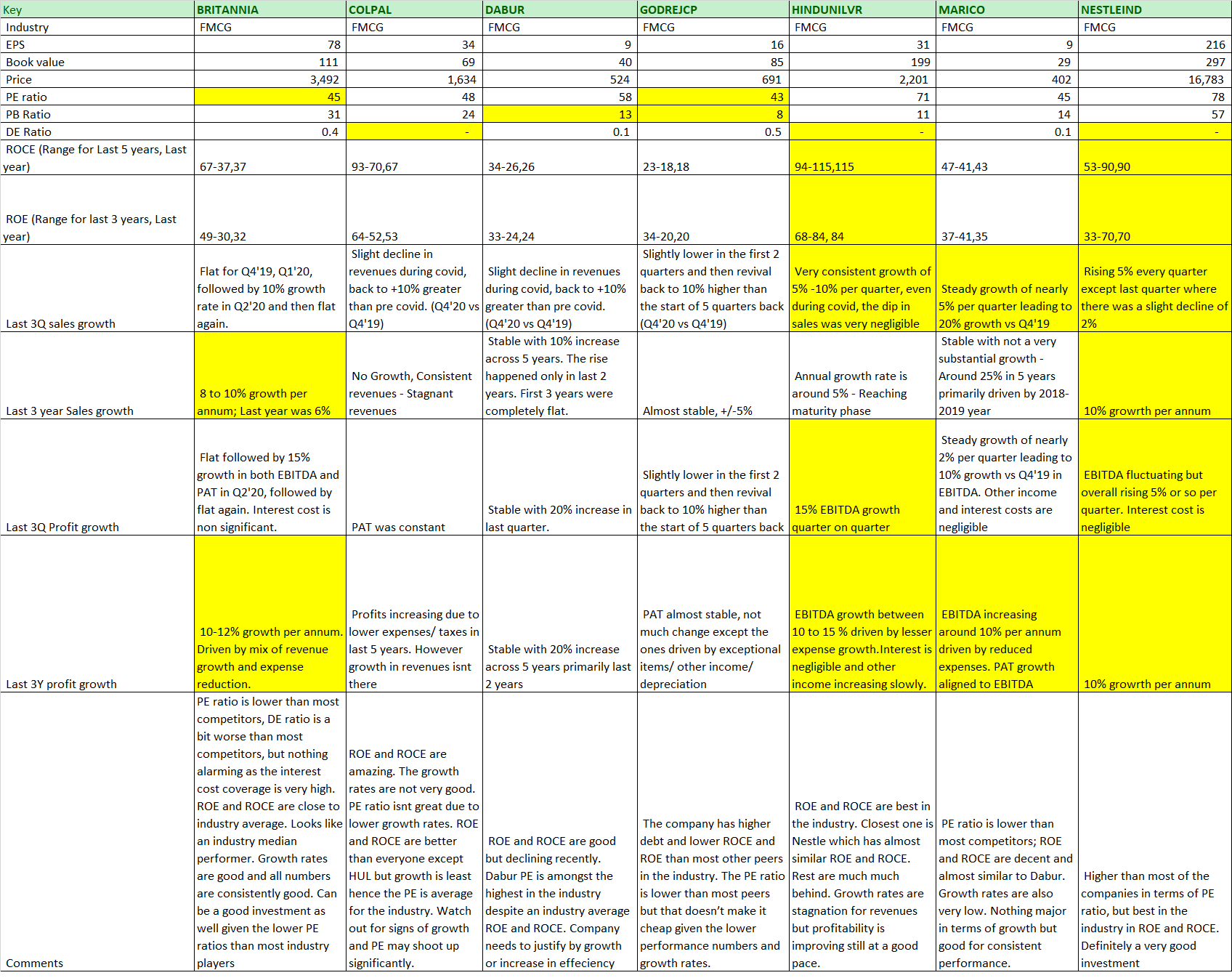

Below is the comparison of the the top FMCG companies in India. The Indian FMCG industry is dominated by 7 players.

Hindustan Unilever is the benchmark in terms of performance. If we look closely at the comparison below, Nestle ranks high (compared to the other players excluding HUL) in most parameters and is reasonably valued as compared to HUL. It is growing a good rate as well and looks like a good investment. HUL has the best capital and performance ratios in the industry but is really expensive. On the other hand, Dabur has a high PE with not very great ROE and ROCE ratios. Also, the growth rates are not justifying the high ratios currently. Marico and Britannia have good growths and better financial performance and are relatively cheaper and hence can be considered for a good investment. Colgate Palmolive has been very stagnant in terms of revenue growth over the past few years. Overall, HUL (Best but expensive), Nestle (2nd best and relatively inexpensive), Marico and Britannia (Growing and relatively inexpensive); Dabur (Not great but expensive).

The columns highlighted in yellow indicate the best performer in the industry for that parameter.

If you like this comparison of FMCG companies, I have made similar comparisons for other major sectors in the Indian equities space. For more such industry analysis, please see my other comparisons.