Exide industries is one of the leading manufacturer and distributor of lead-acid batteries and storage solutions. It is engaged in the design, manufacture and sale of lead-acid storage batteries as well as power storage solutions for automotive, industrial and other applications, which are its core segments.

This includes batteries for two- wheelers, three-wheelers, e-rickshaws, inverter batteries, home UPS systems, integrated power backup systems and solar inverter systems. Exide has an export footprint in 60 countries across the globe.

Exide has introduced eco-friendly and efficient products into emerging sectors such as ISS battery, E-rickshaw battery, lithium-ion battery and solar inverter systems. It is strategically foraying into lithium-ion cell manufacturing by setting up a multi-gigawatt, multi-chemistry, and multi-format lithium-ion cell manufacturing factory.

Exide is also a market leader in automotive OEM space and leading player in after- market segment and industrial space. While India is on an upward economic growth trajectory, Exide is well placed to cater towards increasing demand of energy and energy storage solutions.

Automotive division

Exide has built strong leadership and long-standing relationship with OEMs. It has successfully leveraged to expand market share with both 4W and 2W manufacturers, despite stiff competition.

Exide saw good volume growth led by market share gains in OEM market and growth in domestic vehicle production in FY23. Digital transformation in EXID’s aftermarket business over last few years (which provides micro-market level visibility) has started paying dividends by providing greater transparency not just to the company but to dealers, distributors and other channel partners.

First mover advantage in emerging segments such as batteries for hybrid vehicles with its EXID Mileage ISS & SF HybridX range of batteries aided rise of market opportunities and diversification of revenue sources.

Exports for Exide were impacted in key automotive markets due to 1) geopolitical tensions, 2) appreciation of US dollar, 3) imposition of anti-dumping duty in Gulf Cooperation Council (GCC) countries and 4) demand slowdown in North America & some other markets. The company is making efforts to maintain/regain volumes in key markets and enter new markets.

Industrial division

Industrial segment grew faster than the automotive division led by broad based recovery in end-user market. Exide’s industrial division including industrial UPS, solar, traction, telecom and power saw strong demand across all end-market verticals. While external headwinds like input cost inflation and geopolitical tensions impacted margins and overseas demand, yet domestic demand remained strong. 2HFY23 than 1H was better as these headwinds eased.

Industrial segment is further divided under Industrial Uninterrupted Power System, Solar, Telecom, infrastructure, Traction, Railways and industrial.

Uninterrupted Power System (UPS) is largest business vertical of the Industrial Division which saw good growth in FY23, helped by rising requirement for critical power backup in domestic market and rising demand (as overall economic activity continued to improve). In the industrial division – EXID focuses on diversified portfolio, continuous product/process innovations with presence of strong sales and service network across India.

Exide’s Solar vertical revenue saw strong growth in FY23 led by higher sales of Solar Power Generation System (SPGS) combination which comprises of Solar Battery, PV Panel Solar Hybrid Inverter/Charge Controller.

Business by segment:

- Automotive division

(Rs. Cr.)

| Particulars | 2019 | 2020 | 2021 | 2022 | 2023 |

| 4 wheeler OEMs | 895.7 | 655.2 | 629.3 | 796 | 1149.8 |

| 4 wheeler Replacement | 2916 | 3023 | 3210 | 4060 | 4779 |

| Two wheeler OEM | 765.2 | 545.2 | 400.7 | 396.7 | 492.7 |

| Two wheeler Replacement | 779.8 | 777 | 814.8 | 1057.6 | 1301.3 |

| Auto revenue | 5356.7 | 5000.4 | 5054.8 | 6310.3 | 7722.8 |

- Industrial division

(Rs. Cr.)

| Particulars | 2019 | 2020 | 2021 | 2022 | 2023 |

| Inverter battery | 2480 | 2215 | 2372 | 2482 | 2752 |

| Inverter | 133.9 | 120.5 | 130.1 | 169.2 | 219.9 |

| UPS | 1235.3 | 1235.3 | 1185.9 | 1541.6 | 1927 |

| Telecom | 405 | 344 | 344 | 413 | 495 |

| Submarine and others | 300 | 270 | 243 | 316 | 348 |

| Exports | 677 | 661 | 711 | 1148 | 1127 |

| Industrial Revenue | 5231.2 | 4845.8 | 4986 | 6069.8 | 6868.9 |

Manufacturing locations:

| 1 | Bawal, Haryana | MC battery plant |

| 2 | Ahmednagar, Maharashtra | MC battery plant |

| 3 | Prantij, Gujarat | Nexcharge plant |

| 4 | Taloja, Maharashtra | Auto battery (SF) |

| 5 | Chinchwad, Maharashtra | Auto battery plant |

| 6 | Haridwar & Roorkee, Uttarakhand | Home UPS manufacturing |

| 7 | Shyamnagar, West Bengal | Auto & Industrial batteries |

| 8 | Haldia, West Bengal | Integrated battery manufacturing hub |

| 9 | Hosur, Tamil Nadu | Auto & Industrial battery |

| 10 | CML, Supa, Maharashtra | |

| 11 | CML, Haldia, West Bengal | |

| 12 | CML, Malur, Karnataka |

Global battery industry

In terms of revenue, the global battery market was valued at $111.86 billion in the year 2021 and is projected to reach $423.90 billion by 2030, growing with a CAGR of 16.68% over the forecasting years of 2022 to 2030. The market study has also analyzed the impact of COVID-19 on the battery market qualitatively as well as quantitatively.

CAGR growth: 7%-9%. Global lead acid battery: 45.84 B USD in 2023 expected to grow at CAGR of 5%.

Indian market size of lead acid batteries: $7.5 B USD

Key growth enablers of the global battery market:

- Increasing popularity of consumer electronics

- Lithium-ion batteries are among the most common types of high-capacity secondary batteries utilized in electronic devices such as laptops, mobile phones, computers, cameras, and others. This battery technology is highly popular as it is relatively affordable, offers high power density, and does not self-discharge quickly.

- The rising demand for consumer electronics across the globe is anticipated to increase the demand, as well as the adoption of different batteries for a range of consumer electronic devices. For instance, across sales categories of consumer electronics, computers (+34%), as well as TV sets (+12%), have grown relatively faster as compared to smartphones (+1%) in the last three years (2019-2021) worldwide. This is majorly due to COVID-19 restrictions, in addition to more time spent learning and working from home.

- Incentives for EV battery manufacturing

- Declining prices of batteries

- High demand for automotive applications especially from electric vehicles

Key growth restraining factors:

- Safety issues related to battery usage

The safety features of a battery are profoundly determined by the chemistry of the battery, its operating environment, and abuse tolerance.

- The internal failure of a battery, primarily a lithium-ion battery, is caused by the instability occurring in the electrochemical system. Therefore, understanding material properties, electrochemical reactions, and side reactions in the battery are fundamental for assessing its safety.

- Temperature and voltage are the two main factors that control battery reactions. Safety accidents are followed by continuous gas and heat generation, resulting in battery rupture and further ignition of combustible products.

- Volatility in raw material prices

- Issues related to battery recycling

Organized vs unorganized battery market

Organized companies sell branded batteries with warranties, while unorganized companies provide no warranty or after-sales, sell recycled batteries, and offer products at a 30-35% discount to branded ones. The Indian automotive replacement battery market is leading the lead-acid battery market.

The share of the unorganized segment in the replacement market has been gradually declining, but is still 40-50%.

Non-compliant manufacturers (those who evaded indirect taxes) enjoy a price advantage as high as >20%. While we are yet to see material change in compliance post GST implementation, cost of doing business is expected to increase for non-compliant players, as the government’s focus shifts towards higher compliance.

Impact of EVs

EVs not to displace lead-acid batteries; to create opportunity to manufacture lithium-ion batteries: Contrary to general perceptions, electric cars (EV) have a 12v lead acid battery (LAB) as auxiliary battery for SLI (starter, lighting and ignition) applications. We believe LAB will remain relevant even in the EV world. We expect localization of Li-ion battery to be highest priority for OEMs to reduce cost of batteries and lower forex exposure. Given the criticality of the battery and scope of differentiation it offers, we expect OEMs to manufacture EV batteries in-house. Liion batteries could be a ~USD42b opportunity by 2030 (9x the automotive LAB opportunity). Based on this, the cell manufacturing opportunity would be ~USD15b.

Lead acid battery to remain for SLI applications in EVs

Contrary to general perceptions, electric cars have 12v Lead Acid Battery (LAB) as auxiliary battery for SLI (Starter, Lighting and Ignition) applications – similar to ICE engine powered car.

LAB is preferred for its ability to provide the high surge currents needed for an automobile’s starter motor, making them a reliable power source at an affordable cost.

Hence, LAB will continue to remain relevant even in EV world, unless there is any significant change in technology.

However full electric 2W and 3W vehicles don’t operate on lead acid battery, hence can risk existing lead acid batteries opportunities going ahead. 2Ws and 3Ws contribution to Automotive battery segment at ~40%/~4% (including aftermarket demand).

A high-voltage lithium-ion propulsion battery typically replaces the internal combustion engine and provides power to generate the torque needed for directional movement. However, all EVs, including BEVs, require a low-voltage battery to work in tandem with the high-voltage battery to provide critical functionality during all stages of use – when the vehicle is driving, when the engine or high-voltage battery is off and when an emergency occurs. While the vehicle is in motion, the battery supports peak power demands that exceed the direct current to direct current (“DC/DC”) converter’s capabilities, such as power steering and seat heaters.

While the vehicle is at rest, the low-voltage battery provides power to engage the primary high-voltage battery, both during charging and to initiate driving. The low-voltage battery also supports key-off functions such as theft-protection, entertainment and connected-vehicle technologies such as over-the-air updates. Perhaps most importantly, when a failure occurs resulting in a loss of power from the high-voltage battery or DC/DC converter, the low-voltage battery supplies power to safety-critical systems, providing a crucial layer of redundancy necessary to ensure the vehicle can be safely navigated.

Advanced Battery technologies like AGM and EFB remain the preferred next-generation low-voltage solution by OEM customers and are currently specified into all powertrain configurations, including mild-hybrids, plug-in hybrids and BEVs. We believe the cost of our Advanced Batteries is approximately a quarter of that of low-voltage lithium-ion today. In low-voltage applications, AGM batteries provide a preferable alternative to lithium-ion, as they are able to handle the key-off and peak loads in electric vehicles, are inherently safe and have a superior cost structure. Based on IHS Markit projected electric vehicle platforms and production volumes through 2025, the vast majority of new vehicles will utilize lead battery technology for their low-voltage requirements. The superior performance of our products and our industry-leading AGM capacity position us well to capture additional market share in next-generation vehicle battery demand.

Replacement demand

Replacement segment offers secular and profitable growth opportunity: The automotive replacement battery segment offers a secular and profitable growth opportunity, driven by (a) increasing penetration of automobiles driving expansion in automobile population, and (b) GST-led consolidation. The auto replacement segment enjoys the highest profitability due to (a) B2C nature of the business, (b) high pricing power with diffused customer base, and (c) low competitive intensity.

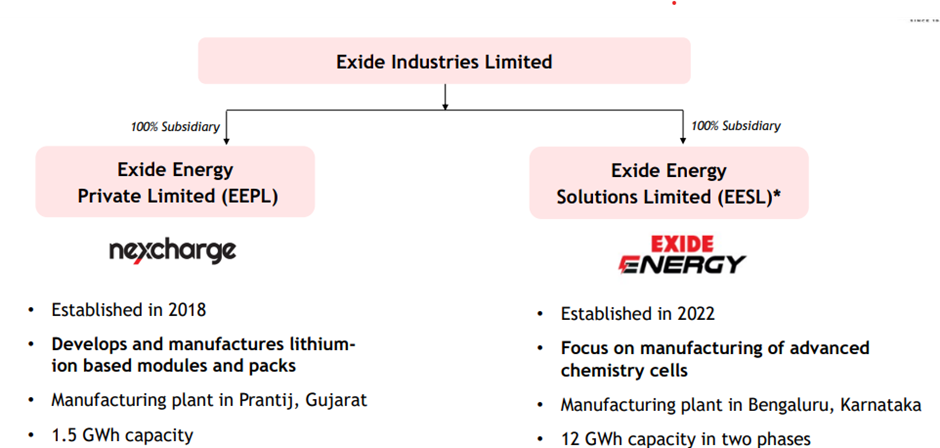

Investment in lithium-ion batteries

Exide has ventured in the lithium-ion battery space through its multiple subsidiaries EXIDE Energy Private Limited (EEPL) and EXIDE Energy Solutions Limited (EESL), both 100% owned subsidiaries. The company is investing into lithium-ion cell manufacturing by setting up a multi-gigawatt, multi-chemistry and multi-format lithium-ion cell manufacturing factory.

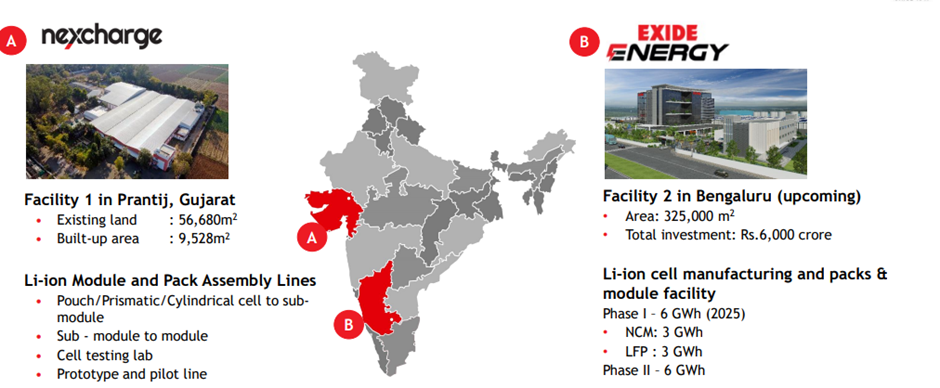

EXIDE Energy Private Limited (EEPL) operates the Nexcharge brand, is already supplying high-quality lithium-ion battery modules and packs in transportation and Industrial applications. This has helped EXID in getting invaluable insights into Indian climatic conditions and safety requirements, enabling it to gain expertise in lithium-ion battery packs and modules.

EEPL has developed Nexcharge BTMS (Battery Thermal Management System), a carefully engineered solution for heat management and superior performance. BTMS effectively controls individual cell temperatures, prevents accelerated deterioration and maximises efficiency, safeguarding against potential battery damage while ensuring durability and peak performance.

During the year EEPL secured orders worth ~Rs. 7bn for lithium-ion packs and modules (order book to be executed in next 12-15 months from 2W, 3W, CVs and telecom (OEMs)). It plans to meet demand and ramp-up production at its 1.5GWh capacity.

EXIDE Energy Solutions Limited (EESL): At its EESL subsidiary, EXID has already made a head-start in setting up single site multi giga-watt lithium-ion cell manufacturing factory at Karnataka. The facility will focus on production of advanced chemistry cells, including cylindrical, pouch, and prismatic types. The projected cost for the entire project is estimated at approximately Rs. 60bn.

This project aims to achieve a total capacity of 12 GWh, in a phased manner over a span of 8-10 years. It has team of experts and seasoned professionals in the lithium ion space, which should help in accelerating the project; EXID expects commercial production under phase-1 (6 GWh of production capacity alongside the establishment of an R&D pilot line) to start by the end of CY24.

EESL has entered into a comprehensive, long-term technical partnership with SVOLT Energy Technology (SVOLT) to facilitate the manufacturing of lithium-ion cells. This collaboration involves a multi-year technical agreement focusing on li-ion cell manufacturing, as well as assistance in setting up the plant on turnkey basis. It has a team of more than 300-400 R&D experts; the company is headquartered in China.

Rising demand for energy storage systems

There has been an increase in the demand for energy storage systems across the globe. Energy storage can play a crucial role in balancing variable generation sources and grid integration.

In this regard, by increasing the overall flexibility of the system, energy storage systems can reduce peak demand, improve power quality, avoid/reduce deviation penalties, and enhance the capacity of distribution/transmission grids.

Emergence of AGM batteries

AGM (Absorbent Glass Mat) batteries are an advanced type of lead-acid batteries that offer superior power to support the higher electrical requirements of present-day vehicles and start-stop applications. Such batteries are extremely resistant to vibration and are completely non-spillable, sealed, as well as maintenance-free.

Moreover, they also provide better cycling performance, minimal gassing, and acid leakage as compared to conventional lead-acid batteries.

Increasing penetration of marine batteries

Marine batteries are specifically designed for use on a boat, with robust construction and heavier plates that are designed to withstand the pounding and vibration that can occur onboard any powerboat.

There are three major types of marine batteries: marine starting batteries, marine deep cycle batteries, and marine dual-purpose batteries.

While there has been an increase in the penetration of marine batteries, market players across the globe are also developing and launching a range of technologically advanced and innovative products catering to the requirements of end-users.

Localization of battery sourcing

In automobiles, companies prefer just in time manufacturing and given the import uncertainties, companies prefer localized players. Also, battery is a significant cost for EVs, hence any increase in inventory due to failure in supply chain will significantly impact the working capital cycle of the company. Hence companies would prefer localized supply chain.

For industrial use, since the orders are not continuous but are mostly large chunky orders, the supply chain is ideally sourced locally.

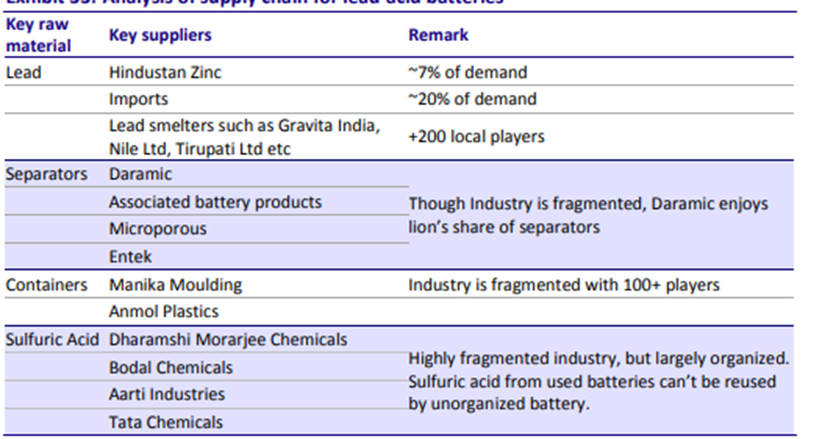

Supply chain for lead acid batteries

Industrial applications

The top 2 contributors in terms of revenue for Exide are Inverter battery and UPS.

Telecom, UPS and Inverters are the largest sub-segments in the industrial battery segment, accounting for 45% of the global and 60% of India’s demand for industrial batteries.

Inverter battery

In FY17, demand from the industrial segment remained healthy, as increase in demand from UPS, Inverter, solar power and motive power offset the moderation in demand from telecom.

Currently, AMRJ and EXID together control 50-60% of India’s INR150b industrial battery market.

Conventional industrial segment (ex e-rickshaw, motive power and solar) is estimated to stabilize from 2HFY19 and grow from FY20, driven by 8-10% CAGR growth in UPS, stabilization in Telecom segment (from 2HFY19) and continued weakness in inverters.

Home inverter segment should also witness shift from unorganized (>50%), benefitting AMRJ/EXID.

UPS

On secular growth path driven by digitalization UPS is third-largest segment in industrial battery application globally and accounted for ~18% of the market in CY16.

Growth in the UPS segment is traditionally driven by IT hardware business growth (primarily servers), e-commerce, power backups and addition to ATM network of banks.

New opportunities such as smartphones, social networking platforms, cloud applications and smart city projects have resulted in increased usage of data and need for data centers.

The size of the battery market for UPS (including home inverter) is INR60b-75b, with estimated average battery life of 3-4 years, providing significant replacement potential. Commercial UPS segment is estimated to be ~INR18b market size.

35-40% of UPS battery demand is contributed by the OEM segment and 60% comes from the replacement market.

According to a recent report by the Associated Chambers of Commerce and Industry of India (ASSOCHAM), the Indian inverter and UPS market is expected to reach a value of ₹99.83 billion by 2023, growing at a CAGR of 11.97%. This growth is being driven by the increasing penetration of electronic devices, the growing demand for data centers, and the rising adoption of renewable energy sources.

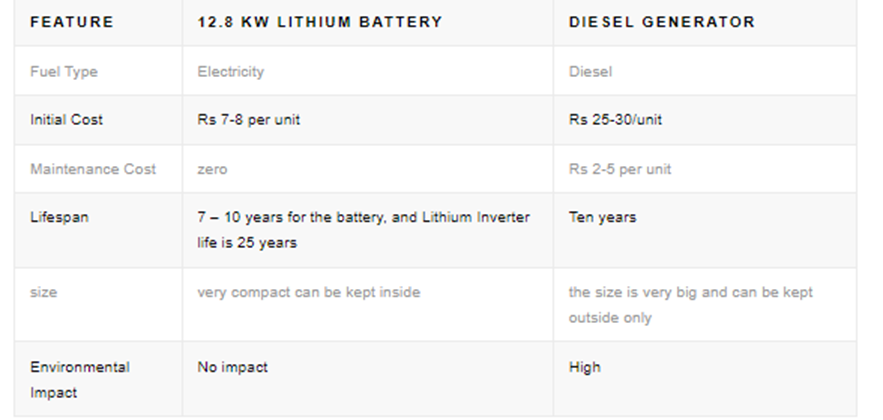

Lead acid battery vs diesel generators

Financials:

| 2019 | 2020 | 2021 | 2022 | 2023 | |

| Sales | 14,721 | 14,471 | 10,359 | 12,789 | 15,078 |

| Expenses | 13,159 | 13,014 | 8,994 | 11,387 | 13,485 |

| Y/Y Growth | 14.93% | -1.70% | -28.41% | 23.45% | 17.90% |

| Operating Profit | 1,562 | 1,457 | 1,366 | 1,402 | 1,593 |

| Op Margin | 10.61% | 10.07% | 13.19% | 10.96% | 10.57% |

| Other Income | 148 | 40 | 132 | 3,725 | 125 |

| Depreciation | 344 | 418 | 394 | 440 | 502 |

| Interest | 117 | 108 | 37 | 64 | 79 |

| Profit before tax | 1,249 | 971 | 1,067 | 4,623 | 1,137 |

| Tax % | 32% | 22% | 25% | 6% | 28% |

| Net profit | 849.32 | 757.38 | 800.25 | 4,346 | 818.64 |

| Net profit Margin | 5.77% | 5.23% | 7.73% | 33.98% | 5.43% |

| EPS | 9.95 | 9.14 | 9.53 | 51.38 | 9.68 |

| RATIOS: | |||||

| Dividend Payout | 24% | 45% | 21% | 4% | 21% |

| ROCE | 21% | 17% | 14% | 11% | 10% |

Long term triggers for investment:

Dominant market position in the automobile batteries market

Exide is the market leader in the domestic automobile battery industry, both in the OEM as well as replacement battery space.

The company’s long-standing presence, its distribution network/ brand and product quality have resulted in strong position for EIL in the domestic battery segment.

EIL currently assembles lithium-ion battery packs used in EVs in its subsidiary, Exide Leclanche Energy Private Limited. Further, the company is looking at backward integrating into lithium-ion battery cell manufacturing over the medium term, through a subsidiary.

- Diversified revenue base across multiple end-user industries in the industrial segment

- Apart from the automobile battery segment, EIL sells its batteries to a large customer pool, spanning across the automobile and industrial battery segments.

- Further, its industrial battery customers are from diversified sub-segments including UPS, solar, telecom, traction, power etc.

- ICRA notes that most of the end-user industries are cyclical in nature. Hence, EIL’s industrial segment revenues are exposed to business downturns, although EIL’s diversified user base mitigates demand risks to a large extent.

- Strong financial risk profile, with negligible debt and healthy cash accruals

- EIL has remained net debt negative for the last several years, aided by healthy accruals.

- At the consolidated level, the company’s total net cash accruals stood at over Rs. 4,800 crore, and it had sizeable cash and liquid investments of Rs. 743.5 crore as against a consolidated gross debt of Rs. 675 crore (including lease liabilities of Rs. 299.11 crore) as on March 31, 2023.

- The company also has long-term investments in HDFC Life Insurance Company Limited, fair valued at Rs. 4,344.15 crore as on March 31, 2023.

- EIL has significant capex plans of over Rs. 4,500 crore. (2Q23 CT)

- Capital expenditure and investments

- The Company represents a significant step to strengthen Exide’s position in the emerging lithium-ion battery market. Its greenfield factory spread over 80 acres of land at the Hi-Tech Defense & Aerospace Park Phase 2, Bengaluru, is designed to produce technology-leading lithium-ion batteries to meet EV & Industrial requirements.

- EESL has entered into a multi-year technical collaboration agreement with SVOLT Energy Technology Co. Ltd (SVOLT), a global technology company that makes and develops lithium-ion batteries and battery systems for EVs as well as for energy storage. In addition to technology, SVOLT is providing support for setting up the plant on a turnkey basis.

- It will also set up a state-of-the-art R&D lab and pilot line to support new product development for the Indian market.

- During the year 2022-23, your Company invested around Rs. 715 crores through equity in EESL for setting up the greenfield unit.

- Setting up a 12 GWh lithium-ion cell manufacturing facility under Exide Energy Solutions Limited at Rs.6,000 crore total cost of the project, which will be completed in two phases