India is now the largest population in the world and the India consumption story is currently evolving at a rapid pace. Below are some interesting numbers about how India spends currently.

India GDP per capita is around 2500$ of which 51% of it is consumed and hence per capita spend in consumption is around $1287. Below is the break – up of $1287.

It is interesting to see that per capita spending is mainly in food and grocery. This is an indication of lack of discretionary spending ability in India which will keep evolving over a period. As an economy moves to richer state, the per capita spend in food and grocery almost stagnates and the spending in other discretionary areas like apparel, fashion, footwear, consumer durables increase.

Another interesting point is that the per capita per annum spend in jewelry is higher than fashion and apparels. Footwear is just 260 rupees per annum ($3)

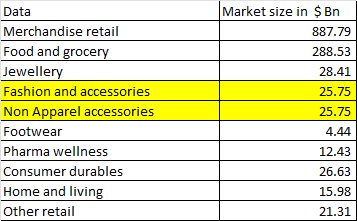

Below is the market size of these industries

As India moves to higher GDP per capita; the spending in discretionary items may increase at a rate faster than GDP growth given that spending in food (which is currently the biggest) will not increase at the same rate. Lets wait to see if India consumption story follows the same trends as other countries in the world.

For more articles – click here