assets has been revamped across all manufacturing sites. Assets older than 2 decades required replacement or revamp. The company has cumulatively invested Rs6.23bn in asset restoration & debottlenecking in the last 3 years.

Dahej Plant:

Dahej plant is in SEZ zone due to which it enjoys export benefits. The total plant is divided into 3 land parcels wherein they manufacture MEA, DEA; 2,5 DCA; 2,5 DCP, NSA, PDCB etc. Dahej is relatively smaller in size.

Ethylation:

The company is the first to produce ethylation derivative or MEA, DEA, OEA and many such products in India. The ethylation unit has adopted Swiss technology. The purity grade is 99.8%. The company has the capacity to manufacture about 8,000-10,000 TPA. It is currently operating at 90% utilization and in lieu of this the company is expanding by another 20,000 TPA. The new ethylation plant under construction is just opposite to the existing facility. As per management it will require another 9-10 months to complete new facility of Ethylation. The raw material used are OT & Ethylene. OT is manufactured in house & ethylene is sourced through a pipeline directly from Reliance Industries which is situated few kms away which enhances supply seamlessness and moderates logistical challenges. Approx. 0.7-0.8 tons of OT is used to make 1 ton of MEA. The end user of Ethylation are Agrochemicals which are used in herbicide applications and speciality additives chemicals.

2,5 DCP (1st LT contract $620 million):

The company manufactures 2,5 DCP which was earlier 10-year supply contract with global chemical company erstwhile Monsanto. However, the customer cancelled the contract and Aarti received termination fees. Post termination of contract, Aarti is struggling to ramp up the capacity utilization of the plant because of demand problems. Also, the product is banned in some countries which is leading to lower offtake. Current capacity utilization is 20-25% which will be ramp upto peak utilization levels as demand improves. The 2,5 DCP is manufactured using input feedstock 2,5 DCA. Aarti has 20,000 TPA of 2,5 DCA & other hydrogenated product capacity which is operating at ~50% utilization levels & of the total production of 2,5 DCA approx. 50% is sold outside & 50% is used in manufacturing of 2,5 DCP. Approx. 1.5 tons of 2,5 DCA is used to make 1 ton of 2,5 DCP. This is majorly used in agrochemical herbicide.

2nd LT contract $1540 million:

In this deal Aarti will supply high value speciality chemical intermediate to global chemical company SABIC over a period of 20 years. The company said it invested Rs3.5bn million to set up a dedicated large scale manufacturing facility for the production of this speciality chemical intermediate. As a part of this contract terms the customer provided the $42 million advance, the desired technology & raw materials etc. Owing to confidentiality obligations of the contract, management did not disclose any specific details. However, as per our understanding the chemistry of this business is different from the existing chemistries of Aarti & current utilization is approx. 50% and it is more of take or pay type of contract.

Other key information:

In the chlorotoluene value chain, the company is planning to make 35-40 products including downstream chemicals. It will be a 6-7 step conversion process which will be first of a kind in India.

Since, chlorotoleune is focused on import substitution, Aarti is planning to capture 50-70% of imports market share in India. As per management, the company will target to ramp up to ~50-60% utilization in year 1 & full utilization in second year.

Management stated that ramp up of capacities and higher operating leverage will lead to EBITDA of about Rs17bn in FY25E (~25% CAGR over FY23-25E). Expected consol EBITDA around Rs11bn in FY23E.

On absolute basis, expected EBITDA growth of 55% from FY23-25E would be primarily led by 35% volume growth & from operational efficiencies. The volume growth would be led by additional volume contribution from NCB, ethylation, chlorination & ramp up of PDA.

The company benefits from decline in raw material prices as it requires lesser inventory & lower working capital cycle, since product prices are generally a pass on, the input output spreads remain constant and supports operating margin.

The company has a clear roadmap for the future and to be a leading player in the specialty chemicals space.

The company is not importing any raw materials from China; hence it was immune to any disruption in supply chain from China. The major raw material for the company is benzene, concentrated Nitric acid, Aniline, PAN, toluene etc.

19 APIs are going off patent with size of $5B

Old harmful chemicals will get discontinued

India is emerging to become a strategic support in developing new molecules.

Research and development team:

The company owns 4 R&D centers in India with a dedicated pool of 400+ engineers and scientists for developing customized products. It operationalized Aarti Research & Technology Centre, its new R&D facility in Navi Mumbai in FY20.

Competitive advantage:

The company has a superior cost structure and competitive advantage as compared to its competitors due to its backward integration and scale. This is why China plus one strategy has helped the company throttle its top line. Further, the company also has 8 international patents and 39 USDMF. For FY22, the company got permission for 11 more patents of the 44 patents filed. Interestingly, Aarti Industries is a global player in benzene-based derivatives with integrated operations as it stands top 3 in chlorination and nitration globally and among the top 2 in hydrogenation globally.

New Capex and Expansion plans:

The management has also guided for a Capex of Rs 3000 Cr for the next 2 years. Out of the projected Capex, the company has spent 200 Cr in the current quarter.

The Capex will be majorly for adding more downstream products in the current benzene chain, the new Chloro Toluene chain, and debottlenecking of the existing products.

All the capacities set up during FY22 should ramp up and clock utilization of ~70-90% by FY24-end. Incremental Capex would be mainly utilized for high-value products.

50% of the Capex will be for the existing products and contracts, while the remaining is for the new product development. A large part of the Capex would be towards chemical products 2500-3000 Cr, whereas for Pharma it would be in the range of 350-500 Cr. Site development work to commence on 100 + acre land at Jhagadia. AIL also acquired over 120 acres of land at Atali, Gujarat. Environmental Clearances obtained / in process. Construction from FY22 – FY24.

The company will be coming up with a Concentrated Nitric Acid plant by FY24 to take care of Nitric Acid requirements. It is evaluating the feasibility of going for a Weak Nitric Acid integrated plant to be completely self-sufficient, while the management has a project cost of 150-200 cr for the CNA plant whereas a Capex of 500CR + for the WNA & CNA plant.

The new capex is being invested on building more versatile plants which can be used to manufacture diverse products.

ROCE estimation

The following are the unit economics in crores:

The EBITDA margin is 18% since it is specialty chemicals – the chemicals over a period move from specialty to commodity and hence the margins shrink – the strength of the company mainly lies in ensuring more and more specialty chemicals are introduced.

| Capex | 1000 |

| Revenue | 1500 |

| EBITDA margin | 18% |

| EBITDA | 270 |

| Interest | 80 |

| Depreciation | 50 |

| EBIT | 220 |

| Asset turnover | 1.5 |

Promoter group

The promoter group consists of the Gogri family who are technocrat founders of the business owning 45% stake. FIIs hold 11%, DIIs hold: 17% and the rest is public.

Chemistry

Benzene is a colorless liquid with a sweet odor. It evaporates into the air very quickly and dissolves slightly in water. It is highly flammable and is formed from both natural processes and human activities. Benzene is widely used in the United States; it ranks in the top 20 chemicals for production volume. Some industries use benzene to make other chemicals which are used to make plastics, resins, and nylon and synthetic fibers. Benzene is also used to make some types of rubbers, lubricants, dyes, detergents, drugs, and pesticides. Natural sources of benzene include volcanoes and forest fires. Benzene is also a natural part of crude oil, gasoline, and cigarette smoke.

Agency for Toxic Substances and Disease Registry (ATSDR)

Benzene appears as a clear colorless liquid with a petroleum-like odor. Flash point less than 0 °F. Less dense than water and slightly soluble in water. Hence floats on water. Vapors are heavier than air.

Industry and size

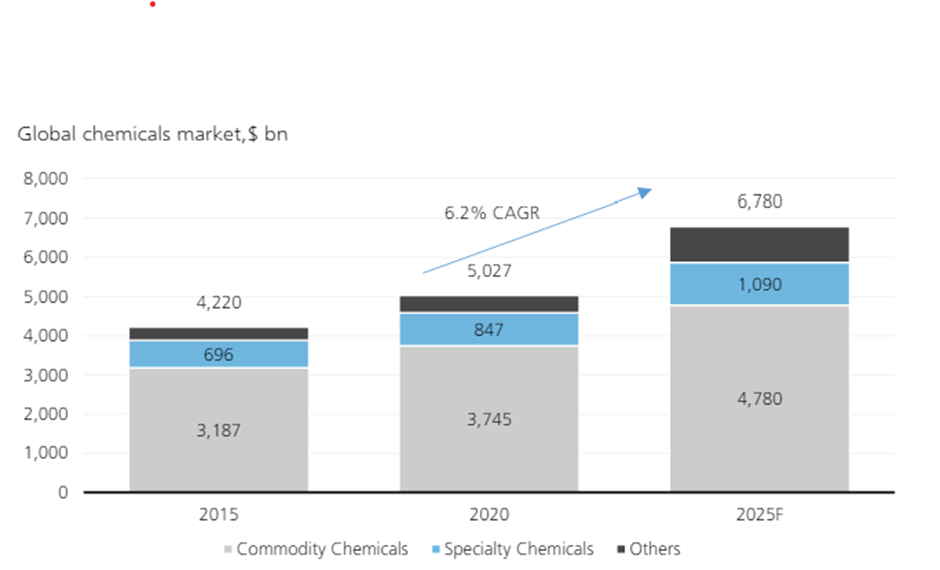

The overall global chemicals market was worth about US$5,027bn in 2020, according to a Frost & Sullivan (F&S) report, with China accounting for a dominant share of around 39%, followed by the EU (around 15%) and the US (about 13%).

This comprises three main segments—commodity chemicals (bulk and petrochemicals), specialty chemicals (including agchem, fertilisers and pharma API (active pharmaceutical ingredients)) and other (largely biotech) chemicals.

F&S forecasts industry growth to accelerate from a CAGR of approximately 3.6% over 2015-20 to around 6.2% during 2020-25, driven by faster growth in the APAC region.

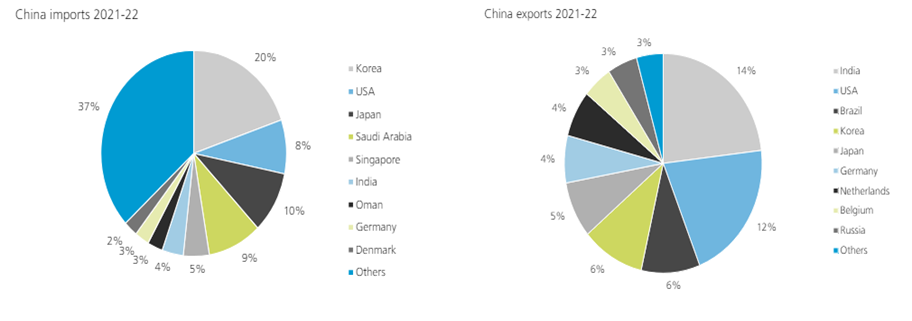

China exports and imports

India’s exports and imports

For more interesting Indian companies – please visit here